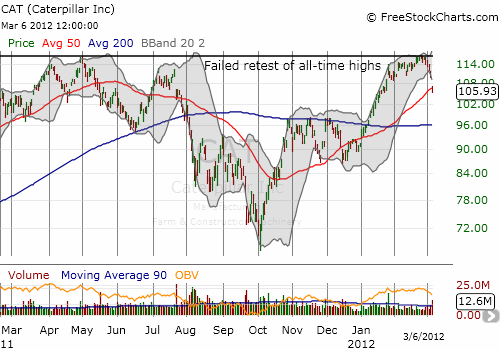

The last time Caterpillar, Inc. (CAT) failed a retest of all-time highs was in the middle of 2008. The stock broke down in June and it was mostly downhill from there for another year. On Tuesday, March 6th, Caterpillar confirmed another failed retest of an all-time high by breaking down below its 50DMA.

Source of charts: FreeStockCharts.com

While subsequent trading action is not likely to take CAT back to its March lows, this breakdown is still an ominous warning, especially with CAT leading the stock market as it fell from historic overbought conditions. The risks do not abate until CAT can fill Tuesday’s gap down, retake the 50DMA, and use it as support. I find it somewhat telling that the stock failed to rebound after Caterpillar presented at the ISI Annual Industrial Conference. CAT reminded its audience that 2011 delivered the “highest sales and profit in Cat history” and “record M&PS operating cash flow.” The company predicts world economic growth in 2012 will resemble 2011. Thus, CAT reiterated its sales and profit guidance for the year. The stock market was not reassured – at least not yet and not with China just recently announcing it expects “only” 7.5% GDP growth this year.

Caterpillar remains my favorite stock for hedging risk in an over-sized portfolio of commodity stocks (see “Profiting from Physical Assets in a Resource-Constrained World – Rules and Picks“). It served me very well in 2011 ahead of the summer’s big sell-off. I am positioned again with puts, but not quite as aggressively as last year.

Be careful out there!

Full disclosure: long CAT puts