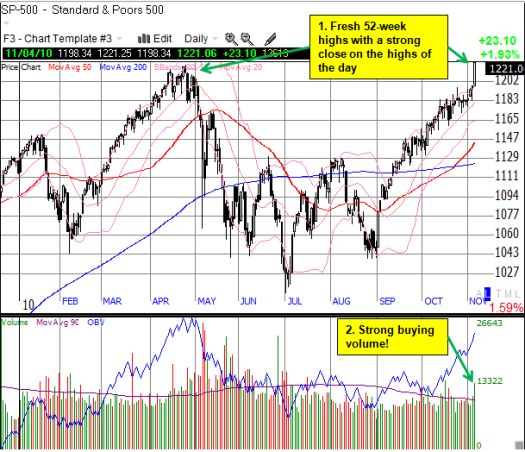

Like my friend TraderMike, I am extremely surprised at the timing of the market’s latest breakout. I too would have thought a breakout would come immediately after one of our three main news items of the week, not in between! I agree with TraderMike that the nature of this breakout leaves open the real possibility that we have witnessed an “exhaustion gap” where the last panicked bears cover shorts and/or flip the switch to the bullish side. However, we must await confirmation in the form of a gap down or an open higher followed by a close lower than Thursday’s close. Rather than speculating on the bearish possibilities, I am going to focus on Thursday’s strength for its bullish qualities – there is a lot for the bulls to like.

When I last wrote about the market’s stubbornly overbought conditions, I noted how complacent even I had become in this trading environment. I interpreted the freshly ominous patterns at the time as a warning to get “extremely cautious”, and I was bracing for the big volume, one-day slide that would signal a top was finally in. That day has not yet come. Instead, the exact opposite happened on Thursday. We got a big up day…and volume actually showed up! Is that the smell of freshly printed dollar bills ?

My favorite technical indicators further paint a picture of a market unbroken. T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs), has firmly rebounded deeper into overbought territory (above 70%). Again, when I last talked about this indicator, I indicated that I believed it was much more likely to break down than to bounce. So, now, we sit at historic day number 41 in overbought territory (last Thursday and Monday the market tip toed right along the 70% threshold).

T2107, the percentage of stocks trading above their respective 200DMAs, hit a fresh 6-month high after stalling through the second half of October. This action indicates more stocks are finally breaking out above their 200DMAs into longer-term bullish technical territory.

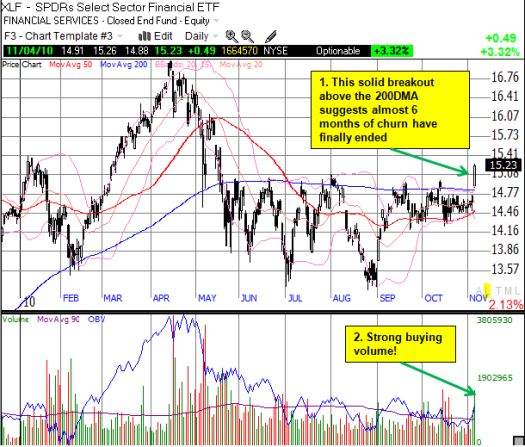

Perhaps the most impressive (and surprising!) development was the breakout of the financials on strong volume.

If the financials follow through and keep pushing upward, the entire market will likely continue making new 52-week highs from here.

While the market remains unbroken, it also remains unloved. According to data from the Investment Company Institute (ICI), Americans are still drawing down on their equity-based mutual funds. Investors were net sellers of these funds over the past 5 weeks, continuing a three-year trend that has defied all expectations for retail investors to jump in and chase stocks upward on rallies. Foreign equity funds continued to see positive gains over these five weeks. Apparently, many of those freshly printed dollar bills from the Federal Reserve are going to find new homes overseas, seeking better yields and better opportunities. Bond funds remain very popular.

So, the market remains unbroken and unloved. I remain cautious because of the overbought conditions, and I used Thursday’s pop to unload a lot of longs. Overall, I am still looking for a large volume, one-day sell-off as a signal that this historic overbought period is finally winding down.

Be careful out there!

Full disclosure: long SSO puts, long XLF puts

There just don’t seem to be any particular driving forces to expect the market to go up. I believe the market is over bought, and the general populace is not ready to “plunge in.” This being said, I believe the market will linger for a short time, and within the next three to six months will trade at or below the DOW 10,000 level.

Sounds like a good enough forecast. The market does need a “new trick” to really motivate significant upside from here in the short-term…