(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag.)

T2108 Status: 22%

VIX Status: 43

General (Short-term) Trading Call: Hold

Commentary

I suppose it is fitting that the market ends its worst quarterly performance since 2008 near the bottom of a choppy trading range, T2108 scraping at oversold conditions once again, and the VIX stubbornly scratching at the top of its recent trading range. On the flip side, bonds reveled in their best quarterly performance since 2008. These are all decent conditions for a big first-of-the-month, first-day-of-the-quarter rally. Such a move is probably the only thing that keeps the S&P 500 from punching through 52-week lows soon. In fact, according to figures compiled by CNBC:

“…when the third quarter sees an official correction, or a 10 percent or more drop, the ensuing quarter is almost always positive.

The S&P 500 for the July-to-September period lost 12 percent heading into Friday’s trading, which saw the market add to its losses. History, then, suggests that the following quarter will post a gain of 7.2 percent. The trend has held up eight out of nine times.”

If this history holds water yet again, the buying oversold conditions on T2108 could generate some very good profits in the fourth quarter.

Note well that leading into Friday’s sell-off, the market had a very mixed performance on Thursday. T2108 surged from 23% to 28% while the S&P 500 only increased 0.8%. At the same time, many high profile tech stocks sold off (for example, see NFLX and BIDU). The NASDAQ was down 0.4%. I would have declared that Thursday printed a bullish divergence and anticipated a rally on Friday. This is a good reminder that these indicators are not perfect and risk must always be managed carefully.

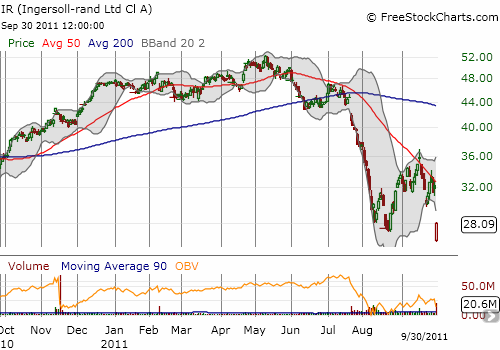

Once again, I am keeping a close eye on cyclical stocks. The market continues to react very poorly to bad news from cyclical companies. Ingersoll-Rand (IR) warned on earnings Friday morning and lost 12% on the close. The only positive is that buyers bought the stock at the new intra-day 52-week lows and prevented the stock from closing at new 52-week lows.

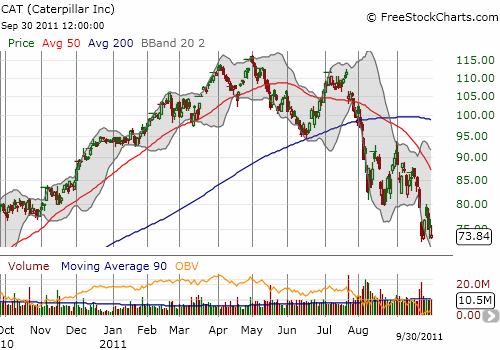

In sympathy, Caterpillar (CAT) experienced mostly selling pressure on the day. It now sits exactly on top of its 52-week closing low.

Source: charts from FreeStockCharts.com

Finally, many steel stocks continue to flirt with their March, 2009 lows. For example, see the chart for U.S. Steel (X) as it hovers about 10% above those climactic lows (click link).

If the market manages to rally on Monday (or next week), either it will occur on the top of a large gap up or only after another wave of sellers gets washed out with new 52-week lows on the S&P 500. Either way, brace yourselves..!

Charts below are the latest snapshots of T2108 (and the S&P 500)

Refresh browser if the charts are the same as the last T2108 update.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Weekly T2108

*T2108 charts created using freestockcharts.com

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SSO, X

Doctor,

Great work. So when are you going to start managing OPM; surely all this publishing is not solely based on humanitarian motivation.

LOL. Well, I love to write, and this blog serves as a sort of diary and journal of my thinking. Managing OPM comes with a LOT of headaches outside my scope of interest and not to mention time. I would be satisfied just know this stuff helps some people…and getting a lot more hits (and ad dollars) on the blog. 🙂