(This is an excerpt from an article I originally published on Seeking Alpha on May 11, 2012. Click here to read the entire piece.)

On Wednesday, May 9th, CNBC ran a story with the following headline: “Stocks Trim Losses Yet Again: Is the Morning ‘Amateur Hour’?.” {snip}… the article concluded that anyone trading against the “dumb money” in the morning, made a lot of money. The article even quoted a hedge fund manager as saying “Amateur hour is 9:30 to 10:30…Smart money trades later in the day. Risk is definitely to the upside here.”

{snip} What struck a chord with me is that even after so much data appear to demonstrate that retail investors and traders appear to be retreating and staying away from the market, we still read insults like the ones posted in this CNBC article. Any wonder that retail stays away from a system that seems rigged specifically to transfer money from them to institutional traders?

{snip}

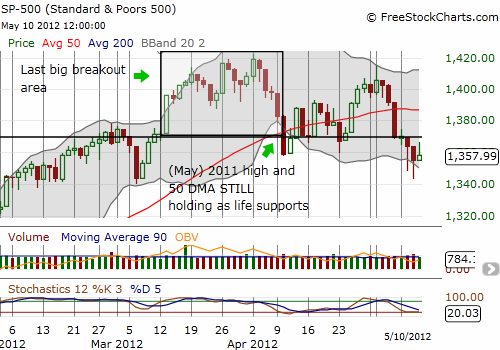

The chart below shows a close-up the action. {snip}

Source: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 11, 2012. Click here to read the entire piece.)

Full disclosure: long SDS, and SSO calls