This is an excerpt from an article I originally published on Seeking Alpha on January 1, 2012. Click here to read the entire piece.)

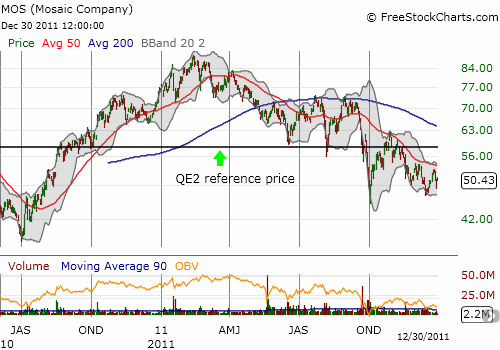

In my last post updating the current list of buy candidates for the “commodity crash” portfolio, I neglected to include fertilizer stocks. Phosphate and potash producers – like Mosaic (MOS), Potash (POT), and Intrepid Potash (IPI) – are currently trading at or below their QE2 reference prices. {snip}

On December 28th, MOS reminded me of its laggard status when the company announced production cuts. Here is the Mosaic announcement in the words of Jim Prokopanko, President and CEO of Mosaic:

{snip}

This announcement was only a mild surprise in light of what I read earlier in the month about expanding supplies of agricultural products that are placing downward pressure on agricultural prices. It is also possible more conservative farmers are planning for what they regard as an inevitable correction to the recent good fortunes of farmers. In “U.S. Farmers More Optimistic After Record Harvest Profit, DTN Survey Shows“, Bloomberg quotes such a farmer on Jan 2, 2012:

{snip}

On the other hand, a New York Times article on December 31st described how farmers in Iowa are rushing to put more marginal farmland into production because of the continued high prices for their crops. {snip}

{snip}

On December 28th, the Fast Money crew at CNBC interviewed the ever vocal, commodity guru Jim Rogers about his investing outlook. {snip}

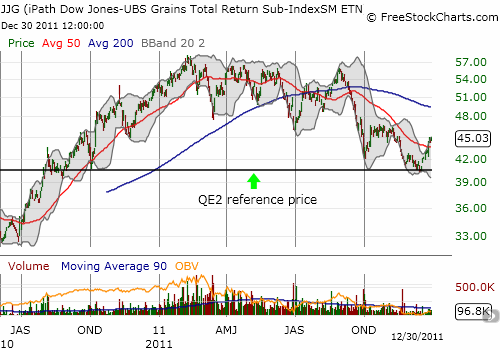

{snip} The only agricultural ETN on my list to have erased its QE2-inspired gains is the iPath DJ-UBS Grains Total Index (JJG). {snip}

Source for both charts: FreeStockCharts.com

{snip}

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on January 1, 2012. Click here to read the entire piece.)

Full disclosure: long MOS, JJG