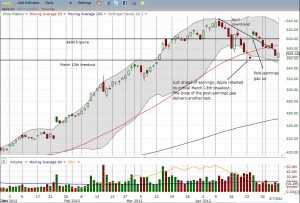

On Friday, May 4, Apple (AAPL) dropped 2.9% in price and came within 5 points (0.9%) of closing its entire post-earnings gap up from April 25. During Monday’s trading, Apple’s low (at the open) brought the stock within one point of closing the gap.

Click image for a larger view…

Source: FreeStockCharts.com

The post-earnings gap is not only essentially filled, but also note that Apple’s post-earnings pop did not free the stock of the downtrend that began with all-time highs in April. From a technical standpoint, Apple is at a critical juncture trading below its 50-day moving average (DMA), still following a downtrend, and retesting a major breakout point from March 13th that launched Apple’s last surge to all-time highs. A break below support could lead to extended selling pressure. The good news so far is that trading volume has not been this light since February. In other words, Apple is likely suffering more from a lack of buying interest than from selling pressure.

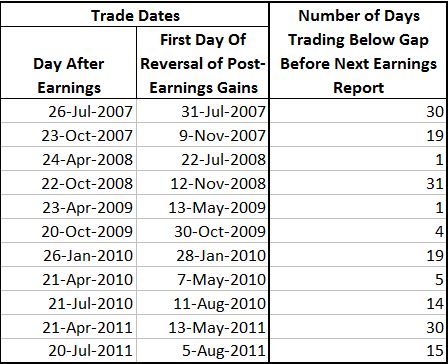

Apple’s post-earnings surge did not surprise me, but this rapid closing of the gap did surprise me. However, it turns out that Apple tends to reverse its post-earnings gains. Since at least 2007, AAPL has closed with a positive gain 17 of 23 post-earnings trading days. Of those 17, AAPL has reversed the gains in 12 of them, including the current one. In 7 of 12 gap reversals, it has taken AAPL at least 14 trading days before the stock finally moved on to higher prices before the next earnings announcement. The table below summarizes this recent history.

Source: Earnings dates from briefing.com, stock prices from Yahoo!Finance

In other words, today’s reversal is typical (I wish I had noted this behavior earlier!). Given the recent history, I suspect Apple will not regain its balance until early June. In the meantime, I will be watching the downtrend and critical support very carefully.

Be careful out there!

Full disclosure: long AAPL call spread and puts