(This is an excerpt from an article I originally published on Seeking Alpha on May 12, 2014. Click here to read the entire piece.)

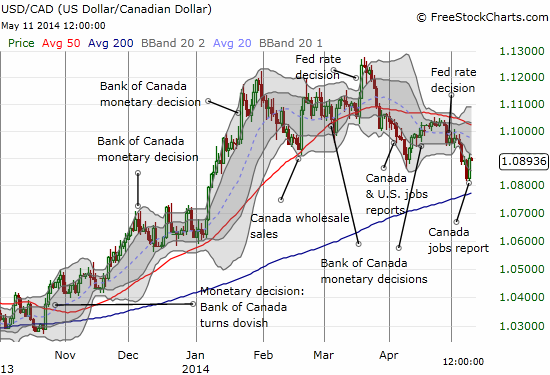

Ever since the Federal Reserve decision on monetary policy on March 19th, the Canadian dollar (FXC) has staged a strong recovery, increasing about 3.4% over that time. Canada’s weak employment report for April seemed to put an abrupt end to the rally on Friday, May 9th.

{snip}

This weakness in the jobs numbers was a reminder that monetary policy in Canada should remain relatively dovish for quite some time. This message was reinforced one more time during a speech on April 24th by Governor Stephen S. Poloz at the Saskatchewan Trade and Export Partnership in Saskatoon, Saskatchewan titled “Canada’s Hot – and Not – Economy“:

{snip}

Poloz also pointed to momentum in the U.S. economy as a facilitator of “diminished strength” in the Canadian dollar. {snip}

It is notable that the persistent weakness in the U.S. dollar index (UUP) has not translated into persistent strength in the Canadian dollar.

Source for charts: FreeStockCharts.com

Per previous posts, I have treated the recent weakness in USD/CAD as an opportunity to rebuild a long position in the currency pair. The on-going weakness in the U.S. dollar index and the arrested upward momentum in USD/CAD definitely puts my upwardly revised target for early 2015 of 1.16 in jeopardy. I am not adjusting the target just yet, but I do feel it is very reasonable to expect USD/CAD to retest recent highs in the coming months.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 12, 2014. Click here to read the entire piece.)

Full disclosure: long USD/CAD