(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 51.0% (a plunge of 15 percentage points!)

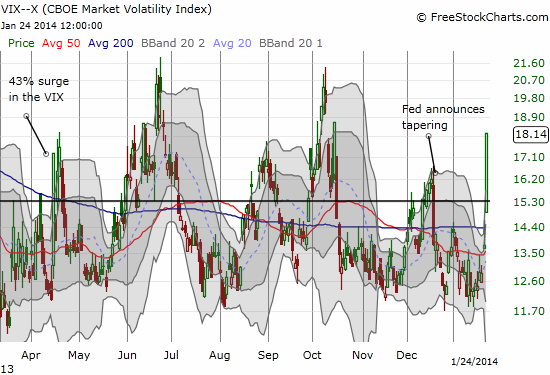

VIX Status: 18.1 (a surge of 32%!)

General (Short-term) Trading Call: Short (bearish bias) but see below for caveats

Active T2108 periods: Day #140 over 20%, Day #23 over 50% (overperiod), Day #2 under 70% (ending 14-day 60% overperiod)

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

Commentary

“Finally, speaking of “something up,” I think there is something up with the general stock market. This whiplash “feels” like the prelude to something big in SOME direction. Bullish and bearish traders need to be on their toes more than normal, ready to pounce on opportunity in an instant.” – T2108 Update, January 14, 2014.

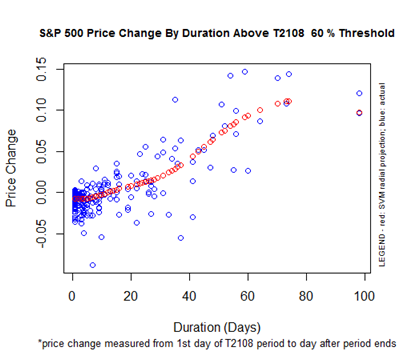

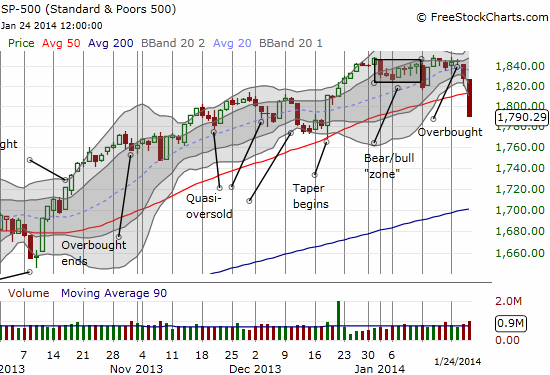

The T2108 60% overperiod lasted for 14 days and ended with a 2.2% loss for the S&P 500 (SPY). This at the lower end of the historical range of performance and well off the projected performance of near flatline for a 14-day long 60% overperiod.

This is just the first of many statements sellers made with Friday’s massive -2.1% drubbing of the S&P 500. Sellers have not been able to make such a statement in a long time, so this surprisingly strong follow-through to Thursday’s angst deserves special study. Hang in there with me on this…

First, a reminder that in the T2108 Update for January 13, I noted how sharp sell-offs have (eventually) followed three cases of “close encounters” with overbought conditions. In the current cycle, T2108 brushed against overbought conditions several times, like a major tease, and finally hit overbought for just one brief day.

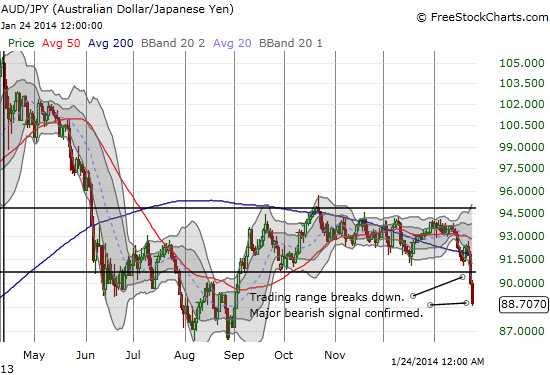

Second check, the Australian dollar versus the Japanese yen took another huge wallop in a move that further confirms its new and important link to the S&P 500.

I am still long AUD/JPY out of my ultimate bearishness for the Japanese yen and my desire to use this pair as a hedge on shorts against the Australian dollar. It also seems creeping inflationary pressures in Australia may force the Reserve Bank of Australia to (eventually) back off historically low rates. I am now watching this currency pair ever more closely for trading clues for the stock market. No need to look any further than the S&P 500 for bearish confirmations: the index crashed through three important technical supports all in one day: the bear/bull zone, the 50-day moving average (DMA), and then the even number 1800 for good measure. I earlier cited these levels as challenges to the sellers. They have my fullest attention now! The sellers were even able to drag the index far below its lower-Bollinger Band.

Anyone who was not already short the S&P 500 ahead of Friday’s trading probably could not move fast enough or confidently enough to join the bear maulfest. Indeed, I chose to unload most of my ProShares Ultra S&P500 (SSO) puts into the selling (I tweeted the trades this time). I kept 20% of the overall position as part of my on-going pairs trade described in “The Low Risk Pairs Trade On The S&P 500 Passes Its First Test.” I felt VERY grateful to have these SSO puts in place thanks to following my trading rules as outlined in earlier posts. Once again, a strong reminder of the importance of having rules and sticking to them.

I was eager to lock in profits because I expected T2108 to go into quasi-oversold conditions. Regular readers should now be very familiar with the setup: the market typically, but not necessarily, trades up following two big down days on T2108. T2108 dropped an incredible 23% on Friday and 28% across Thursday and Friday. The T1208 Model (TTM) generated 86% odds of an up day for Monday. However, the conditions for this prediction have me thinking it is time to open the hood for some investigation and/or retooling. While the error rate is a satisfactory 28%, the classification error is a bizarre 53%. At a bare minimum, the classification algorithm should be able to flip that rate to 47%. I have a sneaking suspicion the classification rate calculation has gone awry, but I did not have time to look further before this post.

The branch of the model activated by this prediction adds to my hesitation. I expected the tremendous surge in the VIX (see below) to drive the biggest portion of the prediction. Instead, the rule for this T2108 prediction is simply a VIX change greater than 1.4% and a T2108 close ABOVE 38.8. No requirements even for the magnitude of T2108 change! Through it all, I still think the odds greatly favor a relief rally on Monday, especially with the S&P 500 extended so far below its lower-BB. Traders should approach with caution: for example, chasing an intraday rally is full of a LOT more risk than fading a gap down.

It is high time I update my analysis of daily S&P 500 performance! The last update was back in May 15, 2013 in “Daily S&P 500 Trading: Monday Under-Performance, Tuesday Out-Performance And Other Patterns.” As you can tell from the title, the expectation absent any T2108 analysis is for a DOWN Monday with the relief rally coming on Tuesday.

Speaking of the VIX, its 32% surge is in the neighborhood with the 43% surge back on April 15, 2013.

Along with April’s one-day surge, the S&P 500 dropped 2.3%. The index recovered much of its loss the very next trading day (a Tuesday!), reversed those gains the next day, and sold off one more day to retest the 50DMA. Even though the VIX eventually traded at higher levels in June and again in October, note that the S&P 500 has still not revisited those levels (around 1550). So, while Friday’s run-up in the VIX may finally look like the top of the market, there is nothing certain about the length or nature of the current sell-off. The 200DMA is at 1701. The S&P 500 has not retested that support since Nov/Dec, 2012. Such a retest would deliver the 10% correction we should expect at some point this year. Before jumping to conclusions, let’s firsts see whether sellers can notch a lower close to follow-up on Friday’s fireworks.

I am trying to bring some perspective on the sell-off because the media, as usual, will try to feed off the bearish emotions naturally generated from such a sell-off. In the T2108 Update, I emphasize trading rules over personal sentiment. Sentiment IS important for understanding the context of the trading (are we being contrarians or following the herd?). With the media and sentiment in mind, I will conclude by reviewing some of the tweets of one of the best spokespersons for today’s bearish case: investment fund manager Doug Kass.

Please note that I have the utmost respect for Kass. I am referencing him here because Kass is bearish without being a fear-mongerer (most of the time anyway), and he is not a bear who just hates the world, the U.S., the government, Obama, etc… In other words, he is NOT a permabear even though he has been fighting the market from a rhetorical standpoint for quite some time now. At various times he has essentially called the market a bubble and has railed against complacency in the market.

On the flip side, he has also made it clear that he is only willing to bet against the market for brief periods of time, and he has bought and held stocks on the long side, including some stocks that have soared to amazing heights. In other words, Kass is a great example of most “rational” bears out there – they maintain full respect for the power of price momentum. I contend this behavior is demonstrated constantly by the shallowness of recent sell-offs and the persistent drive higher. Even bears do not want to miss out on the fun while it lasts. The market is approaching its five-year anniversary of the historic March, 2009 lows. The rally since then has disciplined many to treat every dip as a buying opportunities. We do not know when or how it will end, but we do want to be properly positioned when it comes. Kass is approaching the market in the same way.

Here are some choice tweets I pulled just from the last tow trading days…listed in chronological order…with some commentary in between.

I am covering half of my SPY, IWM and QQQ shorts (from last few days) on this morning's woosh lower taking my net short position back to 5%.

— Douglas Kass (@DougKass) January 23, 2014

Back to market neutral now.

— Douglas Kass (@DougKass) January 23, 2014

In the wake of Thursday’s selling, Kass was very quick to take profits. At a 5% net short position, he definitely was not expecting a massive follow-through and stayed opportunistic, trading in the moment. The listed times are Pacific timezone. You can see that in this case, Kass didn’t even wait until the market opened to close out a large chunk of his short. He went neutral just 30 minutes after the market opened. Bears are VERY afraid now of the market’s quick-trigger propensity to bounce back from almost anything.

@GuvvD I try to balance opportunistic trading with investment longs and shorts dependent upon market conditions.

— Douglas Kass (@DougKass) January 24, 2014

This is a great reminder of Kass’s approach. Kass maintains an active portfolio of longs and shorts. Sometimes he discloses the balance in that portfolio (see below). His tweets mainly focus on the opportunistic trading. It is easy to forget his true sentiment on the market because the opportunistic trades are often no longer than daytrades and take advantage of the market sentiment in the moment. Sometimes it is not clear what happens to the trades that suffer from poor timing.

Sticking with QQQ and IWM shorts (and TWM and TZA longs) but just covered my entire SPY short at 180.31. $SPY

— Douglas Kass (@DougKass) January 24, 2014

Kass was eager to lock in profits from the sell-off. This tweet was minutes after I tweeted I had sold most of the rest of my SSO puts.

Sold most of rest of $SSO puts on fresh #SP500 breakdown. Keeping last 20% "just in case." $SPY #120trade

— Data-driven $$$ (@DrDuru) January 24, 2014

These trades apparently slid Kass into bullish territory…

With the S&P futures -29 handles, I am now slightly net long for the first time in a while. $SPY

— Douglas Kass (@DougKass) January 24, 2014

I literally fell out the chair when I read this; I did not initially comprehend the importance of his earlier short-covering. The market sell-off was just a day and a half old and Kass already switched to a bullish stance?!?! Again, the bears have shown no ability to sustain fire, and this was another example. This move at least validated my feeling that the market could bounce at any moment.

Next, Kass seemed to indicate that he was getting ready to expand his long exposure and take yet another quick retreat from the bear camp…

I have covered my QQQ and IWM shorts and I have sold my TWM and TZA longs. Slightly net long now. Baby steps.

— Douglas Kass (@DougKass) January 24, 2014

BUT with the market closing in less than an hour with no sign of the typical dip buyers taking the market off the lows, Kass threw up his hands and threw out almost ALL his chips…

Mostly in cash now.

— Douglas Kass (@DougKass) January 24, 2014

Kass’s positioning went from bear to neutral to bull to neutral in just two days o trading…and I thought T2108 was flipping me around!

I post these to show that one of the more thoughtful bears out there is not calling for a crash, is not pressing shorts, and is definitely not positioned for a rapid continuation of selling. In fact, I strongly expect that Kass, like me, will selectively buy if the market’s sell-off extends further at the open on Monday (or he will beat me to it and buy in the pre-market). Again, none of what i have posted here is to critique Kass’s approach, it is to show how bears likely have little commitment to the bear case.

Now here are some of words of wisdom from Kass: Mr. Market is NOT our friend! It underlines why a trader cannot stay stubbornly committed to any one opinion about the market.

@thedewey Not saying that. Voicing an opinion, only. Nothing can be claimed from Mr Market – he is there to confuse and ridicule us.

— Douglas Kass (@DougKass) January 25, 2014

And in case you forgot through all this that Kass is bearish, Kass today (time of writing January 26th) reposts a link to his piece on complacency in the market and says that the market is still biased toward risk. He has been featuring and re-featuring this link since Friday.

As expressed in Monday's "Climbing a Wall of Complacency" on RMPRO – Mr Market still possesses more risk than reward http://t.co/cBZwzOY2NK

— Douglas Kass (@DougKass) January 26, 2014

To me, this is a very mild assessment for any bear to make. The S&P 500 was up 30% in 2013. There should be PLENTY of room to the downside and thus plenty of room for bears to predict outright doom and gloom for 2014. Yet, Kass is not ready to go there (I think), so do not be surprised if the general lack of commitment by sellers shows up next week in the form of a rapid and sharp relief rally. We also have a Federal Reserve meeting on Wednesday to help the process.

Finally, here is a tweet the repeats a theme Kass has repeated for months in chastising any bullish sentiment…global growth is slowing. This claim alone should make anyone following fundamentals extremely bearish on the market regardless of the price action.

In a slowing global growth backdrop my favorite asset class remains closed end municipal bond funds.

http://t.co/5JzMBbRHMn

— Douglas Kass (@DougKass) January 23, 2014

Anyway, if you are still reading at this point, you had to wade through a lot of material. As I said, I think this juncture deserves careful thought and consideration because the bears have not made a statement like this one in a very long time. Given Kass’s positioning, I am actually wondering whether the stronger statement is really from the bulls who are finally closing up shop. Either way, as usual, I will do my best to stay on top of the signals. Buckle up and get ready…!

Finally, some quick trading updates…I bought back into Mellanox Technologies (MLNX) as a downgrade helped clocked the stock back to its 50DMA (I love this price). I discussed this trade in the January 15th T2108 Update. I also bought iPath S&P 500 VIX ST Futures ETN (VXX) puts in expectation of an eventual pullback in volatility – periods of high volatility are typically followed by low periods and vice versa. Options on ProShares Ultra VIX Short-Term Futures ETF (UVXY) were not available, presumably because UVXY just did a 4:1 reverse split.

(Also, my apologies, given the time, I do not think I will have the opportunity to update the Apple earnings trading model. You may have to watch for my tweets toward the end of the trading day!)

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SPHB and SPLV and SSO puts; long AAPL shares; bearish bias on the Australian dollar and Japanese yen (still long AUD/JPY for now); long MLNX, long VXX shares and puts;