This is an excerpt from an article I originally published on Seeking Alpha on November 27, 2011. Click here to read the entire piece.)

The Conference Board of Canada anticipates stronger growth in Canada over the next two years. The sovereign debt crisis in Europe represents the most significant downside risk to this forecast:

{snip}

Expectations for continued strength in the commodity-based sectors are of particular interest to me. {snip}

This bullish outlook holds even as the Canadian government goes about cutting its deficit. {snip}

Overall, I consider Canada to be a “buy on the dip.” To the extent that problems in Europe send Canadian assets to lower prices, I will be an even more aggressive buyer. My approach is consistent with the “commodity crash playbook” to the extent that China’s economy finally tips over thanks to problems in Europe; Europe is China’s largest regional customer for its exports.

The most immediate implication is on my currency-trading strategy.{snip}

Based on a little over two years of trading, I am assuming for now that the Canadian and U.S. dollars will trade within the band shown below. {snip}

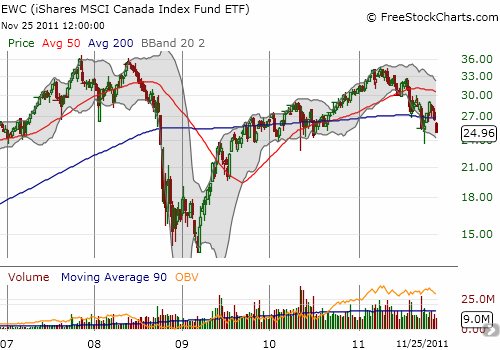

The Canadian stock ETF, EWC (iShares MSCI Canada Index Fund ETF) remains stuck in a downtrend for 2011. {snip}

Source for all charts: FreeStockCharts.com

Finally, I re-initiated a position in 5N Plus (TSX: VNP) a Canadian primary producer of CdTe (Cadmium Telluride) and CdS (Cadmium Sulfide). {snip}

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on November 27, 2011. Click here to read the entire piece.)

Full disclosure: net long the U.S. dollar, short USD/CAD; long VNP, long FSLR