(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 49% (2-month low)

VIX Status: 20.9

General (Short-term) Trading Call: Hold (your bearish positions should have been in place BEFORE today’s sell-off)

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

Commentary

Today’s 1.5% drop in the S&P 500 is a drop in the bucket compared to sell-offs we saw throughout 2011. In the context of a generally complacent rally where buyers chased every downtick and sellers lacked conviction, today felt like a massive move. Certainly this first post-overbought day delivered the kind of climactic move that seems befitting the end of such a historic 43-day run at overbought conditions.

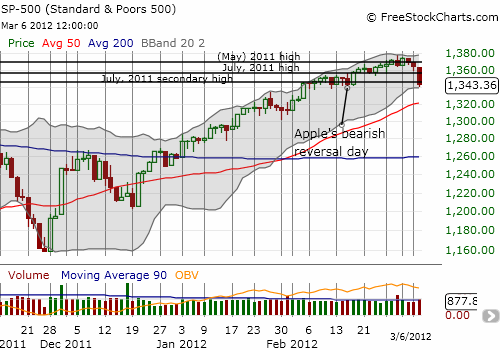

The chart of the S&P 500 below has several very important features:

- Confirmation of a false breakout to new 52-week and multi-year highs.

- A dramatic display of how quickly a sluggish rally can reverse. It took a month for the S&P 500 to move from the resistance of the July, 2011 secondary high to new 52-week highs. It took THREE DAYS to wipe out all that hard work.

- A tag of the lower Bollinger Band (BB) – a critical juncture where either buyers need to lift the index off this support or else sellers will surely take the index quickly to the 50DMA.

- A return to the lows of the day where Apple (AAPL) suffered a major reversal day – indicating that the violation of that early topping signal may also have been a false move.

- Volume was just average.

I won’t regurgitate all the important statistics I listed in the last T2108 Update about historical overbought periods and their aftermath. Instead, I want to summarize some additional thinking I have been doing.

To understand a likely path forward, I am going to imagine there are three main types of traders and investors out there. One group chased stocks higher mainly because their prices were going higher, a momentum-driven confirmation of the “safety” of being in stocks. This group has already begun to abandon ship and is likely the major drag on the market. This group particularly does not like the quickly increasing number of stocks breaking important trend support levels.

A different group thinks stocks look great because of fundamentals. After patiently waiting for cheaper prices, a LOT of stocks have suddenly dropped hefty percentages, making some valuation model flash green again. These stocks are breaking trends, support levels, and making a lot of other technical missteps that this group cares little about. What this groups sees are a lot of bargains that just last week seemed out of reach. This group should start buying tomorrow and will pick up steam the cheaper stocks get.

Finally, there are the bears. They have been lurking throughout the rally. Until today, they had become increasingly discouraged by the market’s near magical abilities to rally off almost any downtick. Poor volume throughout this rally has convinced them that the market just needs a catalyst to get knocked down. If they were not ready to dive back in on Tuesday’s selling, they will be ready at the open to fade rallies and chase breaks of support.

The average volume today suggests to me that the momentum players are far from finished selling, and the bears are just getting started. These two groups SHOULD overwhelm the eager buyers for at least a few more days. HOWEVER, with T2108 already at 49%, it is no longer appropriate to stay aggressively bearish. Recall that the typical selling after such a long overbought period has a roughly equal chance of ending after a 2% drawdown or an 8% drawdown. The S&P 500 is right at that cusp.

Here are my conditionals that attempt to respect the critical need for flexibility and fast interpretation:

- If the S&P 500 immediately rallies from here (as discussed above I am doubtful), do NOT expand bearish positions and do not chase stocks higher. Wait for the S&P 500 to close on a “convincing” new 52-week high (like with at least average volume!) before stopping out of bearish positions. More eager buyers can go back to dipping into the most beaten up stocks to play for quick pops – I would be almost exclusively focused on industrial and commodity-related stocks

- If the selling continues, assume a retest of the 50DMA is imminent. Do not expect to achieve the full 8% drawdown if T2108 is already approaching 30% by that point. I expect buyers to get ever more aggressive at this point, so I will close out some bearish positions and perhaps dip my toe into some choice long candidates.

- If the 50DMA breaks, assume the full 8% drawdown is imminent, featuring a retest of the 200DMA, a complete erasure of 2012’s gains, and T2108 at oversold levels.

I greatly prefer the third scenario because it provides maximum gain on my bearish positions, restores the T2108 portfolio to solid profitability, and subsequently puts me in a very comfortable place to buy. However, as the list suggests, I have to think through this one step at a time, always respecting the historical odds for upside and downside.

I conclude by noting how many bearish signals all converged to make Tuesday’s sell-off almost “obvious.” The most interest post I read was “Top Likely by March 5th (10 Trading Days)” by Equity Capital. A reader pointed me to this post last week along with a host of other signals all flashing bearish signs. You can review them in the comments section of the last several T2108 Updates. The icing on the cake for me was noting that the Russell 2000 had already started to break down, leaving the Russell 1000 to hold up the small cap universe. So, it occurred to me…with so many bearish signals screaming at those of us who pay attention to these things, isn’t it likely the trading robots that now dominate so much trading were also all clued in to the same conclusion? Couldn’t these programs and algorithms, now synchronized to the same danger signs, trigger Tuesday’s exodus? We will never know. But if so, Tuesday’s selling should provide the necessary feedback to continue the selling programs at least for another day or two.

(In the next post or two I will finally review volatility. The VIX has now marginally broken its downtrend and has returned to levels that immediately preceded last summer’s sell-off).

Charts below are the latest snapshots of T2108 (and the S&P 500)

Refresh browser if the charts are the same as the last T2108 update.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SDS and VXX; long VXX puts