Will deregulation and tax cuts far outweigh the economic damage of broad-based and global tariffs, chaos in the Federal government, and an assortment of other economic and policy uncertainties? This question rides high on the minds of traders and investors. Where you fall on this question might determine how worried you are about the current market sell-off. The data currently weigh on the side of concern as a “growth scare” increasingly dominates economic and stock market headlines and conversations.

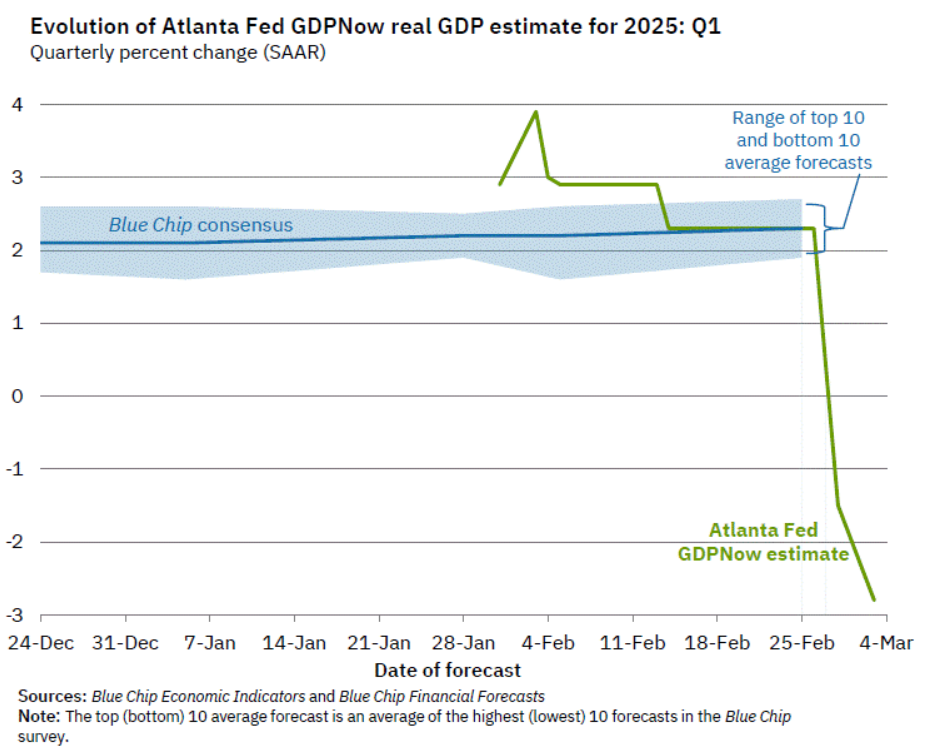

The plunging GDP Now projections summarize the growing concerns. In less than two weeks, the quarterly growth projection for real GDP flipped from +2.3% to -1.5% and now -2.8%. The projection almost hit +4.0% just over a month ago.

Plunging GDP estimates have helped to push the market into oversold conditions as I described in a recent video (see below). As a result, my short-term trading call flipped from neutral to cautiously bullish. However, I also acknowledge a significant downside risk as indicated by the percentage of stocks trading above their 200-day moving averages (DMAs) or AT200. Thus, for example, I am holding firm to my March SPY $365/$350 put spread as a partial hedge against a fresh sell-off from current levels.

David Zervos from Jeffries represents the unconcerned (I say complacent) side of the market. While Zervos makes ideological assumptions without presenting data or analysis, I still consider it important to understand this positioning that clings to a positive base case. In fact, Zervos’s argument reflects a 2025 version of “Why Wall Street Wants A Recession” from 2022.

Zervos’s core claim is that the reduction of public spending will create significant long-term positive benefits alongside deregulation. Zervos surprisingly did not discuss tax cuts. With the help of ChatGPT, I summarize the key points using the transcript of the CNBC interview from YouTube. Each block concludes with the main point supporting a positive longer-term trajectory for the stock market and economy.

Deregulation and Privatization as the Key Economic Story

- The main economic story is deregulation and a shrinking federal government, leading to a re-privatization of the U.S. economy.

- Resources, including labor and capital, are shifting from the public sector to the private sector, which is expected to improve economic efficiency.

- This transition is considered a long-term positive for economic growth and productivity.

Interest Rates Cushioning the Market

- Interest rates have fallen significantly, providing a cushion for the market.

- Lower interest rates benefit equities by reducing borrowing costs and increasing liquidity. (emphasis mine)

- The bond market is helping to cushion stock market weakness, preventing major declines.

Overemphasis on Tariffs and Political Issues

- Trade tariffs and geopolitical tensions are receiving too much attention in market discussions.

- Tariffs are more about negotiation tactics than having a real, lasting economic impact.

- The stock market, as reflected in the S&P 500, appears to recognize this, as it is only down slightly for the year.

- Investors and commentators are overly focused on short-term negatives, such as tariffs and immigration policies, rather than the broader economic transformation.

- The overall economic picture is more positive than widely perceived.

Zerbos thinks the short-term pain and chaos will lead to a stronger foundation for growth in 6 to 9 months. In the meantime, market fear is driving investors the safe haven of bonds a shift which in turn provides support for stock valuations (it is the goldilocks scenario were money leaving stocks for bonds actually supports stocks). However, Zervos here gives no consideration to how negative growth over this time will turn around on a dime. He clings to the narrative that tariffs will not last; this narrative replaces the earlier claims that tariffs would never happen in the first place because they are supposed to be part of negotiating tactics.

However, it is much easier to destroy than to build. The current plunge in GDP growth is exactly what I feared from earlier posts. This year began with an economy that was performing about as well as it could – significant changes risk significant under-performance.

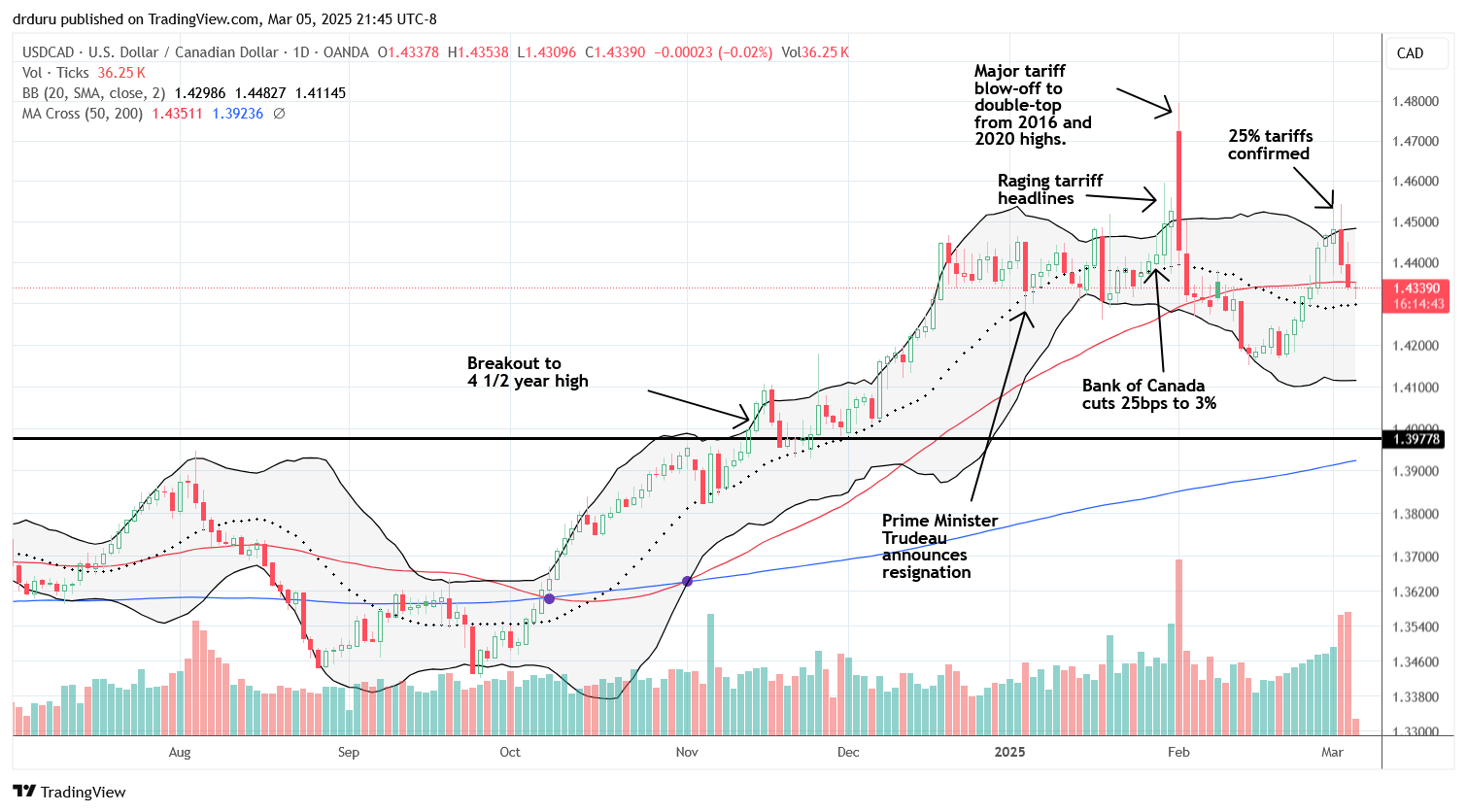

The response by Canada’s Prime Minster Justin Trudeau to 25% across the board tariffs (already reduced by a month-long pause in auto tariffs – yes, more economic chaos) is the clarion call for this new era of economic warfare that threatens to hold financial markets in bearish conditions.

I provide below key quotes from the transcript; I highly recommend interested readers watch or listen to the entire video. This blistering and defiant tone sets the stage for an extended period of economic under-performance.

“The United States launched a trade war against Canada, their closest partner and ally their closest friend. At the same time they’re talking about working positively with Russia, appeasing Vladimir Putin, a lying murderous dictator. Make that make sense. Canadians are reasonable and we are polite, but we will not back down from a fight not when our country and the well-being of everyone in it is at stake…

…I want to speak first directly to the American people. We don’t want this. We want to work with you as a friend an ally and we don’t want to see you hurt either. But your government has chosen to do this to you. As of this morning markets are down and inflation is set to rise dramatically all across your country…

Let me be crystal clear: there is absolutely no justification or need whatsoever for these tariffs today. Now the legal pretext your government is using to bring in these tariffs is that Canada is apparently unwilling to help in the fight against illegal fentanyl. Well that is totally false…

…and now to my fellow Canadians, I won’t sugarcoat it. This is going to be tough even though we’re all going to pull together cuz that’s what we do. We will use every tool at our disposal so Canadian workers and businesses can weather this storm from expanding EI benefits and making them more flexible to providing direct supports to businesses, we will be there as needed to help. But Canada make no mistake, no matter how long this lasts, no matter what the cost, the federal government and other orders of government will be there for you. We will defend Canadian jobs. We will take measures to prevent predatory behavior that threatens Canadian companies because of the impacts of this trade War leaving them open to takeovers. We will relentlessly fight to protect our economy we will stand up for Canadians every single second of every single day because this country is worth fighting for.

The recent months have been stressful and in fact exhausting for all of us, but I believe we can be reassured by the incredible solidarity we’ve seen among Canadians….”

Be careful out there!

Full disclosure: long SPY put option, long USD/CAD