(This is an excerpt from an article I originally published on Seeking Alpha on April 21, 2013. Click here to read the entire piece.)

On April 17th, the Bank of Canada decided to leave interest rates unchanged. In its Monetary Policy Report Summary, the Bank of Canada extended out its forecast to mid-2015 as the time when the Canadian economy will finally return to full capacity:

{snip}

With expectations for inflation to only gradually rise to 2% by mid-2015, I am assuming the Bank of Canada is very likely to leave rates low until then. This target is no accident. {snip}

Moreover, the Federal Reserve staff continue to project subdued inflation through 2015.

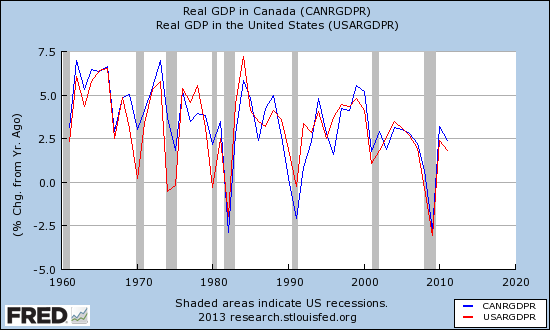

The Bank of Canada’s projections of a marginal decrease in the GDP growth rate from 2014 to 2015 are less optimistic than the marginal increase it expects for the U.S. of 3.1% to 3.3%. {snip}

Source: Federal Reserve Bank of St. Louis (FRED)

A big part of Canada’s problem is the very slow recovery in exports. {snip}

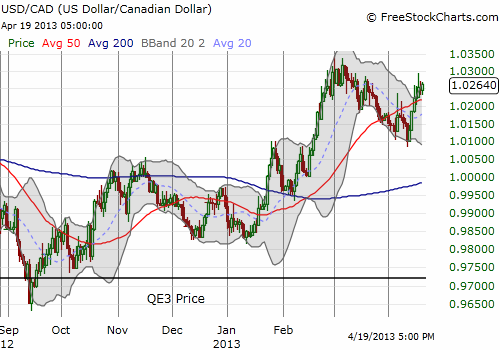

Source: FreeStockCharts.com

Since the abatement of the 2008-2009 financial crisis, USD/CAD has traded in a relatively well-defined range. The currency pair is now in the middle of that range. Absent any dramatic changes in economic conditions or trends, I continue to expect a gradual return to the top of the range (around 1.08), and I will not be surprised to see USD/CAD continue to move higher in the many months to come if the actual economic numbers show on-going out-performance by the American economy over the Canadian economy.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 21, 2013. Click here to read the entire piece.)

Full disclosure: long USD/CAD