Overall Assessment

I am neutral on Pulte Homes (PHM). The company’s Q3 2019 earnings report was good but not spectacular. I am warily eyeing year-over-year net income and earnings per share declines even as the company experiences robust demand and buys back shares. Most importantly, with a 2.0 price/book ratio, PHM is relatively expensive compared to other builders. The stock is currently pulling back from a near 14-year high with a year-to-date performance slightly lagging the iShares Dow Jones Home Construction ETF (ITB).

Pulte Homes is pivoting toward the market of lower-priced homes like so many builders. Similar to the experience of other builders with increasing emphasis on the entry-level market, this pivot is driving robust demand dynamics. Average selling price generally declined with this shift but margins improved. Guidance for the 4th quarter follows these trends.

Reading through the transcript of the earnings call made me start to consider whether the rush of builders into the entry-level market will soon saturate the currently robust demand. Mortgage rates are low but have likely bottomed for the time-being as sentiment in financial markets improves. As last year’s plunge demonstrated, affordability issues in the housing market have made home buyers extremely rate-sensitive. A growing dependence on the entry-level market will exacerbate the downside for builders like PHM if that sensitivity rears its head again.

So overall, going forward, I only want to buy the stocks of home builders on dips and at the lower end of valuations (closer to 1.0 price/book). PHM is pulling back now, but the selling looks like it is just reversing a surprising post-earning acceleration in price. Even though the seasonally strong period for the stocks of home builders is underway, PHM does not get interesting to me until at least $36/share where it tests its uptrending 50-day moving average (DMA).

Stock Performance

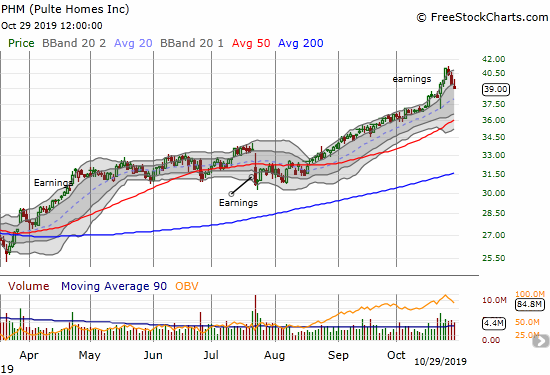

PHM was accelerating toward a 14-year high when sellers stepped into the home building sector. The selling started right as the iShares Dow Jones Home Construction ETF (ITB) perfectly tested and failed at its January, 2018 high.

Source: FreeStockCharts

While PHM is up sharply this year, especially since the July/August lows, investor reaction to earnings reports this year have displayed plenty of reluctance. On January 29, 2019 (not shown above), PHM gapped down before rebounding to a small gain. It took another two months for the stock to push higher. April earnings generated a modestly positive response, but the stock spent two months in a tight trading range before rallying into July earnings. The stock promptly lost 8.3% after the July earnings report. The eventual rally looks like it has more to do with sympathy with the industry rather than the stock itself. Even earnings last week first brought in fresh sellers before the stock rebounded sharply.

Note well that in 2019, PHM has slightly under-performed ITB.

- One day after reporting Q3 2019 earnings: +3.2%

- Since the close after Q3 2018 earnings: +86.8%

- Since the close after Q3 2019 earnings: -1.1%

- For the year until the close before earnings: +46.9%; compare to +49.8% for the iShares Dow Jones US Home Construction ETF (ITB)

Valuation (from Yahoo Finance)

- 12-month trailing P/E: 11.9

- 12-month forward P/E: 10.0

- Price/book: 2.0

- Price/sales: 1.0

- Short % of float: 4.6%

Year-Over-Year Performance (3 months ended September 30, 2019 and quarter-ending values)

- Total homebuilding revenue: +2.5%

- Home closings (units): +2.6%

- Average selling price: -0.2%

- Net income: -5.7%

- Gross profit margin: from 24.0% to 23.1%

- Operating margin: from 14.2% to 12.8%

- Earnings per diluted share: -2.0%

- Ending backlog value: +2.0% (number of homes +4.0%)

- Cash and cash equivalents: +1.2%

- Ratio of net debt to capital: from ?% to 34.6%

- First-time home buyers share of orders: from 25% to 31%

- First-time home buyers share of closings: from 26% to 29%

Year-Over-Year Performance (9 months ended August 31, 2019)

- Total homebuilding revenue: +0.8%

- Home closings (units): -4.6%

- Average selling price: +0.7%

- Net income: -13.2%

- Earnings per diluted share: -10.0%

Year-Over-Year Guidance and targets for 4th quarter

- Closings: 23,000 to 23,200 (full year); +15.0% to +16.9%

- Deliveries: 6,600 to 6,800; -1.6% to +1.4%

- Community count: +3% to +5%

- Average sales price: $425,000 to $430,000; -6.8% to -5.6%

- Gross margin: 23.2% to 23.4%; from 21.5%

- EPS: N/A

- Full year cost of material and labor closer to 1% growth (from 2%)

Highlights from the Earnings Call

Market Conditions and Characteristics of Demand

- “home buying activity remained strong and even accelerated in the third quarter”

- Largest Q3 order volume since 2006

- Demand driven by declines in interest rates and resulting affordability: “Given this improvement in affordability, we are optimistic about the sustainability of housing demand and the potential for new home sales to continue marching higher.”

- Orders from first-time home buyers increased 39%

- Targeting 33% share of closings from first-time home buyers (currently 29% of closings)

- Move-up and active adult orders each increased 4%

- All three months of the quarter similarly strong

Inventory

- 42% of land lots held via option; target is 50%

- 68% of the lots approved for purchase over first 9 months included an option

- Specs are 26% of home production, same as last year

- Goal for land of three years owned, three years optioned

Margins and Costs

- Pulte Homes has the highest margin mix in the home building industry

- About 60% of wood-framed houses use pre-manufactured wall panels and pre-manufactured trusses.; looking to move more and more building to factory

- Historically margins in entry-level have been lower than move-up, but current demand has flipped that relationship

Pricing Power

- ASP for first-time homes dropped 6% to $340,000 driven by a mix shift favoring the Southeast, Florida, and Texas.

- “While demand dynamics are clearly better, we are being careful in our pricing actions as we believe affordability though improved is still an issue within particular markets and buyer segments.”

- “…as Q4 comes to fruition, you’ll have a lot of builders out there working to liquidate their standing inventory and so we think that will impact pricing.”

- ” We have seen a favorable pricing environment…”

Share repurchasing activity

- Q3: Repurchased 4.1M shares for $136M at an average $32.93/share

- Q1 to Q3: Repurchased 7.7M shares for $244M at an average $31.86/share

- Pulte expects to always be active in repurchasing stock

Earnings sources

- 2019 3rd quarter results: October 22, 2019

- 2019 2nd quarter results: July 23, 2019

- 2018 4th quarter results: January 29, 2019

- 2018 3rd quarter results: October 23, 2018

- Seeking Alpha Transcripts: PulteGroup Inc (PHM) CEO Ryan Marshall on Q3 2019 Results Earnings Call – Transcript

Be careful out there!

Full disclosure: long ITB calendar call spread