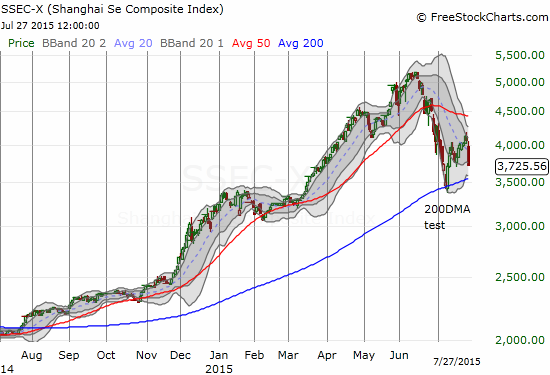

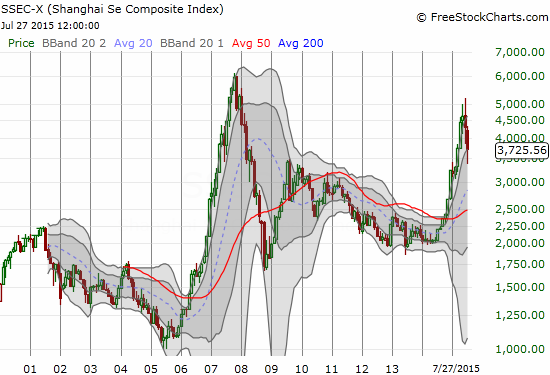

The Shanghai Composite Index (SSEC) plunged 8.5% to start trading for the week. The ripple effects were wide and far-reaching even as arguments continue floating that the collapse in China’s stock market matters little outside of China and does not truly reflect on economic conditions in the country.

Apple (AAPL) CEO Tim Cook summed up a lot of the soothing words to-date during last week’s earnings conference call (from the Seeking Alpha transcript of AAPL’s Q3 2015 earnings conference call):

“…we remain extremely bullish on China and we’re continuing to invest. Nothing that’s happened has changed our fundamental view that China will be Apple’s largest market at some point in the future. It’s true, as you point out, that the equity markets have recently been volatile. This could create some speed bumps in the near term. But to put it in context, which I think is important, despite that volatility in the Chinese market, they’re still up 90% over the last year, and they’re up 20% year-to-date, and so these kind of numbers are numbers I think all of us would love.

Also, the stock market participation among Chinese household is fairly narrow. And the stock ownership is very concentrated in a few people who put what appears to be a smaller portion of their wealth in the market than we might. And so I think generally this has been, at least as we see it, maybe it’s not true for other businesses, that this worry is probably overstated. And so we’re not changing anything. We have the pedal to the metal on getting to 40 stores mid next year. As we had talked about before, we’re continuing to expand the indirect channel as well.”

Cook went on to quote a McKinsey study that estimates China’s middle class will grow from 14% to 54% of households from 2012 to 2022. I now put such estimates right up there with the iron ore miners who continue to lean on very bullish assumptions about China’s steel consumption over the next 10, 20+ years. They are using these forecasts to help them look past the current acceleration in the 4-year long collapse in commodities.

Regardless, I think no one should take any comfort in a massive short-term loss just because the gain over a year or so is still tremendous. Such a setup only tells me that the market still has plenty of room to fall and reverse course. One must wonder why the Shanghai Composite index exploded as it did just as China’s economic growth rate was finally slowing down.

Source: FreeStockCharts.com

We have heard the “do not worry” in the financial news. Take July 27th’s Marketplace where various analysts weighed in on the insignificance of China, the world’s #2 economy…

- China’s financial markets are mostly closed off to those outside of the country – foreigners own less than 2% of Chinese shares.

- China is just 7% of U.S. exports.

- A lot of the growth in China was bad growth: credit-fueled, over-investment. So, a slowdown in China will have a healthy cooling effect and transition China into more of a consumer than producer.

The last point was of course a masterful way of turning an alarming negative into a positive!

The stock market churn has been so unimportant that the Chinese government has panicked and executed extreme measures to manipulate market behavior. We outsiders received a swift reminder of the true nature of Chinese capitalism and likely the expectation in China’s financial markets that the government SHOULD “do something” to take control of the situation. Of course, China’s manipulation is probably just an overt and more heavy-handed version of the government intervention in Western economies to bring order out of the chaos of the financial crisis.

Some slag Chinese stock bail outs but fail to note the US, UK et al pumped $trillions to stop banks failing. It's call economic management

— Stephen Koukoulas (@TheKouk) July 28, 2015

Yet, the extreme nature of the Chinese government’s interference makes its stock market extremely unattractive. No true rule of law seems to exist, and the government is free to do anything, including jail people who “illegally” sell their stocks, to accomplish its objectives. Own stock one day under one set of rules and wake up the next day with a different set. Under these circumstances, I am trying hard to avoid Chinese-related stocks, even my favorite Baidu (BIDU) which got crushed in after-hours about 8% after reporting its earnings. Normally, I would be licking my chops to jump on cheaper shares and take advantage of BIDU’s tendency to bounce sharply off oversold levels.

However, there is one China-related trade that still looks as good as ever: iShares MSCI Emerging Markets (EEM).

Source: FreeStockCharts.com

Chinese stocks are just a part of EEM, but I find EEM to be a good theme-based play on what is happening in the emerging markets that are greatly influenced by what is really happening in China. Most importantly, the options for EEM seem chronically under-priced. They rarely seem to take into account what I think are high odds for EEM to break sharply upward or downward. The 7% decline in 10 trading days has taken EEM past its lower-Bollinger Band (BB). Selling volume is picking up. A sharp bounce seems in the cards sooner than later.

I like to play EEM by going long “strangles”: the simultaneous purchase of out-of-the-money call and put options. The past several strangles I have executed on EEM have all made enough money on the put side so quickly that I was compelled to take profits. I keep hoping the call side of the trade will add to the profits but to no avail. This time around, I am expecting the profits to come from the upside. But the beauty of these strangles is that I am able to stay relatively agnostic about direction. I care a lot more about the speed of the move.

Here is an example of a trade I might initiate (I will announce it on StockTwits and Twitter with the #120trade hashtag), all options expire on August 21, a little over three weeks from now: the $37 call options sell for $0.52/0.57 bid/ask, the $35 put options sell for $0.37/0.40. If EEM just challenges resistance from its recent high, the call options deliver at least a triple and deliver plenty of profit to pay for the put options along the way. If EEM continues a plunge from here, I would expect increasing options premium to help make the puts at least valuable enough to pay for the call options. Either scenario can easily happen in three weeks. Previous experience tells me that one of them should play out within the next week.

There are of course other trades I have referenced that have direct dependence on China, like Caterpillar (CAT) and the Australian dollar (FXA). However, I China is not my #1 consideration for these trades.

Be careful out there!

Full disclosure: long AAPL call options, long and short various currencies against the Australian dollar

Addendum

The Nightly Business Report (NBR) for July 27th provided a few companies with large share of sales in Asia.

S&P 500 companies with the highest revenue exposure to China:

Skyworks Solutions (SWKS): 62%

Yum! Brands (YUM): 52%

Qualcomm (QCOM): 48%

Other companies with a large share of their sales in Asia in general:

Abbott Labs (ABT): 31%

3M (MMM): 30%

Schlumberger (SLB): 24%

ConocoPhillips (COP): 22%

Boeing (BA): 25%