(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are highly likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 68.1%

VIX Status: 13.5

General (Short-term) Trading Call: Hold

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar)

Commentary

The S&P 500 (SPY) heads into the feared month of May right on the edge of overbought. Bulls took the burden of proof in stride and closed out April at fresh all-time highs. We also have a Federal Reserve meeting to start the month with fireworks.

T2108 sits at 68.1%, right at the edge of being overbought. This is also day #10 with T2108 trading above the 40% threshold (the 40% “over-period”). The bias for S&P 500 performance at this juncture is becoming decidedly more negative IF this over-period were to end soon (click here for the explanatory chart). So, I will be inclined to buy SSO puts soon whether or not T2108 flips to official oversold (above 70%). Technical confirmation will be a lower close on the S&P 500, say below 1580. I have learned that using additional technical cues should improve my timing of entries and reduce triggers on false positives. Without such confirmation, I will let the S&P 500 ride for about another week before I return to a bullish bias. At THAT point, I will assume an extended (overbought) period has begun. (Note that I sold my remaining SSO calls on Monday).

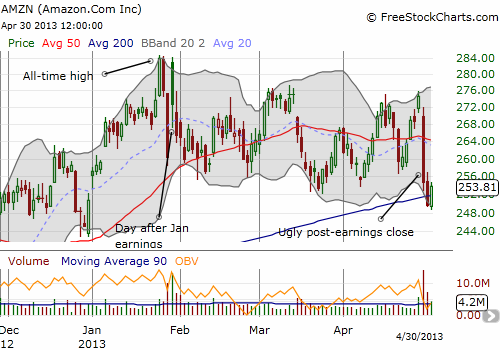

I conclude with two important charts: Apple (AAPL) and Amazon.com (AMZN). I need to write more complete pieces on both soon, but I offer up quick chart reviews as stand-ins until I can carve out the time. AAPL and AMZN almost look like stocks heading in opposite directions now.

Apple (AAPL) broke through an extremely important resistance point with the convergence of the 50DMA and the former support (next turned resistance) around $532. Buying volume has been solid since earnings, and it is looking more and more like AAPL has indeed printed an important bottom. Next clear resistance is at $470 where the last and ONLY breakout of the current downtrend from all-time highs flared out. Closing above that resistance would be a VERY bullish signal. Until then, AAPL is still in “show me” mode. Note that the current bullish run has also (of course) completely reversed the previous more bearish daily trading patterns that I noted in my last Apple update. This change in patterns has meant that I have not held call options as long as I should have and have ended up with too much hedging with put options (in other words, a LOT of money left on the table!). I will be re-evaluating the short-term trading strategy after about another week or so. I imagine Apple is likely to churn the closer it trades to its next resistance.

I think Apple’s bond issuance is a great move: replaces the need to repatriate cash at a high tax rate, and provides access to cheap funds for shareholders in the form of Apple turning those bonds into higher-yielding shares.

Amazon had a very poor post-earnings performance with a decline over 6%. By immediately breaking the low of that first post-earnings day, AMZN is officially in bearish post-earnings territory. The battle at the 200DMA highlights the drama. Given the poor open, I decided to wait before executing the typical AMZN post-earnings strategy to buy the open. That wait did not help much as my call options were of course crushed by the close of tradings. On Tuesday, I went with June put spreads to play what I think will be at least a rough two weeks, if not more, for AMZN.

In order to do the close-up, I cut off AMZN’s picture-perfect bounce off its 20DMA last November. This makes the current struggle at the 200DMA all the more ominous, particularly coming off all-time highs when profit-taking will be on many minds (just look at what happened to Apple!).

I have updated the Google spreadsheet that tracks the post-earnings stats on AMZN. The last post-earnings trade was particularly treacherous because the stop-loss rule actually increased overall loss this time around, making it the second worst performance in the series.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long AAPL shares and puts, long AMZN calls and put spread