Extremes in sentiment create trading opportunities. Peloton Interactive (PTON) looks like it is delivering a particularly combustible opportunity.

The Commercial

Over the U.S. Thanksgiving holiday, Peloton aired a commercial that celebrated the journey of a woman exercising with a Peloton bike gifted by her husband. I thought the commercial was silly, especially given the amount of times I saw it during football games. I could not figure out why the woman was excited enough about riding nowhere that she felt compelled to take selfies of the experience. Were tears of joy welling up in her eyes? Moreover, the woman’s goal on this journey was a mystery: was she just excited to be riding? I was left confused and amused.

I had no idea that this commercial was causing controversy and derision until a friend of mine alerted me on Wednesday. The din was loud enough to generate a response from Peloton:

“Our holiday spot was created to celebrate that fitness and wellness journey. While we’re disappointed in how some have misinterpreted this commercial, we are encouraged by — and grateful for — the outpouring of support we’ve received from those who understand what we were trying to communicate.”

The Trade

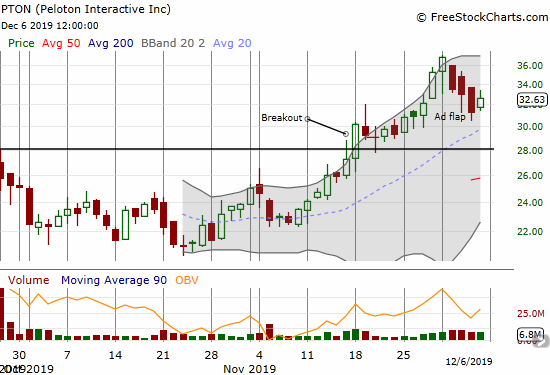

Knowing PTON is now a hot, momentum stock, I pulled up the stock chart to examine the impact. Surprisingly, the selling did not start until AFTER the stock closed at a fresh all-time high on Monday. That behavior told me that fundamentally the stock still has support, and the selling is an over-reaction relative to the overall technicals supporting the stock.

Over PTON’s short trading history, the stock has experienced five short spurts of selling, the longest lasting was the first four days of trading as a publicly traded company. Assuming this latest selling episode would behave similarly, I bought stock (a little early) on Thursday. Friday’s small gap up and 4.2% gain is the first step in validating the pattern. My stop loss is below the intraday low on Thursday since presumably a close below that level signals a high risk of a change in behavior with a lot more selling to come. The horizontal line marking PTON’s big breakout provides the next level of support.

Peloton reported earnings on the morning of November 5th. The stock lost 7.6% that day. After buyers stepped in the next day, the stock rallied into a breakout and buying pressure continued until last week’s pullback. This post-earnings strength is also telling: buy the dips.

The Expense

My biggest concern from the barrage of Peloton holiday television spots was the expense of it all. Peloton spent $77M on sales and marketing in its last quarter, a 71% year-over-year increase and 34% of revenues. I imagine these numbers will go much higher in the next quarter. General and administrative is another 27% of revenue. I want to be out this trade before Peloton’s next earnings report. PTON will likely be a much better buy once it figures out how to generate cash from operations. At least the stock is not “overly” expensive at 8.9 times sales and price/book equal to 5.9 (according to Yahoo Finance).

Note also that bears are all over this stock with 66% of the float sold short. They can look forward to the tsunami of shares that will come onto market after the lock-up expires. Shares sold short are only 10% of shares outstanding.

Be careful out there!

Full disclosure: long PTON