This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

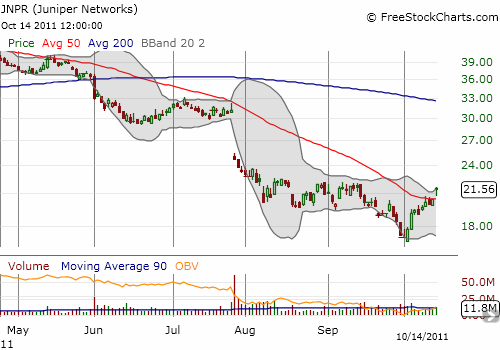

Juniper Networks (JNPR) has surged 24% since I wrote about the stock’s plunge to 2 1/2 year lows. At that time, I claimed it was time to trigger my idea to do a pairs trade long JNPR versus short Cisco Systems (CSCO). I have tweeted the related trades since then, but I thought I would provide some more detail and color on the status of this trade in a post.

Source: FreeStockCharts.com

{snip}

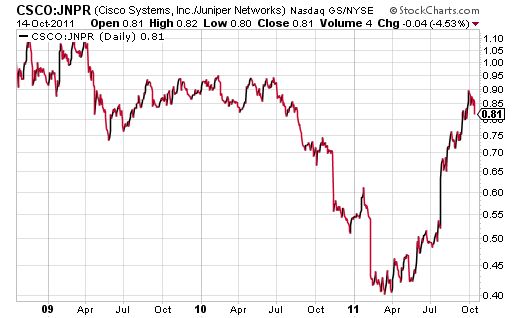

I was fortunate to nail the day JNPR hit its last 52-week (and multi-year) closing low (granted I was guided by my technical analysis flashing a buy signal on the S&P 500 based on oversold conditions). CSCO has jumped 16% during this time and has lagged JNPR’s gains. The current performance differential between JNPR and CSCO has validated the launch of the pairs trade at the 0.90 CSCO:JNPR price ratio as “close enough” to the (recent) historical high of 0.95.

Source: Stockcharts

JNPR has performed so well that my calls are already in-the-money and no longer providing much leverage. On Friday, I decided to use some of the profits to add to the CSCO puts to pad my downside hedge. {snip} In retrospect, I should have used the profits to purchase a new set of out-of-the money calls on JNPR. {snip}…

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

Full disclosure: long calls on JNPR and long puts on CSCO