(This is an excerpt from an article I originally published on Seeking Alpha on September 2, 2013. Click here to read the entire piece.)

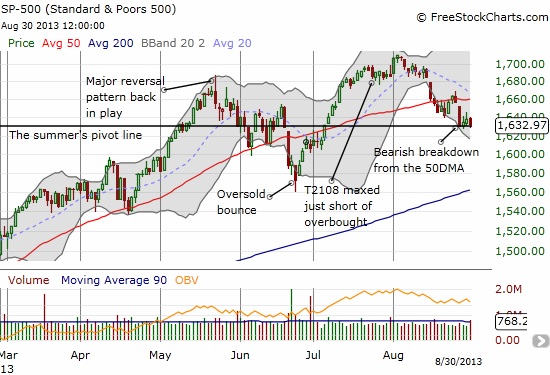

The summer of 2013 delivered a flat performance for the S&P 500 (SPY). The S&P 500 closed at 1,630.74 on May 31st. The 1,632.97 close on August 29th ended the summer with an imperceptible gain of 0.1%. This performance means that my prediction for a positive close to the summer came through with the slimmest of margins. More importantly, buying the summer’s dips performed quite nicely even if traders are still holding onto the one trade the summer delivered (oversold conditions in late June).

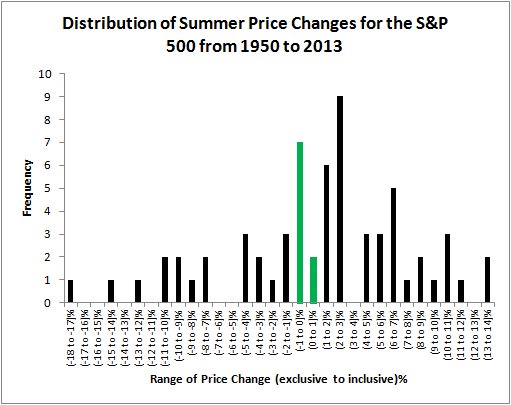

A flat summer has become a rare occurrence. {snip}

Source: Prices from Yahoo!Finance

I am surprised that the summer ended flat, but it represents an interesting balance in the fight between bears and bulls. {snip}

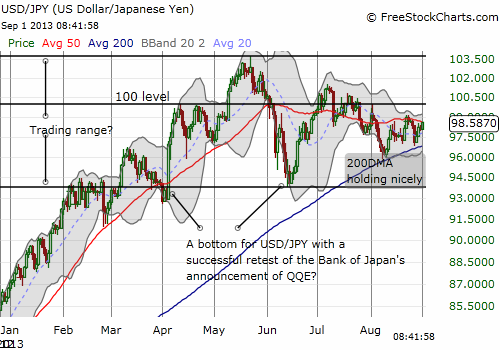

The month also ended with the dollar index bouncing well off recent lows, and the Japanese yen (FXY) in retreat. I showed in a previous piece how the numbers seem to indicate the dollar (UUP) is losing its place as a “safety” currency to the yen and even to the euro. {snip}

So, overall, it seems the bearish and bullish forces remain in balance. Certainly, bears must be getting extremely impatient for a catalyst to spark a real sell-off. {snip}

Bears itching to chase this sell-off lower may experience whiplash. {snip}

With this balance of bears versus bulls, a new catalyst will need to emerge to break the current balance either to lower lows or to higher highs. Whatever it is, I strongly suspect it will be something that is not yet receiving enough attention…

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 2, 2013. Click here to read the entire piece.)

Full disclosure: long SSO calls, net long U.S. dollar, net short Japanese yen