A little over a week ago, I explained why I put the Mexican peso and the Canadian dollar (FXC) on shorter leashes. Canada’s extremely strong second quarter GDP report at the end of August just loosened that leash a little.

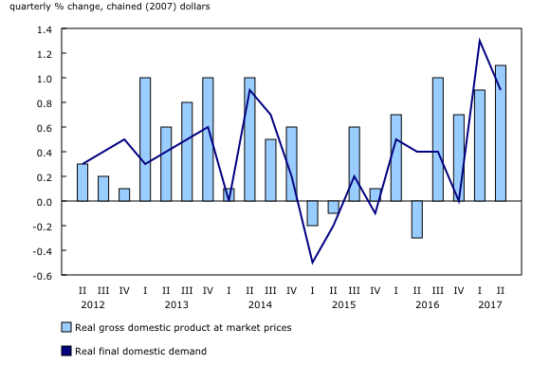

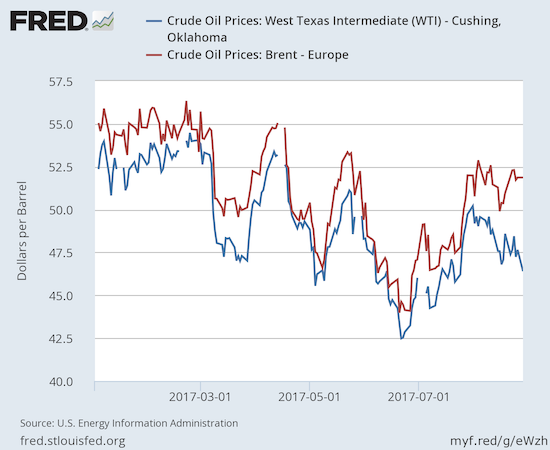

Statistics Canada reported 2Q real GDP growth of 1.1%. The annualized growth rate of 4.5% was a blistering pace that hurtled the real GDP 2Q growth in the U.S. of 3.0%. Combined with the strong growth in the first quarter, Canada experienced its strongest first half of a year since 2002. Given this growth occurred during a period of generally declining oil prices, it seems the Bank of Canada succeeded with its strategy of cutting rates earlier. It also seems that the Bank may need to soon talk of “normalizing” monetary policy although I doubt it will rush to hike rates in its next decision on monetary policy this Wednesday, September 6th.

Source: Statistics Canada

Source: U.S. Energy Information Administration, Crude Oil Prices: West Texas Intermediate (WTI) – Cushing, Oklahoma [DCOILWTICO], Crude Oil Prices: Brent – Europe [DCOILBRENTEU], retrieved from FRED, Federal Reserve Bank of St. Louis, September 3, 2017.

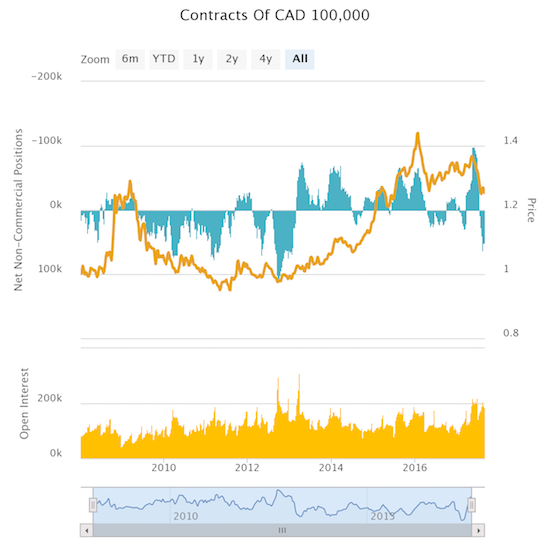

The currency market responded decisively to the strong GDP report. USD/CAD is now trading at a 2-year low.

Source: FreeStockCharts.com

Since quickly ramping back to a net bullish position on the Canadian dollar in July, speculators have held net long contracts steady. Current levels were last seen in early 2013 but are still nowhere near the “maximum bullish” levels of 2012. Speculators have plenty of runway to get more bullish.

Source: Oanda

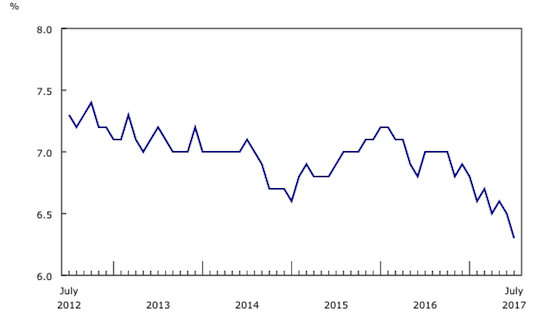

Statistics Canada will report on the August health of its labor force on Friday, September 8th. If the current trend is any indication, the report should deliver more good news and continue to support the strength of the Canadian dollar. Even if the report contains a negative surprise, I would treat any subsequent weakness in the Canadian dollar as a buying opportunity.

Source: Statistics Canada

Be careful out there!

Full disclosure: no positions

A hike at the next meeting would be a surprise. Although if I was them I would get it out of the way. But they haven’t prepared the market so I doubt they will. So if there is a rally in usd.cad after the meeting, it could be a sell. Either way, 1.22 looks like it will be in play between now and the next rate hike. I have a starter position here and intend to make that a full position on any further weakness to 1.26.

Eur.usd also entered starter position long.

All this adds to the reflation idea and further dollar weakness will later in the year add to inflationary pressures for the fed to hike again. A great long dollar opportunity should present itself in the next 6 months when the short dollar consensus gets very overcrowded and overdone. My only problem with short dollar here is how crowded it is already. But as you mention it can get more crowded. However, when I look at the long spec positioning in AUD and NZD, I get a bit nervous and have one foot out the door already. I guess for now it is play dollar weakness and risk on, but watching for the exits. All this could go on for longer than I expect though.

The trends usually go on longer than we expect. So, to manage risk, just trade in and out alongside the trend. Watch for breakouts/breakdowns that violate the trend. When the dollar finally ends its suffering, I definitely want to go all in long! That could be one tremendous recovery as shorts scramble.

The BOC decision should be very interesting. Either way there should be a lot of volatility. Market based expectations amazingly are currently 55% odds of hike in Canadian rates at the meeting Wed. I am puzzled why the BOC has not leaked something. Whatever the decision, it is going to wrong foot half of the market.

Woah. 55%?! That’s a lot higher than I would have expected. That means I definitely need to be on my toes. Where did you get that number?

That was the implied probability interpolated from short term interest rate futures – quoted by Marc Chandler yesterday. I did try calculating it twice in the past for US implied probabilities and he is usually very accurate. I did think the figure was high but other articles I read also had implied probabilisties around 50% after Canadian GDP Friday, so I didn’t bother confirming the calculation myself. I actually thought about going short CAD here as I don’t think they will hike. But CAD has been a bit sold already so I might buy a little here and wait for the decision and decide whether to buy some more after the decision, particularly if there is a pullback in CAD from no hike back to 1.25.

I wish Chandler provided a source? What I really want is a site that publishes all these probabilities across central banks in a grid. 🙂

I am very hesitant to have any CAD position on ahead of that decision. But I will welcome CAD weakness to buy into….

Woah! BoC did it! Wowza!

Yes surprising! But not that surprising because they just did what the market expected. Maybe they didn’t leak because they hadn’t made up their mind before the meeting. That’s slack ! I think I will start a position here long usd.cad. 1.2 should be at least a short term floor, if not the floor. In retrospect, should have had crazy bids in at 1.21 and 1.2 knowing the odds.

The fact that they didn’t leak the meet result to me indicates it was a close thing and they are done for a while hiking, so I am

More inclined to buy cad here.

They have to be done for a while given the slow pace of the Fed. I have already started scaling in to short USD/CAD. I did a quick flip on a short GBP/CAD.

Did you mean long usd.cad ? I got that confused in my post also. Basically, I am

looking into scaling into long usd.cad also. I have a starter position around 1.22. My main concern is that oil may not have peaked in the short term.

There seems to be probability of an oct 25 hike being priced into CAD now. I think the chances of that are very low (almost zero) but it is getting priced in at more than this as CAD has not been sold yet. I suspect the earliest they will hike again would be Dec or next year. It would make no sense to have 3 rate hikes in a row when they did nothing for 2 years and with the housing market where it is. Hence I’m inclined to sell CAD here but the price action looks scary.

No. I definitely meant SHORT USD/CAD. My position is already closed out with a profit. I will keep fading rallies in USD/CAD.

Since I thought a hike in September was too early, I can’t rule out the market being right again about an Oct hike. If the economic data keep running very hot, BoC may have no choice.

Surprising strength in CAD, dovetailing with ECB. Took a loss on the countertrend punt shorting CAD after the rate hike. There was obviously no delayed sell the news activity and the follow through buying has been impressive.