Stock Market Commentary

After just acknowledging politics could deliver on-going surprises for traders and investors, both up and down, I certainly did not expect the first day of trading after that post to confirm my assessment. On Sunday, President Biden bowed out the 2024 Presidential campaign and endorsed VP Kamala Harris. The stock market greeted the latest political twist with a rally that delivered several hints that bears are also ready to bow out just says after blow-off tops that seemed to cap the stock market. Each of the major indices gained at least 1% on the day, and the volatility index plunged. Blow-off tops for regional banks, SPDR S&P Regional Banks ETF (KRE), and home builders, iShares U.S. Home Construction ETF (ITB), are on the edge of invalidation. The semiconductor index recovered instantly from a 50DMA breakdown but still has a hill to climb to invalidate a double-top.

The Stock Market Indices

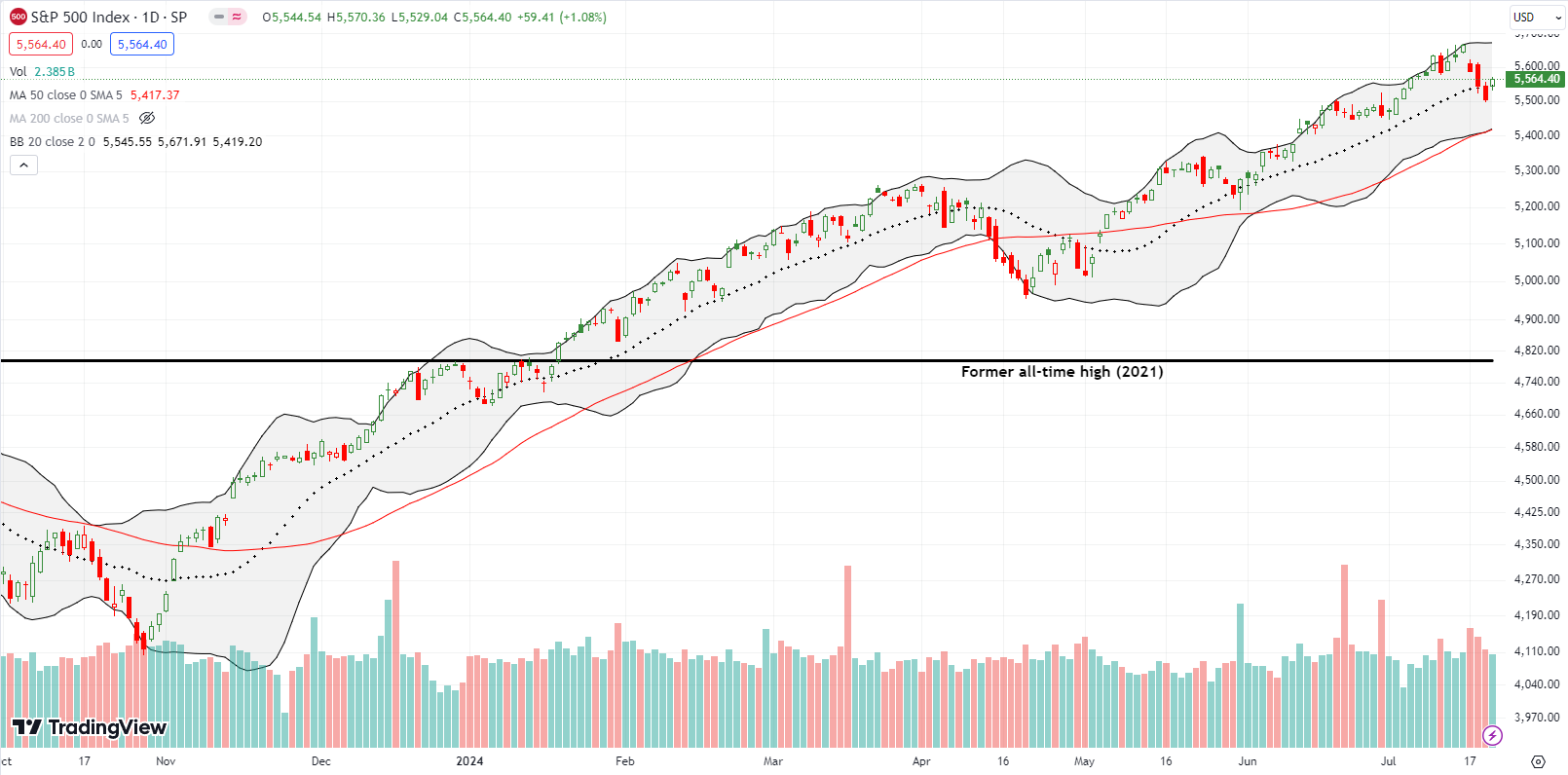

The S&P 500 (SPY) gained 1.1% and recovered an uptrend with its 20-day moving average (DMA). Eager buyers on the presidential bow out news immediately reversed Friday’s loss at the open. This instant rebound is significant given the index has only closed below its 20DMA four times this year excluding the April sell-off. I can see the window of opportunity for bears slamming shut for this cycle. I faded the mini-rally with a weekly SPY put option in case bears have one last gasp in them.

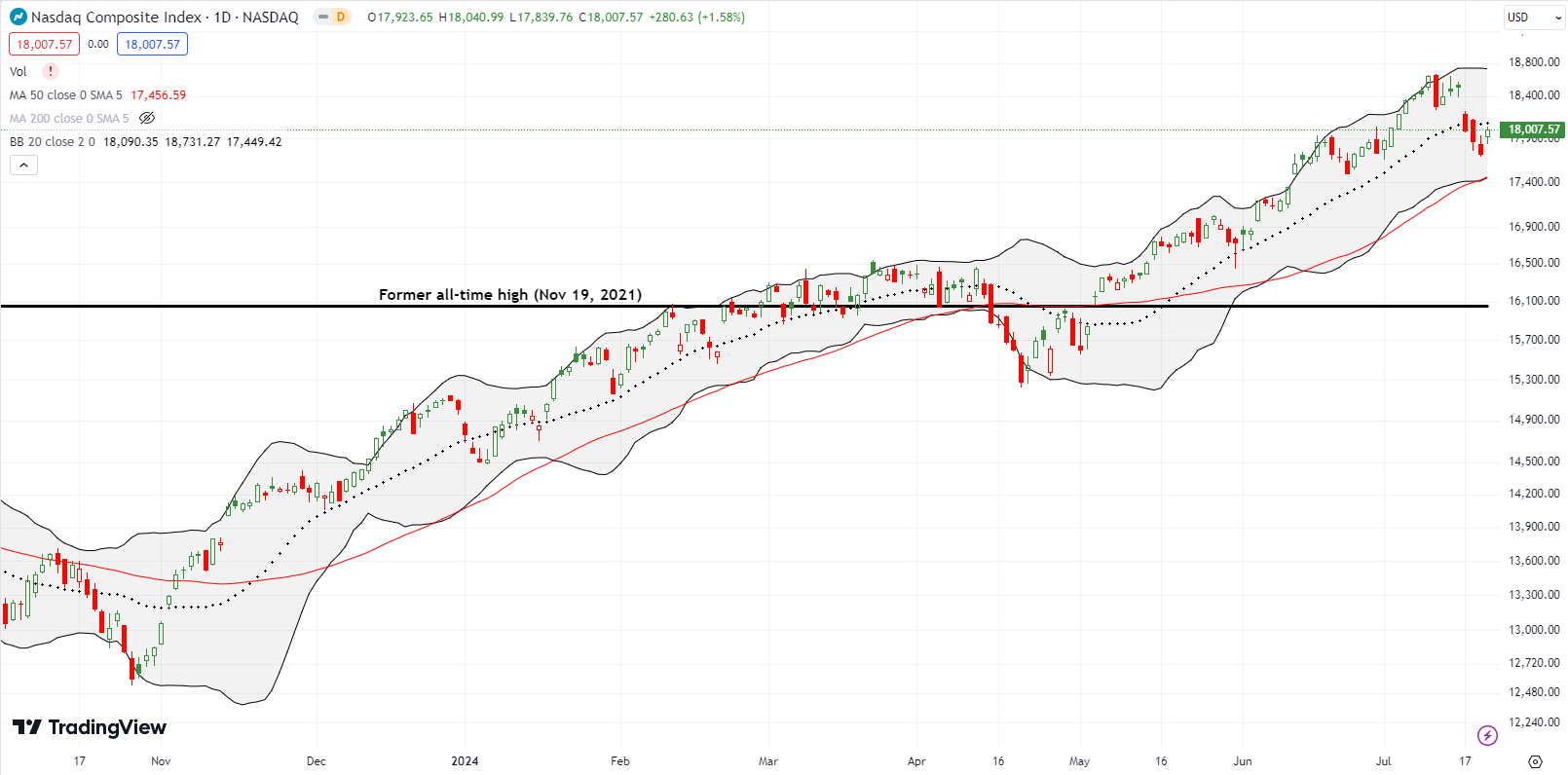

The NASDAQ (COMPQ) gained 1.6% but closed below its 20DMA. While bears cling to hope, they missed a golden opportunity to push the tech laden into a test of its 50DMA (the red line) support. A lot of big tech earnings are coming up so I will stay alert for quick changes in apparent sentiment.

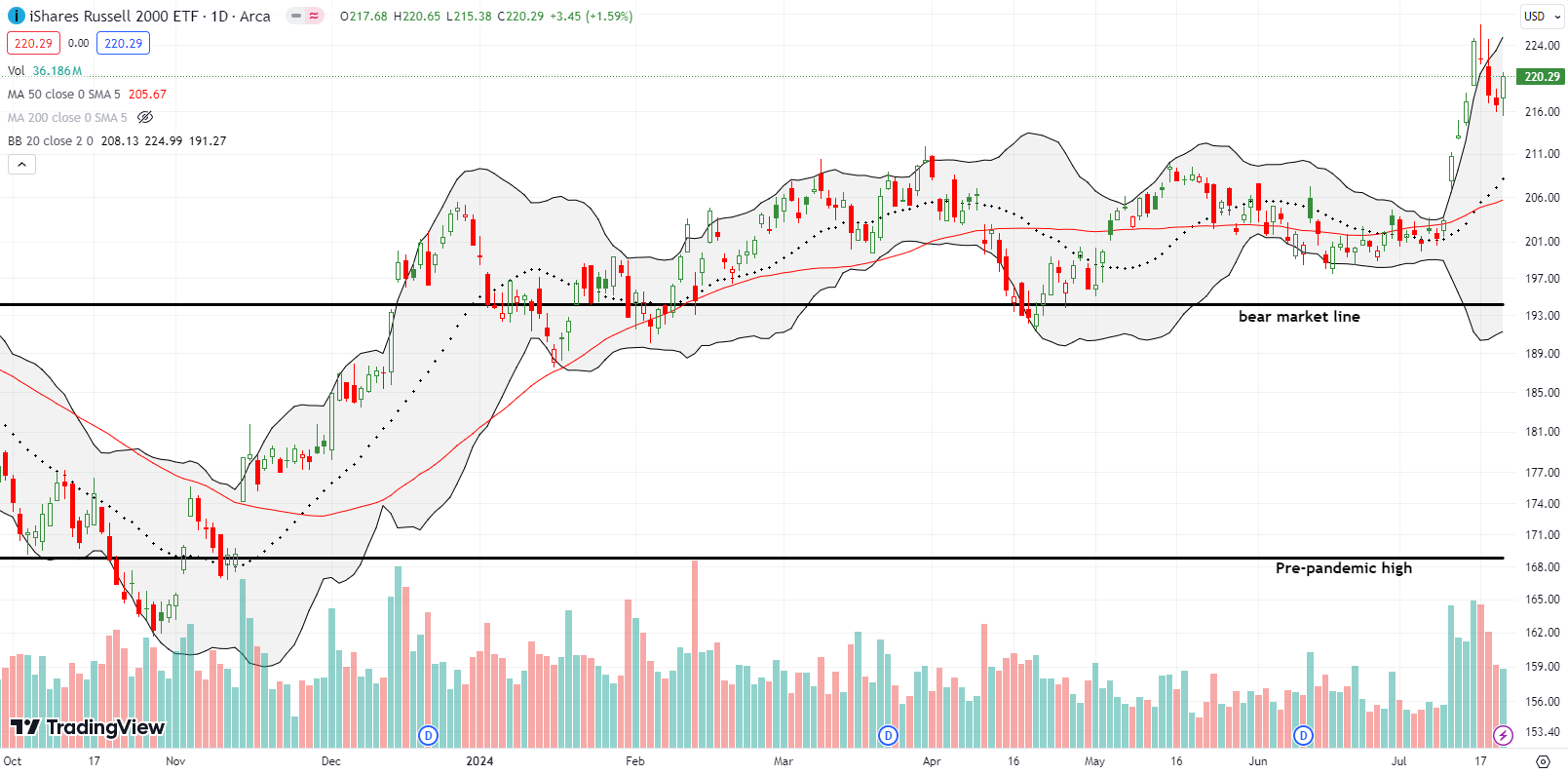

The iShares Russell 2000 ETF (IWM) gapped slightly at the open and immediately dove slightly below Friday’s low. Buyers stepped in at that point and drove IWM higher all day for a gain of 1.6%. I was late in noticing the bumrush and ended up chasing IWM with an August $230 call option. I am preparing for an eventual breakout and a potential fast run-up following an invalidation of IWM’s double-top. Thus, I plan to accumulate call options as long as IWM remains above $216.

A huge proclamation from permabull Tom Lee on CNBC also nudged me. He thinks small caps will rally 40% from current levels (it was unclear whether he meant from October to December or through the end of summer – he said both in the video interview below).

The Short-Term Trading Call When Bears Bow Out

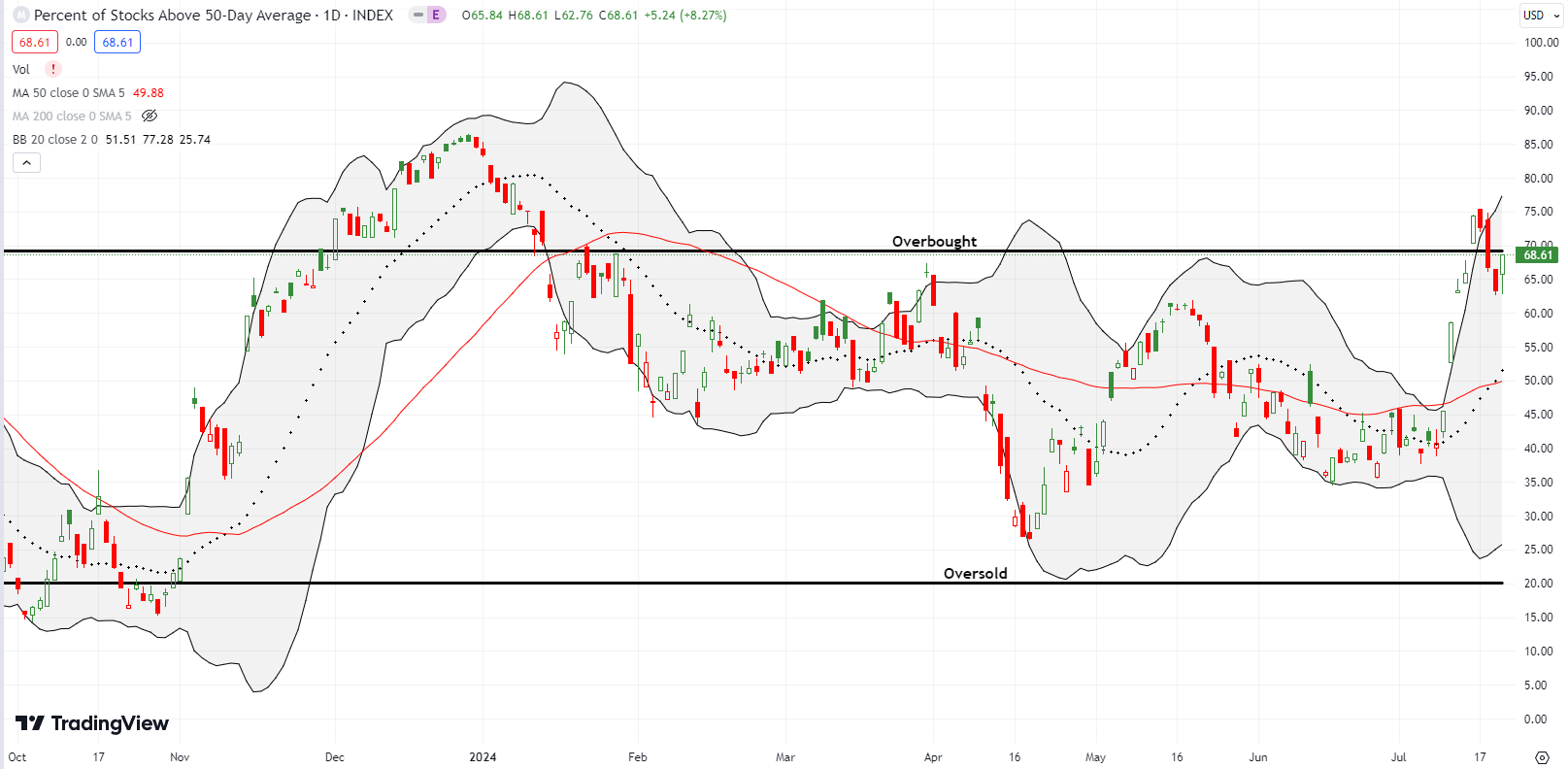

- AT50 (MMFI) = 68.6% of stocks are trading above their respective 50-day moving averages

- AT200 (MMTH) = 65.2% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: cautiously bearish

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, jumped to 68.6%. My favorite technical indicator already looks ready to return to overbought conditions. This possibility combined with my observations about the S&P 500 and IWM forced me to reduce my level of bearishness to “cautiously bearish.” I was tempted to flip right back to neutral but the AT50 trading rules keep me some flavor of bearish. In the meantime, I fully expect the bears to bow out yet again from the stock market race higher.

The volatility index (VIX) added its vote helping bears to bow out. In a previous post I noted how the VIX was getting stretched to the extreme that it was not likely to hold for long: “The upshot of this sharp increase is that the VIX cannot sustain long run-ups. Thus, while the VIX confirmed a bearish turn in sentiment, it also started a timer on the window of opportunity for the bears.” That window slammed with a sharp 9.8% reversal in the VIX. In this case, I had VXX put options ready just in case, and I quickly took profits. If recent VIX patterns this year are any indication, bears will have at most one more shot to drive fear in the market over the next month or so.

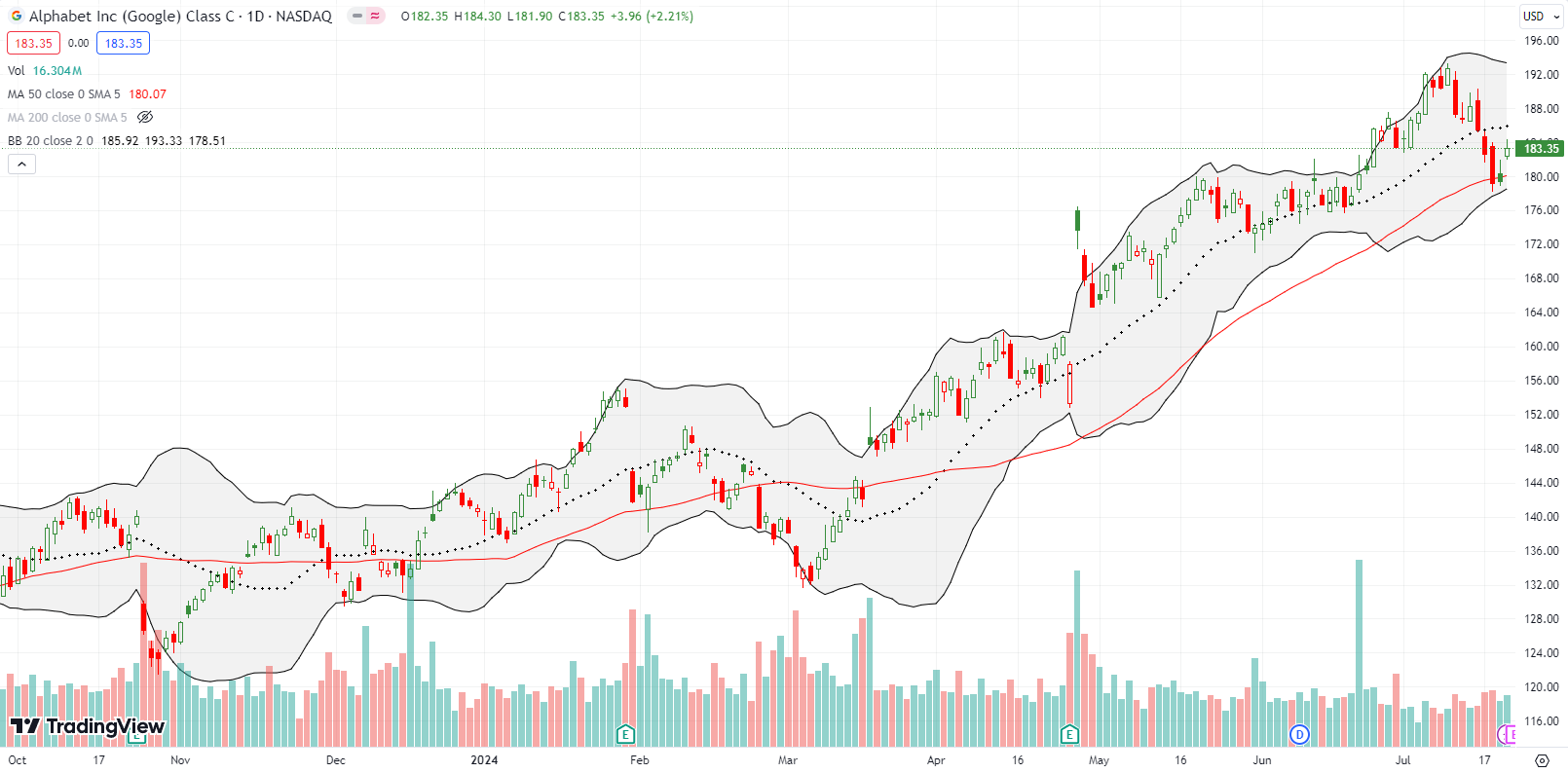

Alphabet Inc (GOOG) joined the market rebound with a perfect bounce off 50DMA support. I went ahead and bought a pre-earnings GOOG call option given the successfully test of support. I buy dips aggressively given GOOG’s membership in my (permabull) generative AI basket, but I should have been ready on Friday to jump in.

CrowdStrike Holdings, Inc (CRWD) failed to get the memo about bears bowing out. CRWD had an even worse day than Friday with a 13.5% loss and a close at the lows. CRWD is now just up 3.4% for the year and faces more imminent pressure as the U.S Congress compels CEO George Kurtz to testify. Needless to say, THAT testimony will likely mark a bottom for CRWD. In the meantime, I still think that CRWD’s valuation is far too high for rushing in to buy into disaster. The stock was priced for perfect and is still priced for good performance. From a technical perspective, CRWD still has PLENTY of room to fall if things gets really bad for the company: the stock has tripled in value just since the beginning of 2023.

Be careful out there!

Footnotes

Subscribe for free to get email notifications of future posts!

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #165 over 20%, Day #64 over 30%, Day #11 over 40%, Day #8 over 50%, Day #7 over 60% (overperiod), Day #3 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long SPY put and put spread, long KRE puts, long ITB shares and put option, long SMH call spread

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, Twitter, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.