This is an excerpt from an article I originally published on Seeking Alpha on November 12, 2011. Click here to read the entire piece.)

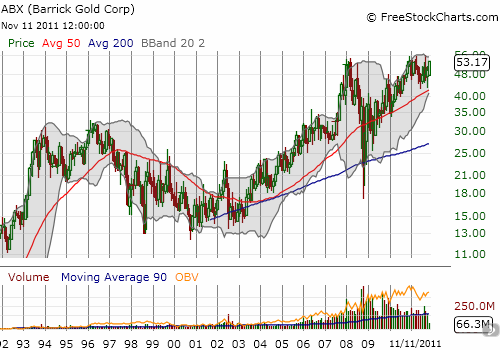

I have long argued that gold sentiment does not exhibit the euphoria one would expect in a bubble (for example, see “Enthusiasm for Gold Continues to Wane“). A recent podcast on National Public Radio’s Planet Money provided further evidence that the rising price of gold is not being met with explosive enthusiasm. In “Boom Town“, Planet Money tells the story of Elko, Nevada where the high price of gold has brought an economic boom. Unemployment is half the statewide rate, and Barrick Gold Corporation (ABX), the mining company running the local mine called “Gold Strike”, wants to hire 1000 MORE people in the next year. Wages are strong. A chemical salesman who travels from Idaho to do business describes Elko as a “beehive.”

Despite this boom, caution seems to rule sentiment. The interviewers found what they called an “undercurrent of anxiety,” “fear in town,” and “nervousness everywhere”: “No one wants to take a chance on the price of gold staying high.” {snip}

Wondering why gold works so well as money? Planet Money put together a short explanatory video called “Why Gold.” A chemist uses the periodic table to quickly narrow down the potential candidates to gold.

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on November 12, 2011. Click here to read the entire piece.)

Full disclosure: long GLD