Question. When an analyst lowers the price target on a stock to a level still substantially higher than the current price, what do you expect to happen? What if that price target comes with a downgrade from buy to neutral? If you answered lower, you win a prize… a discounted price on homebuilder stocks.

A Citigroup downgrade of Lennar (LEN) and DR Horton (DHI) to neutral accompanied price target cuts on the stocks from $174 to $164 and from $181 to $156 respectively. Those new price targets, presumably 12-month targets, imply 21.1% and 15.4% upside respectively from today’s close. Those returns look pretty good to me. Yet, the slides are understandable given Citigroup listed a litany of reasons for caution. From CNBC’s Fast Money short coverage of the downgrade (podcast):

- Softness in permits, starts, sales, and pricing continuing into the second half of the year.

- Outsized exposure to Florida and Texas housing markets which are “rolling over”.

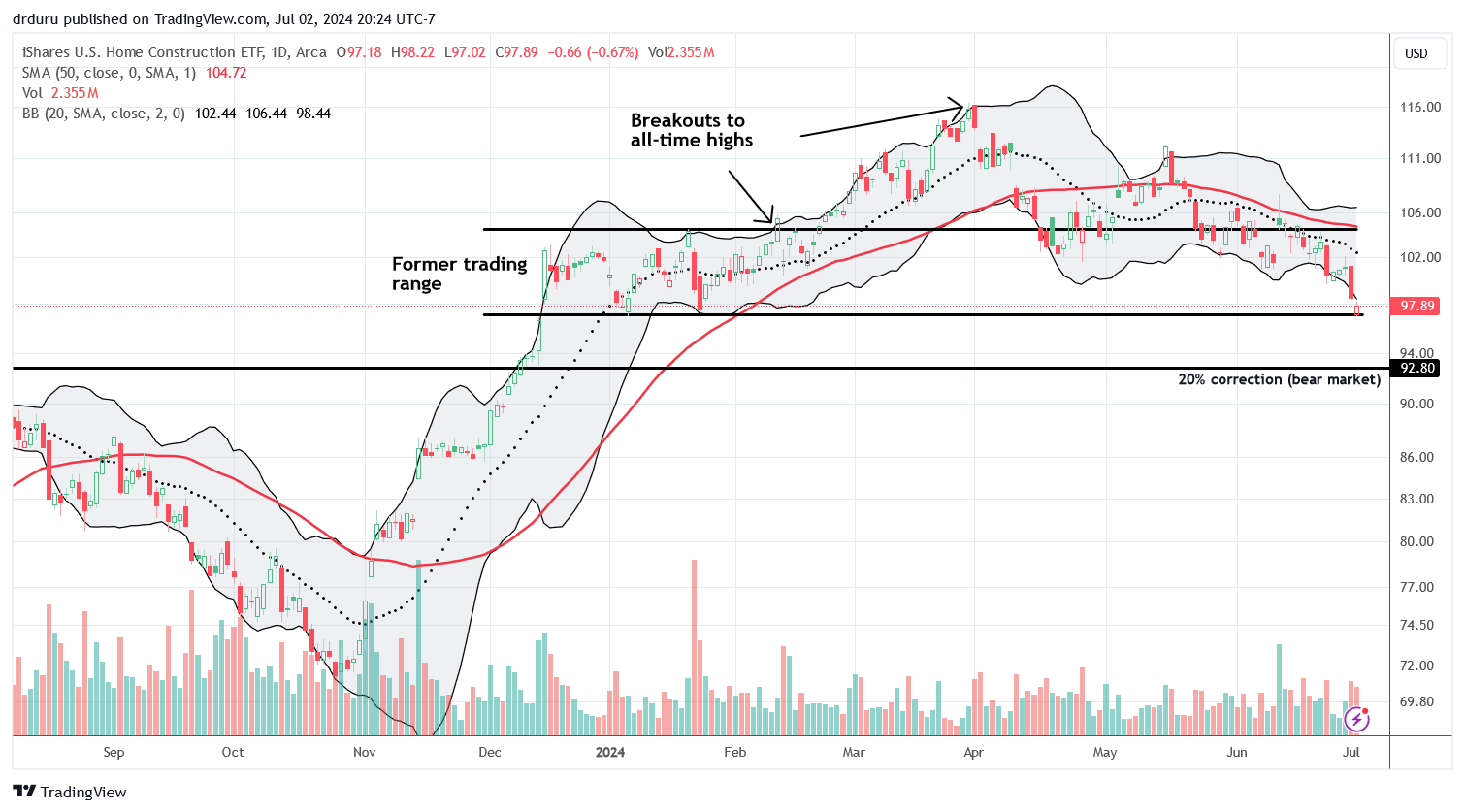

I covered all of these topics in past reviews of the housing market and most recently in “What Happened in the Housing Market – A Spring Selling Season Bust“. Thus, Citigroup’s assessment does not surprise me. What interests me more is the technical damage done to LEN, DHI and the iShares U.S. Home Construction ETF (ITB) in general. LEN closed near a 7-month low and finished reversing its gains from December earnings. DHI closed at a 7-month low and looks even more toppy than LEN. ITB fell right to the bottom of its former trading range and feebly bounced from there.

I added a line to identify a bear market – conventionally triggered when an index or stock drops at least 20% from its all-time high – given a bearish assessment from Carter Braxton Worth on CNBC’s Fast Money. He made the technical case for continued selling pressure at least down to the bottom of a multi-year uptrend channel.

If the calendar was in the middle of the seasonally strong period for home builder stocks, I would start buying ITB here (adding to a very small core position). Instead, I am looking at the calendar and wondering whether a bear market might perfectly coincide with or near the start of the buying season homebuilder stocks. A big wildcard is the on-going drama waiting for the Fed to finally cut interest rates. That event could spark an “early” rally what would be hard to resist.

Be careful out there!

Full disclosure: long ITB

1 thought on “What Happened to the Homebuilders: A Citigroup Downgrade”