(This is an excerpt from an article I originally published on Seeking Alpha on May 9, 2012 PRE-EARNINGS. Click here to read the entire piece.)

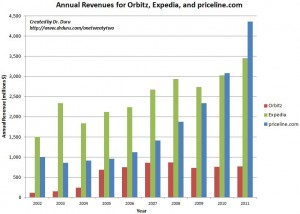

{snip} In 2010, PCLN finally overtook Expedia (EXPE) in revenues.

Click image for a larger view…

Source: MSN Money

{snip}

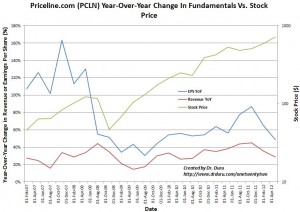

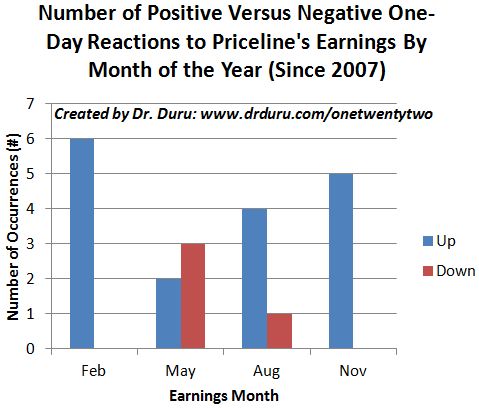

With earnings coming up for PCLN, and given recent successes in analyzing post-earnings prospects for Amazon, Best Buy, and Apple, I decided finally to take a look at the post-earnings prospects for PCLN. In summary, it seems that given the recent divergence in price versus earnings and revenue growth (that is, a more expensive valuation), PCLN is “due” for a rare post-earnings sell-off. Moreover, the May earnings cycle is PCLN’s worst performing month for post-earnings price performance. {snip}

First, the fundamentals for PCLN have remained strong over the past five years, even through the recession. {snip}

Click image for a larger view…

Source: EPS and Revenue data from MSN Money, stock price data from Yahoo!Finance

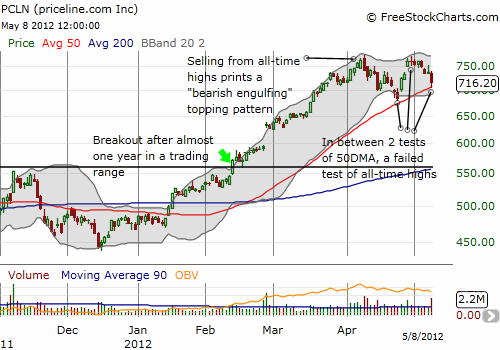

{snip} This trading action all but confirms PCLN has made a top for now given the selling was so strong from the all-time highs in early April.

Source: FreeStockCharts.com

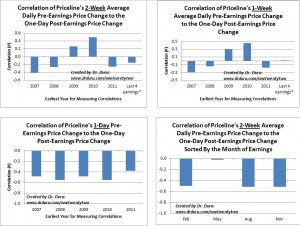

{snip} None of this trading is strongly correlated to PCLN’s price performance the day after earnings are reported. {snip}

Click on image for a larger view…

{snip} Since I am biased toward thinking PCLN will trade down following earnings, the above data provide a very weak expectation for a positive close for Wednesday’s trading ahead of earnings.

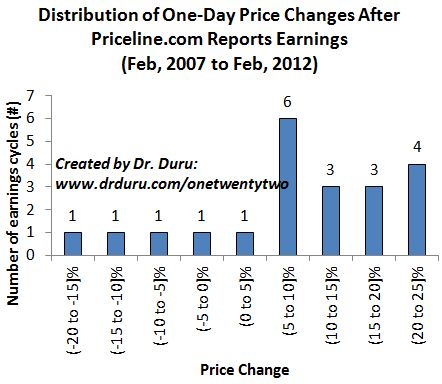

Over these same 21 earnings cycles, PCLN has traded up the day following earnings an amazing 17 times, for an 81% post-earnings winning record. However, and this is a BIG “but”, three of those four post-earnings sell-offs occurred during the May earnings report. The May report is the only one of the four quarterly reports with a losing record.

The range of post-earnings price performance has been quite remarkable. {snip}

{snip}

Overall and all things considered, the arrows are pointing south for PCLN post-earnings, but making such a bet includes high risks. {snip}

If PCLN manages to soar post-earnings yet again, history shows little potential for a fade. {snip} In other words, PCLN can be bought on post-earnings strength.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 9, 2012 PRE-EARNINGS. Click here to read the entire piece.)

Full disclosure: long calls and puts on AAPL