(This is an excerpt from an article I originally published on Seeking Alpha on June 7, 2013. Click here to read the entire piece.)

{snip}

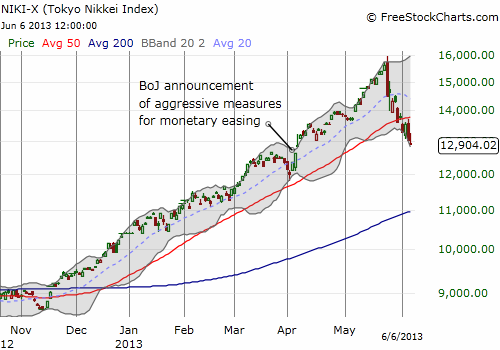

Notably, this retracement erases almost all of the stock market gains from the Bank of Japan’s announcement of aggressive monetary policy in early April called “Introduction of the “Quantitative and Qualitative Monetary Easing.” {snip}

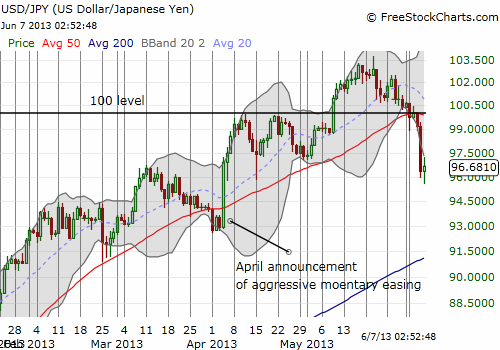

This could have been a unique buying opportunity, except the Japanese yen is on the move again and it is now warning of danger ahead.

The yen (FXY) suddenly looks like it is starting to transition out of its cycle of persistent devaluation. {snip} The yen’s renewed vigor could get exaggerated by the “need” to fill the vacuum of a rapidly weakening dollar. On Thursday, the dollar index experienced a very rare one-day plunge of over 1%.

Source for stock and forex charts: FreeStockCharts.com

Source for data: FreeStockCharts.com

The increasing volatility in the Japanese yen is an echo of the burst of volatility that hit the Japanese bond market starting right around the time Japan announced excellent GDP numbers May 15th. {snip}

Japan’s latest GDP results seemed to vindicate and confirm the the power of “Abenomics.” {snip}

These economic signs should be encouraging and should support an eventual turn-around in the Japanese stock market. However, if currency markets rekindle their love affair with a strong Japanese yen, the bear market Nikkei-style may hang around a lot longer.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 7, 2013. Click here to read the entire piece.)

Full disclosure: net long Japanese yen