(This is an excerpt from an article I originally published on Seeking Alpha on June 18, 2012. Click here to read the entire piece.)

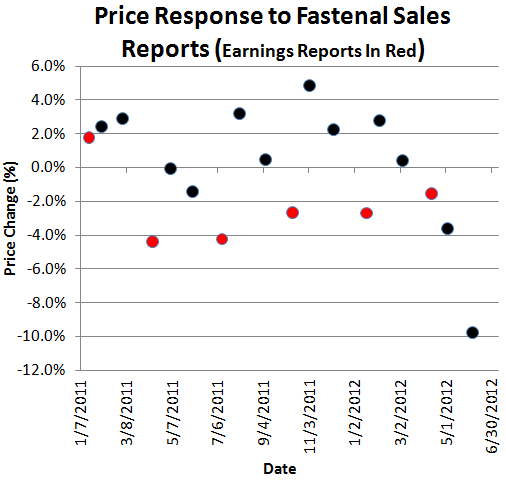

On June 5, 2012, Fastenal (FAST) dropped 9.8% in response to its May sales report. This sharply negative reaction got my attention because Fastenal’s industrial and construction supplies business should be highly sensitive to the health of the overall economy…{snip}

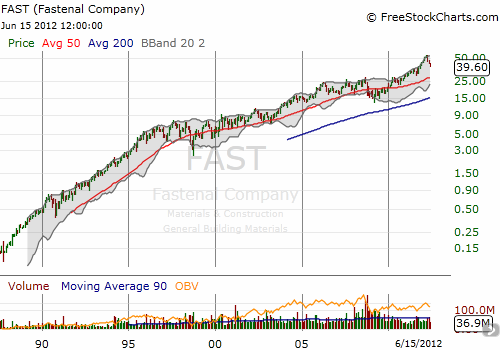

{snip} FAST is the kind of stock you want to own in a long-term portfolio. {snip}

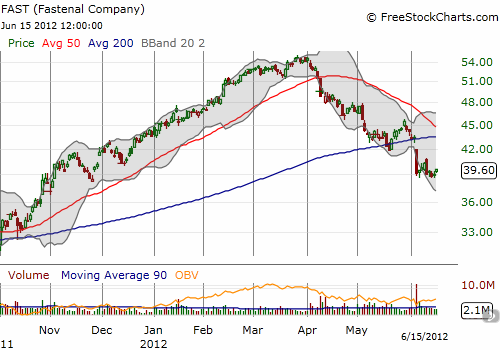

{snip} FAST is now down 27.5% from its all-time high and is down 9.2% for the year.

It turns out that the market has reacted poorly to FAST’s last three reports including an earnings report. {snip}

Source: Report dates from Fastenal web site, stock prices from Yahoo!Finance

Moreover, fellow parts supplier W.W. Grainger, Inc. (GWW) has fallen in sympathy with FAST. {snip}

Source for charts: FreeStockCharts.com

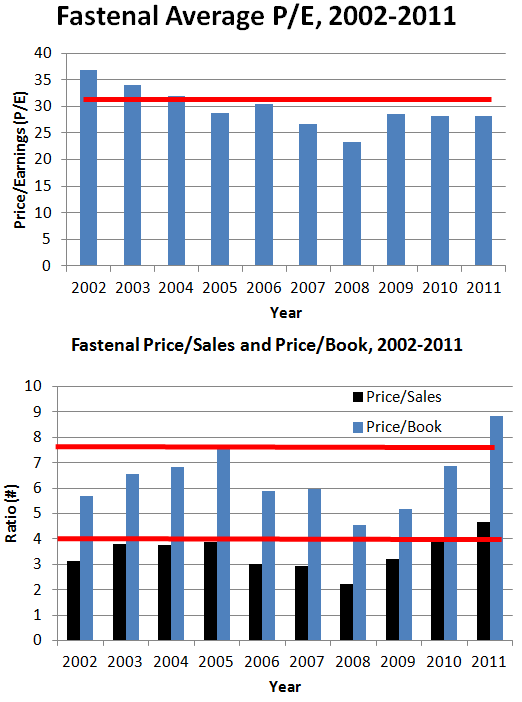

FAST’s valuation is also very high, especially for a stock with declining sales growth trends. {snip} The red horizontal lines in the charts below represent current valuations.

Source: MSN Money Ten-Year Summary for FAST

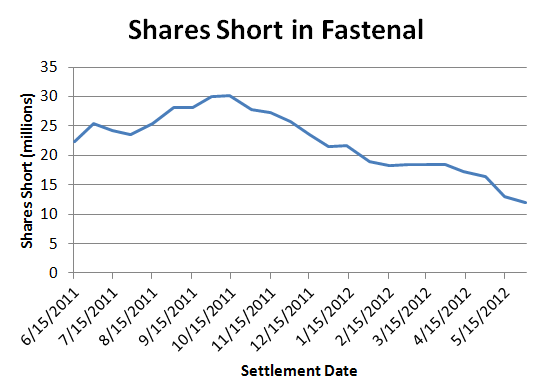

FAST’s drop has yet to attract the attention of short sellers. In fact, shorts have been pulling away from FAST since last October. {snip}

Source: NASDAQ short interest for FAST

So where does this all put FAST? In the short-term, I think it is very likely to lose more value as valuations get shaved closer to historical norms. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 18, 2012. Click here to read the entire piece.)

Full disclosure: no positions