President Trump will address a joint session of Congress on Tuesday night, February 28th. Traders will no doubt have notepads ready to jot down the latest corporate targets of Trump’s wrath and praise. Trump’s words and tweets move markets, yet recent impacts have not lasted and have even worked in reverse of expectations. It is time to think of Trump Trades more as short-term generators of volatility. Nimble traders can continue chasing the immediate reaction for however long it lasts. More circumspect traders can treat the volatility as a way to buy/sell into the pre-Trump trade at a better price; in other words, give consideration to the contrary case. In preparation for the potential trade-worthy aftermath of Trump’s address, I examine lessons from four recent Trump Volatility scenarios: Nordstrom (JWN), Intel (INTC), Cognizant Technology (CTSH), and the iShares Nasdaq Biotechnology (IBB).

Nordstrom (JWN)

On February 8th, Trump complained about Nordstrom dropping his daughter Ivanaka’s line of products from its stores. The market started to sell JWN shares, but, abruptly, buyers returned fire in force. By the end of the day, JWN was UP a startling 4.1%. JWN gained the next day as well. JWN churned from there but never returned to the price it had when Trump tweeted.

Source: FreeStockCharts.com

The day after Trump’s tweet, Trump counselor Kellyanne Conway underlined her boss’s outrage by encouraging viewers of “Fox & Friends” to go out and buy Ivanka’s products. JWN gained another 2.3% in the wake of that news.

Apparently, JWN’s decision had nothing to do with politics and everything to do with business. According to Yahoo Finance:

“Beyond people not wanting to purchase Trump-branded clothing, the core problem is actually entirely unrelated to politics. The real culprit is the dominance of athleisure, making Ivanka Trump’s structured dresses and pumps seem out of sync with how people dress these days — more casually, even to work.”

That assessment helps explain the lack of selling pressure. Perhaps the buying interest was out of relief that JWN was further rationalizing its product lines. To highlight the minor nature of this incident, JWN never referenced it until analyst Omar Saad from Evercore ISI pressed the issue. Peter Nordstrom responded. Here is the brief exchange from the Seeking Alpha transcript of the earnings call:

“…And I’m sorry I have to ask, did you see any change in trend in your business at all around the President’s tweets, whether it’s helped you or hurt you at all? Is there something you can comment on?”

“This is Pete. No, that would be negligible. I think it’s not really discernible one way or the other.”

Going forward, I think the Trump-effect is a non-issue for JWN except that it seems the immediate response may have washed out a sizable portion of motivated sellers (note that a whopping 21% of JWN’s float is already sold short). The reaction to the earnings report looms much larger now with the stock pressing against resistance at its 50-day moving average (DMA) and 200DMA resistance looming overhead. Note that the 13.0M shares traded were not as high as the trading volume from earnings last August.

Intel (INTC)

On February 8th, Intel CEO Brian Krzanich visited the White House to announce plans to invest in an Arizona factory. From Intel’s press release accompanying the visit:

“Intel Corporation today announced plans to invest more than $7 billion to complete Fab 42, which is expected to be the most advanced semiconductor factory in the world. The high-volume factory is in Chandler, Ariz., and is targeted to use the 7 nanometer (nm) manufacturing process. It will produce microprocessors to power data centers and hundreds of millions of smart and connected devices worldwide…

The completion of Fab 42 in 3 to 4 years will directly create approximately 3,000 high-tech, high-wage Intel jobs for process engineers, equipment technicians, and facilities-support engineers and technicians who will work at the site. Combined with the indirect impact on businesses that will help support the factory’s operations, Fab 42 is expected to create more than 10,000 total long-term jobs in Arizona.”

While the factory has been on the books for several years, Krzanich explained that Trump’s plans for corporate tax cuts and regulatory reform convinced the company to finally move forward with its plans. The market’s reaction to the visit with Trump was very mixed. On the day, the stock pivoted high and low around its 50DMA. The next day, INTC broke down in response to its analyst day. The selling ended the next day with a near picture-perfect test of support at its 200DMA.

I am not clear whether INTC’s job creation offset the U.S. portion of the 12,000 people that Intel announced it would layoff globally (11% of its workforce at that time). Intel broke the news last April as a part of its earnings announcement at the time. The stock is up 15.6% since then even with the recent pullback.

Source: FreeStockCharts.com

For INTC, Trump praise had little to no immediate impact on the stock besides intraday churn and volatility. The more important news came the next day with the stock moving in the opposite direction of the praise. INTC was another case where it was more important to think of trading around Trump Volatility rather than to look for a sustained reaction in support of the headline. Note that given my bullishness on INTC in between earnings, I used the selling to double-down on my between-earnings-trade.

Cognizant Technology (CTSH)

On January 29th, Bloomberg reported that Trump was drafting an executive order to strike at the H-1B VISA program. Indian information technology firms use this program to fly in workers for projects. The market reaction gapped Cognizant Technology (CTSH) down to a 4.4% loss. At the time, I noted the bearish technical implications of the selling. The selling came to a quick halt as traders awaited earnings. Once again, earnings news dominated the Trump headlines as CTSH soared right through 50 and 200DMA resistance. The following day, CTSH broke through its recent downtrend. The stock has crept higher ever since and looks poised for more with CTSH initiating “a robust capital return program” featuring dividends and a cash buyback.

Source: FreeStockCharts.com

It turns out Indian IT companies have been bracing for visa reform for ten years. They claim that they have been adjusting their business model to rely less on the H-1B visa. Still, various Indian IT firms quickly rallied to plan some lobbying to stave off damaging regulations. This episode surely brought back nightmares from the severe restrictions in the Immigration Reform bill that was proposed back in 2013.

If I had known about the industry’s preparation over the H-1B visa issue, I would have pounced on the selling as a potential pre-earnings buying opportunity… especially with this new Trump Volatility trading framework.

In its earnings announcement, CTSH addressed the issue head-on noting how it is already expanding local workforces. From the Seeking Alpha transcript of the earnings:

“We will also continue to invest extensively in training and re-skilling our team and in substantially expanding our local workforces in the U.S. and other local markets around the world where we operate, as agile development and the pervasive influence of technology increases the value of co-location and a consultative approach. To complement this organic investment, we are intensifying our efforts to acquire companies, expanding our intellectual property, industry expertise, geographic reach, and platform and technology capabilities. We’ve recently ramped up this activity and we expect to accelerate the pace further in 2017, while keeping to our strategy of focusing primarily on tuck-in acquisitions.

…we’ve been expanding our local hiring and retraining and so forth in various geographies around the world, but assumes essentially that we continue on that path with no significant changes in terms of immigration policy or so forth.”

CTSH noted that trying to anticipate relevant changes to U.S. immigration policy is too speculative an exercise right now for planning.

Needless to say, I will be buying the dips in CTSH going forward.

The iShares Nasdaq Biotechnology (IBB)

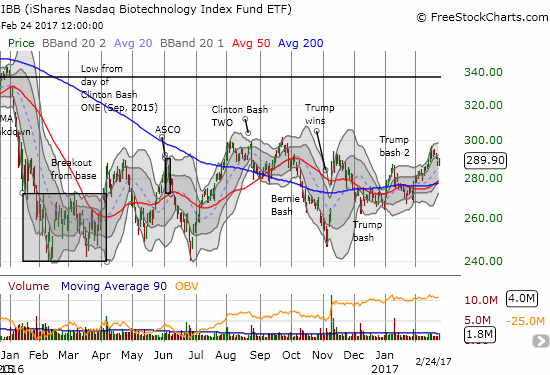

Across the political spectrum politicians have recently bashed the pharmaceutical industry. The words of three politicians have carried enough market weight to pressure IBB downward. Former Democratic Presidential candidate and Secretary of State Hillary Clinton kicked things off on the campaign trail for the Democratic primary in September, 2015 when she announced a coming plan to address price gouging on drugs. To my surprise, IBB has yet to recover from that bash. In fact, IBB has yet to even sustain a recovery from the second Clinton bash which came last August. Trump’s victory wiped out a bash from Senator and former Democratic Presidential contender Bernie Sanders. Two subsequent bashes from Trump looking for ways to lower drug prices first marked a post-election bottom and then second created a 3-week sell-off that was fully reversed by mid-February.

Source: FreeStockCharts.com

At this point, IBB has survived a lot of negative headlines, political bashing, and selling. The chart above shows that IBB carved out a double bottom between February and June, 2016 that survived a test last November. I now assume that a sustainable bottom has finally arrived for IBB and future dips driven by political wrangling are likely buying opportunities. At least it should take more than words to keep IBB down going forward. If IBB breaks out to the upside from the current range… look out.

Parting Thoughts

These four cases represent a portion of the various Trump trades that have pervaded the stock market. I picked these stocks out as examples of how the Trump trade can work out in reverse of the initial or headline expectations. With many of the big programs becoming old news on Wall Street, the market should growing increasingly impatient to get specifics and legislation underway. Under these circumstances, I think short-term Trump Volatility will characterize the market’s reactions instead of the more sustained advance in the weeks following the November election.

Be careful out there!

Full disclosure: long INTC call options