“We are encouraged that inflation is declining, and we are seized with the importance of staying the course and restoring price stability for Canadians.

Inflation is coming down quickly and is forecast to be around 3% this summer. The economy is expected to grow modestly even as inflation comes down. This is good news, but it is not job done.”

“Monetary Policy Report Press Conference Opening Statement” – Tim Macklem, Bank of Canada Governor, April 12, 2023

The Bank of Canada maintained its interest rate at 4%, continued quantitative tightening, and yet warned Canadians that service price inflation could be “stickier than projected.” A key downside risk is a global (note not a Canadian) recession. Overall, risks to economic conditions are roughly balanced, but the Bank of Canada is more concerned with upside risks. Accordingly, Macklem declared that “if monetary policy is not restrictive enough to get us all the way back to the 2% target, we are prepared to raise the policy rate further to get there.”

Goldilocks In Canada

Macklem portrayed an economic scenario that could hardly be better given the circumstances. Goldilocks has taken up residence in the Canadian economy.

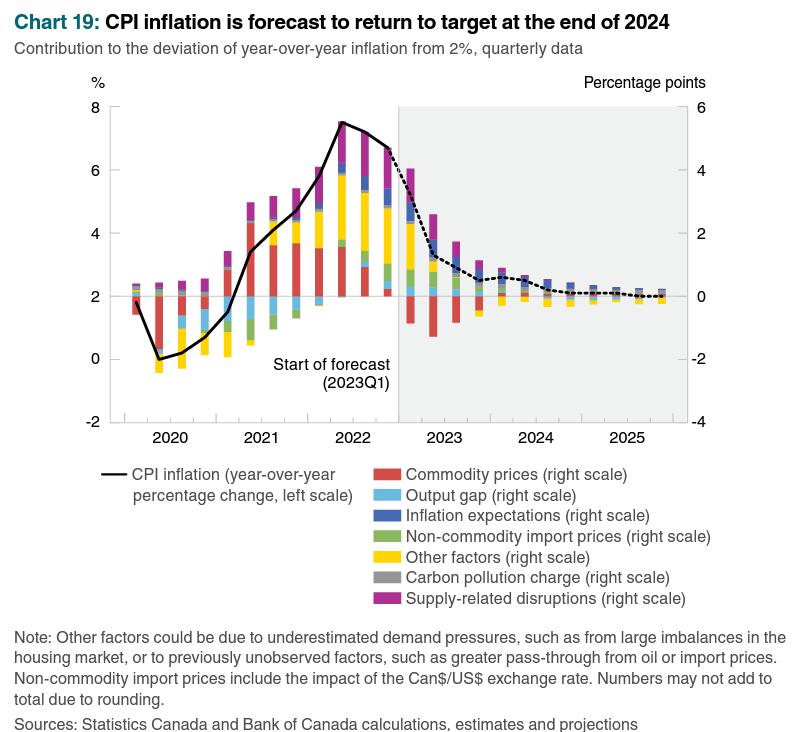

The Bank of Canada is focused on economic indicators such as inflation expectations, services price inflation, wage growth, and corporate pricing behavior to ensure that the Consumer Price Index (CPI) inflation continues to progress towards the 2% target. The Canadian economy remains in excess demand, and GDP growth is expected to be weak for the rest of the year. Macklem reminded Canadians that growth needs to weaken to get the economy back in balance. After this weakness, the Bank of Canada expects growth to “pick up gradually in 2024 and through 2025.” In other words, the Bank is targeting a goldilocks scenario where the economy avoids a major economic slowdown before growth resumes in a low inflation environment. The glide path to the 2% target also looks hopeful.

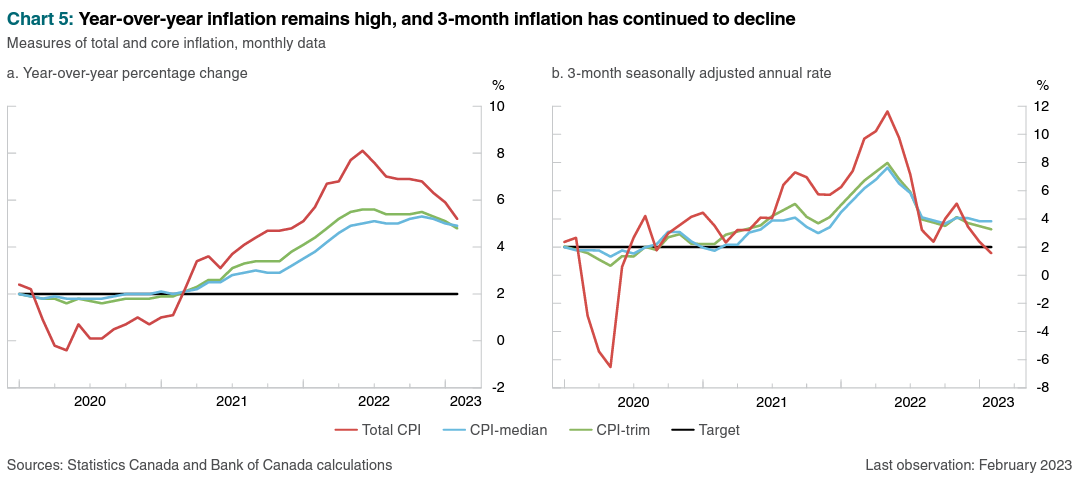

Current inflation trends all point favorably toward the Bank of Canada’s forecast.

Inflation Controls

The rosy outlook on inflation still depends on several things going well. From the Q&A session during the press conference (emphasis mine):

“The end of 2024 really reflects the fact that there are a number of things that still have to happen. Inflation expectations, yes they are coming down, but they’re still higher than our own forecasts…Wage growth has been running at four to five percent, unless there’s a surprising acceleration of productivity that’s not consistent with two percent inflation. That needs to moderate. Service price inflation needs to come down…when we talk to firms, they’re still telling us they’ve got cost pressures, and they intend to pass those through. So, it has not been normalized. We need to see those things come into place to get inflation all the way back to Target, and that looks like it’s going to take some time.”

To keep inflation expectations under control, Macklem made clear that rate cuts this year are unlikely: “….you know based on the information we have today, the implied expectation in the market that there are going to be a cut, that we’re going to be cutting our policy rate later in the year, that doesn’t look today like the most likely scenario to us.”

Macklem is also setting a confident anti-inflation tone with businesses that should resonate throughout the economy: “inflation is coming down, don’t plan on inflation staying high…our message is plan for inflation to come back down. Plan for price stability.”

Implications for the Canadian Dollar

The Canadian dollar (USD/CAD) (FXC) is caught in the middle of a monetary policy on pause and commodity prices lifting into the gap that central banks are leaving behind with the winding down of tightening cycles. The Canadian dollar typically fares best when commodity prices are on the rise. So, the shifting winds favor strength for the Canadian dollar against the U.S. dollar.

USD/CAD has slowly drifted higher for the past two years as investors first anticipated and then enjoyed a Federal Reserve getting serious about fighting inflation. As that tailwind for the U.S. dollar comes to an end, I expect USD/CAD to give back a good amount of its 2-year gains. I went short USD/CAD after it broke down below its 200-day moving average (DMA) support.

If this trade sustains itself, I will likely add shares in Invesco CurrencyShares Canadian Dollar Trust (FXC) to hold for a longer timeframe. FXC of course broke out above its 200DMA resistance. USD/CAD still needs to break below the lows for 2023 to demonstrate a new trend is underway.

Be careful out there!

Full disclosure: short USD/CAD

(Obviously, “wages” includes salaries). I’m bugged by the demand that worker productivity grow to match wage growth. No one appears to have considered the possibility that productivity *already* increased because work-at-home and virtual meetings significantly reduced time and costs wasted on commutes and business travel, and companies can offer higher wages as a result.