AT40 = 47.0% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 54.4% of stocks are trading above their respective 200DMAs

VIX = 10.4 (volatility index)

Short-term Trading Call: cautiously bullish

Commentary

At the time of typing, financial markets are carefully stepping into “Trifecta Thursday” – or maybe not so carefully if measured by the volatility index. The VIX remained amazingly calm ahead of what has been heralded as a key meeting on monetary policy form the European Central Bank (ECB), testimony from former FBI Director James Comey on Russian election meddling and President Trump’s potential connections to it, and a national election in the United Kingdom that is serving as yet another referendum on Brexit.

Contrary to the market’s remarkable calm, I decided to buy a handful of call options on ProShares Ultra VIX Short-Term Futures (UVXY) expiring next week. I did not bother hedging with put options since my stock positioning is heavily skewed to the long side. If volatility does manage to wake up, I plan to close out the UVXY call options quickly given my assumption the current period of extremely low volatility likely presages an overall calm summer.

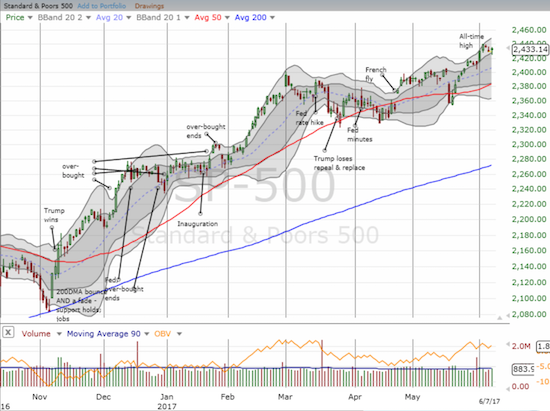

The calm is of course reflected in an S&P 500 (SPY) that is just off another set of all-time highs. Although this week started with an immediate reversal of the gains following last Friday’s U.S. jobs report, the index neatly bounced off the bottom of the upper Bollinger Band (BB) channel that defines the latest short-term uptrend.

While AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), brought fresh credibility to the rally with a convincing show of breadth last week, my favorite technical indicator returned quickly to its over-arching theme of wavering. AT40 closed last week at 55.3% and has lost ground for three straight trading days. It closed Wednesday at 47.0%. The downtrending energy sector is likely a culprit once again. Fresh weakness also appeared in retail stocks with Macy’s (M) taking a shellacking on Tuesday after reporting guidance tainted by weaker margins. The storied retailer is approaching a 7-year closing low. Over the last two years, Macy’s has lost a whopping 68%. Macy’s helped drag the SPDR S&P Retail ETF (XRT) right back to its low of the year and a near 52-week low.

On May 26th, electronics retailer Conn’s, Inc. (CONN) regained my attention after Best Buy’s (BBY) stellar post-earnings performance. I decided to wait for earnings before deciding to buy CONN. The stock went on to rally for the next five days going into earnings. The stock stumbled after reporting earnings. Before I could even think of buying this dip, CONN rallied off its post-earnings low and then soared 9.9% on Wednesday to finish closing the gap down. Stifel reiterated a buy rating on CONN and upped its price target from $19 to $20. This strong trading action suggests CONN is still a buy (preferably on dips). It is hard to believe that CONN was trading at less than half of its current trading level just two months ago! CONN is now back to a 15-month high.

Now I move on to see whether the market expresses any care or concern with Thursday’s trifecta. I will be watching the currency markets more closely than the stock market. Currency markets more consistently care about the day-to-day, hour-to-hour news cycles.

Be careful out there!

— – —

FOLLOW Dr. Duru’s commentary on financial markets via email, StockTwits, Twitter, and even Instagram!

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #326 over 20%, Day #146 over 30%, Day #13 over 40% (overperiod), Day #2 under 50% (underperiod), Day #28 under 60%, Day #98 under 70% (corrected from June 2, 2017 post)

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

*All charts created using freestockcharts.com unless otherwise stated

The charts above are my LATEST updates independent of the date of this given AT40 post. For my latest AT40 post click here.

Related links:

The T2108 Resource Page

You can follow real-time T2108 commentary on twitter using the #T2108 or #AT40 hashtags. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag.

Be careful out there!

Full disclosure: long UVXY call options, long BBY calls and puts

*Note QQQ is used as a proxy for a NASDAQ-related ETF

I shorted some euro to balance out cad short risks in case dollar rallies. I think very likely Draghi will be dovish and idea he will taper is over priced in. Dollar may pop so I am hedging out dollar shorts.

I saw the Bloomberg cocoa article and it was the principle thing that made me not enter that yet. I think if Bloomberg is anticipating a bottom, I am worried it is not there yet.

Oil is getting nailed. I wonder where the bottom is. I think the move has everyone disorientated. I am managing the long cad position but worried.

Can’t resist going short eur.gbp here with draghi and British election. Gbp should rise after the election just from the volatility compression in cable and removal of GBP hedges after the event. Draghi, if he is super dovish again will have a short term effect on EUR.

I am focused on buying dips in the euro. Taking a long time to develop. 🙂 Cocoa is struggling hard. This bottom will take a lot of time to confirm I think.

So I think the euro risk is past at this point. On to the UK election! I am trying not to over-anticipate. So, I will trigger trades on pairs going through particular thresholds. Don’t forget that there is still a chance Theresa May loses face through this election and the pound gets crushed. I don’t think this scenario is being taken seriously so I wonder how much upside is there for a Theresa May win.

Wow, what a crazy election. Went short eur.gbp going into the election and after the dip covered 90% at a tidy profit. Went to sleep (as I live in the Southern Hemisphere) and woke up to find gbp had fallen out of bed. The loss on the 10% I left on wiped out the profit on the other 90%. Back to waiting for CAD to rally for me. The Brits, what a crazy bunch. Cable could sink to new lows. I thought about shorting it after, but I think I will think it over some more.

I decided to take a short gbp.usd position with the retrace to 1.2750 post election. Article 50 is still triggered, May will probably still be able to form a coalition and it will give the Europeansmote confidence to negotiate hard.

No one understands the electorate anymore! I actually was short the pound going into the election and kept trading in and out throughout the fallout. I decided not to write about it because it doesn’t help people much to review things they cannot repeat for themselves or things I did not set up with an earlier discussion. I simply never got time to lay out the pre-election plan. As you could tell from my comments earlier, I thought the market had baked in a very good outcome from the election. As a currency trader, you always have to give such consensus a thorough shake down! I think the UK political situation will be unstable for a while, so I am hoping to keep trading in and out, short and long until the technicals tell me to do otherwise…