Stock Market Commentary

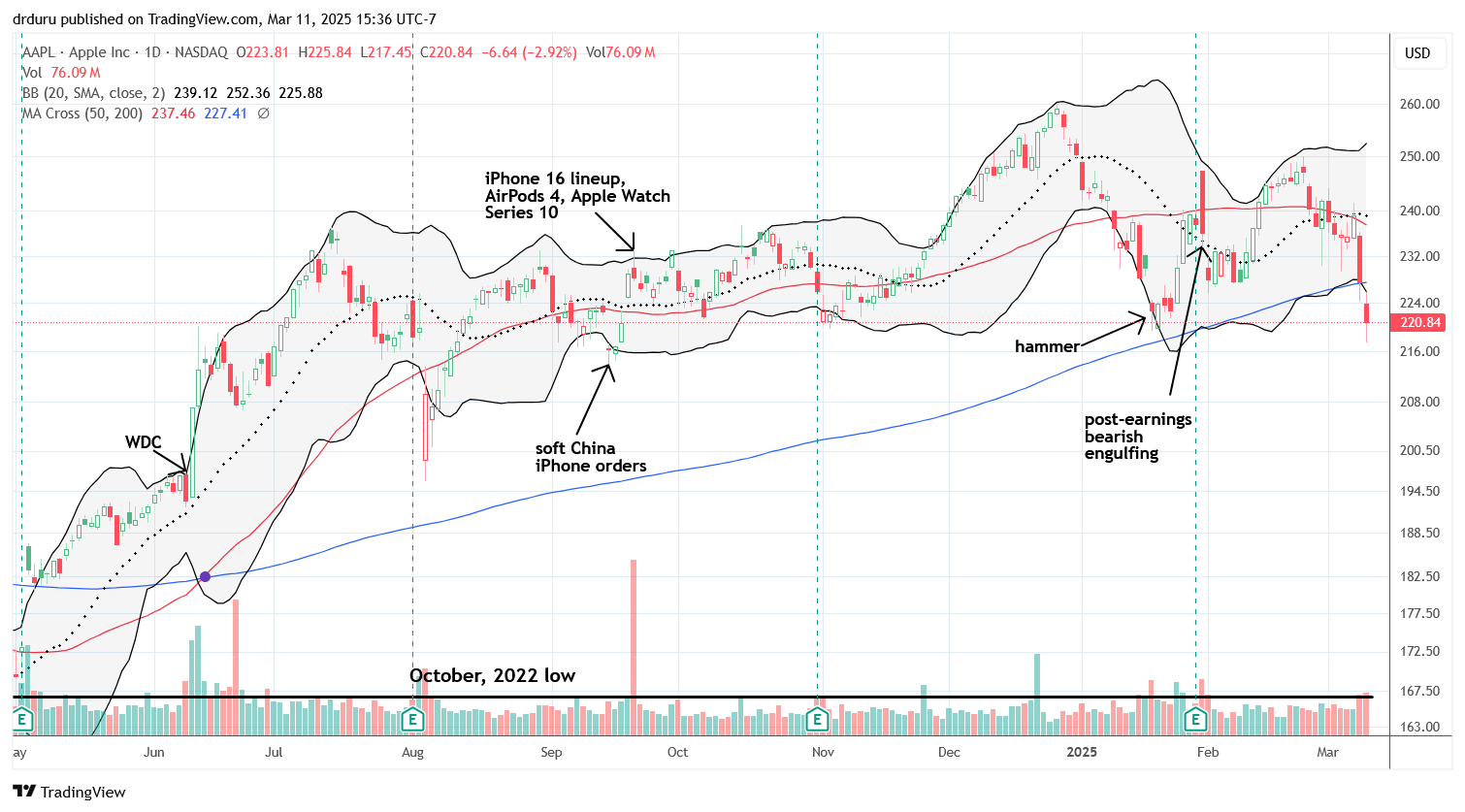

I used key indicators in late February to issue a red flag warning on the stock market. I used additional indicators to serve as caution even as I flipped to a bullish posture on the stock market last week. Now, a fresh indicator of caution has emerged in the form of an ominous breakdown for Apple Inc (AAPL). This key big cap tech stock lost 2.9% and broke down below its 200-day moving average (DMA) (the blue line below). Moreover, AAPL confirmed overhead 50DMA resistance (red line), and, like so many stocks, hit a closing 6-month low. So now I transition from yesterday’s falling rotten eggs to today’s fallen apple. Breakdowns below 200DMA support represent bearish trading action. so AAPL confirmed what the major indices are already saying with their respective 200DMA breakdowns.

The Stock Market Indices

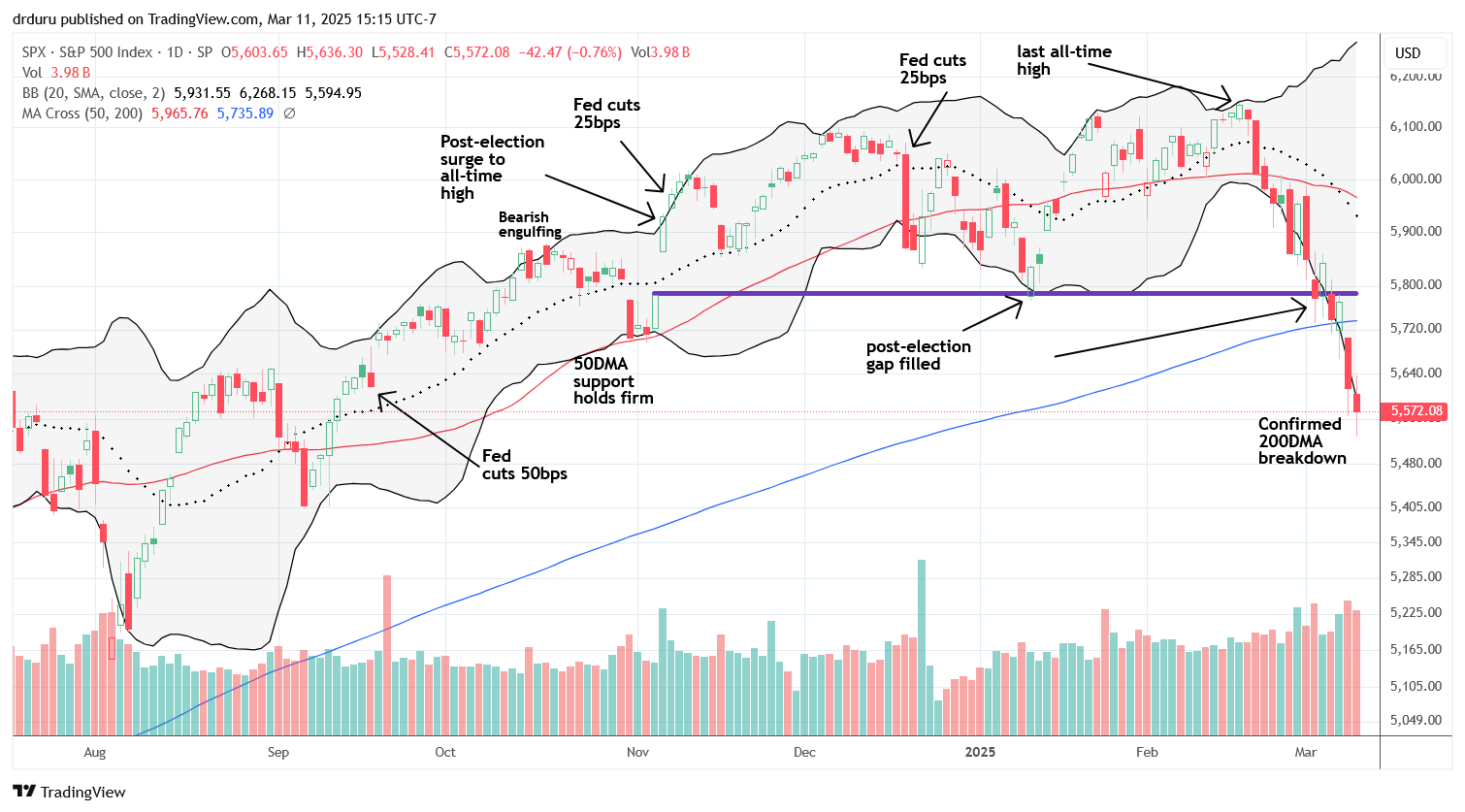

The S&P 500 (SPY) fell 0.8% and confirmed its 200DMA breakdown. While the loss seems minimal, trading conditions felt pretty bad at the lows given the index was up for a brief period in the morning. The S&P 500 has now traded through and around its lower Bollinger Band (BB) (the black line that defines the bottom of expected price volatility over 20 days) for 12 straight trading days. The last two days have held the index below the lower BB. At the bottom of the chart, you can see a general uptrend in trading volume as well. In other words, this selling pressure is serious and getting more so!

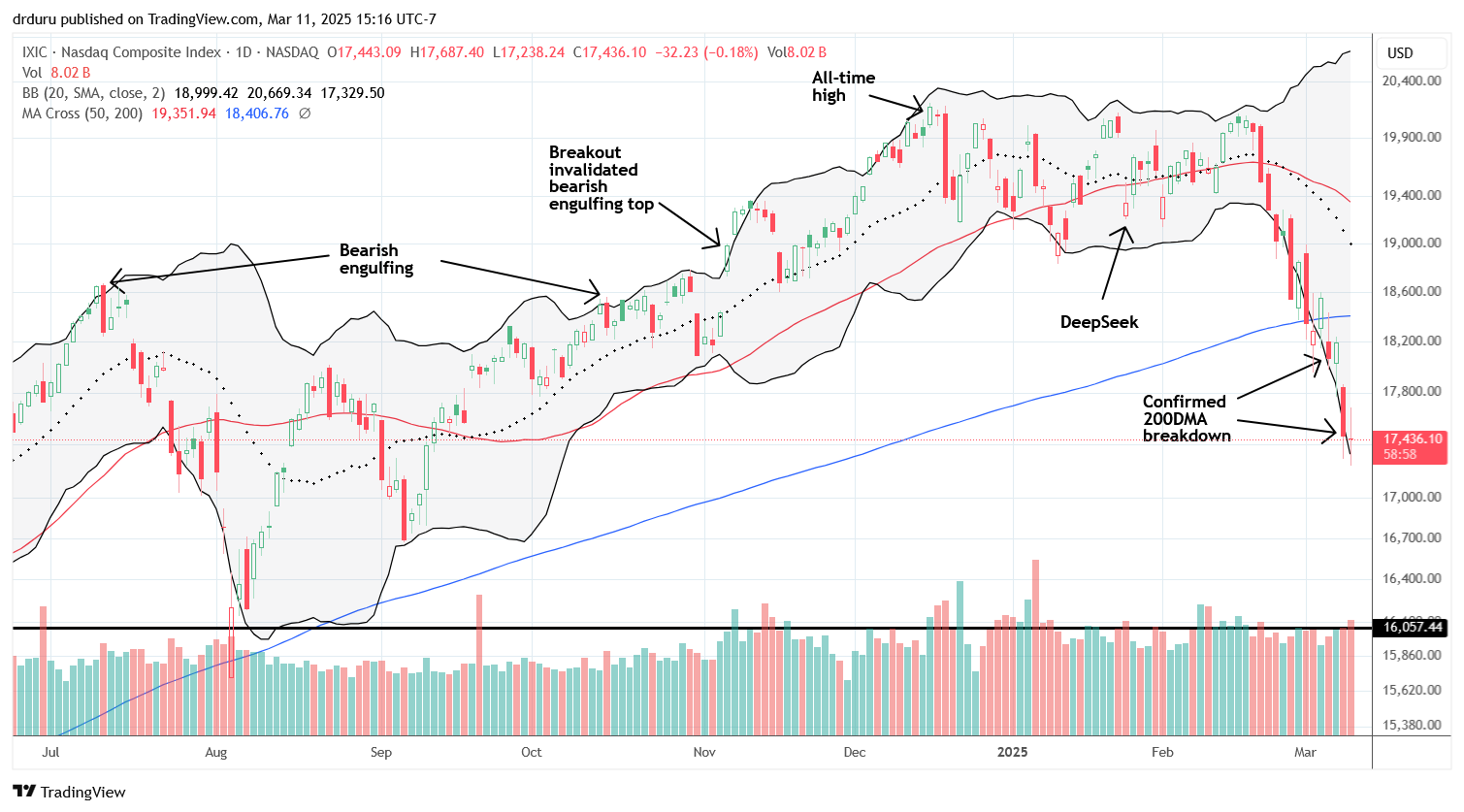

The NASDAQ (COMPQX) has fallen faster and more steeply than the S&P 500 but has somehow managed to give its lower BB a few breaks during this sell-off. The tech laden index even managed to close essentially flat on the day. With trading volume relatively flat over this time period, I am worrying about what will happen when sellers get more serious about dumping their tech stocks… That horizontal black line beckoning from below is the former all-time high from November 19, 2021.

The iShares Russell 2000 ETF (IWM) took a break from the selling with a flat close. Like the NASDAQ, the ETF of small caps was up notably for the day before sellers faded all the gains away.

The Short-Term Trading Call With A Fallen Apple

- AT50 (MMFI) = 24.3% of stocks are trading above their respective 50-day moving averages

- AT200 (MMTH) = 34.7% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: cautiously bullish

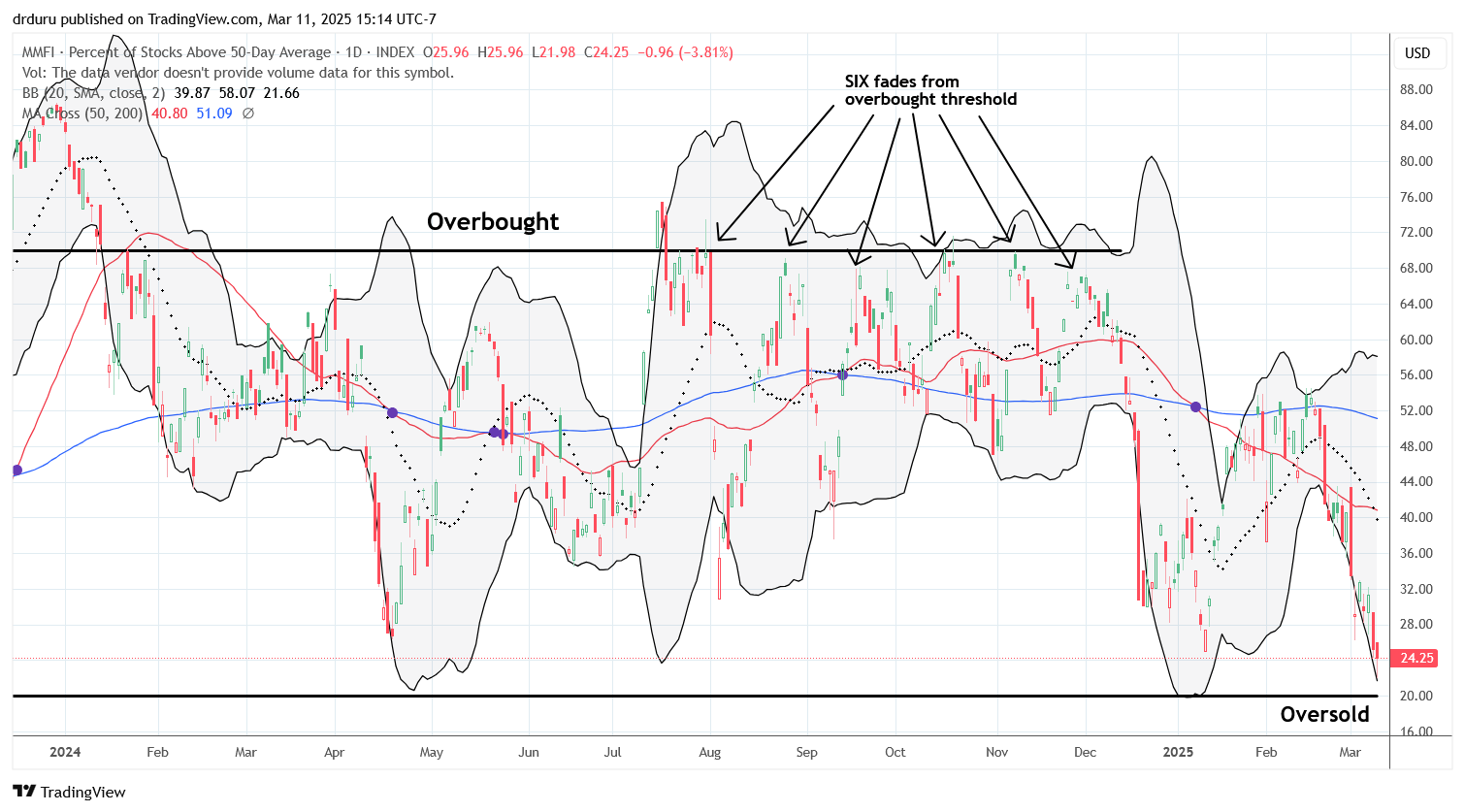

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, closed at 24.3% after losing a single percentage point. My favorite technical indicator is tantalizing me with this slow roll to the official oversold threshold of 20%. The fallen Apple should have been enough to press the issue. Instead, despite my short-term trading call sitting at cautiously bullish, I have found precious little to interest me. As I mentioned in my last post, I am eagerly awaiting a major spike in volatility and/or a major volatility implosion before I can comfortably trigger the AT50 trading rules. The VIX fell a mere 3.4% and did not even reverse the previous day’s gains. The VIX is hanging around its highs from the market’s disappointment with the Fed’s December decision on monetary policy.

As a reminder I now consider the stock market to be in a bear market given the unified trading below 200DMAs. The fallen Apple is just one more confirmation. AT200 (MMTH), the percentage of stocks trading above their respective 200DMAs, dropped a full percentage point and fell to a new 16-month low.

Tesla, Inc (TSLA) captures the current market ethos of chaos and retrenchment. The stock is so far removed from the technical analysis I did reviewing the prospects for its breakout in December. That episode started the beginning of the end. Three months later, roughly half the country hates CEO Elon Musk, and the other half already hates EVs (electric vehicles). Around the globe, TSLA car sales have also plummeted. However, Musk is rich enough not to care as he focuses on his government job. For the rest of us, TSLA offers a case study in technical analysis. {Addendum: note well that President Trump threw his hat in the ring on March 11 by promising to buy a Model S).

TSLA never recovered from its disappointing delivery report in December. The breakout ended there and an obligatory bounce from the buying faithful quickly fizzled out around 20DMA resistance (the dotted line). January earnings gave TSLA a chance to recover from a 50DMA breakdown. Once those tepid gains reversed, the bearish momentum on TSLA officially began. In fact, sellers have been nearly relentless since then. I successfully traded TSLA to the downside (using TSLQ), but I was not nearly aggressive enough.

TSLA is now at another key juncture as it hovers over a price level representing the stock’s 2023 breakout point. A near “obligatory” (3.8%) bounce away from this support line was a rare moment of market out-performance for TSLA. Still, I decided to register TSLA for an outlier hedge. After taking profits on my outlier SPY put spread, and with the stock market persisting in its bear market behavior, I felt compelled to establish a new outlier hedge. My TSLA June $160/$145 put spread fits the bill. For reference, TSLA hit a low of $142 in 2024 during times better than these for the company. (Note I am sticking with my trading and investing plan in ARKK – ARKK’s biggest holding is TSLA….unfortunately).

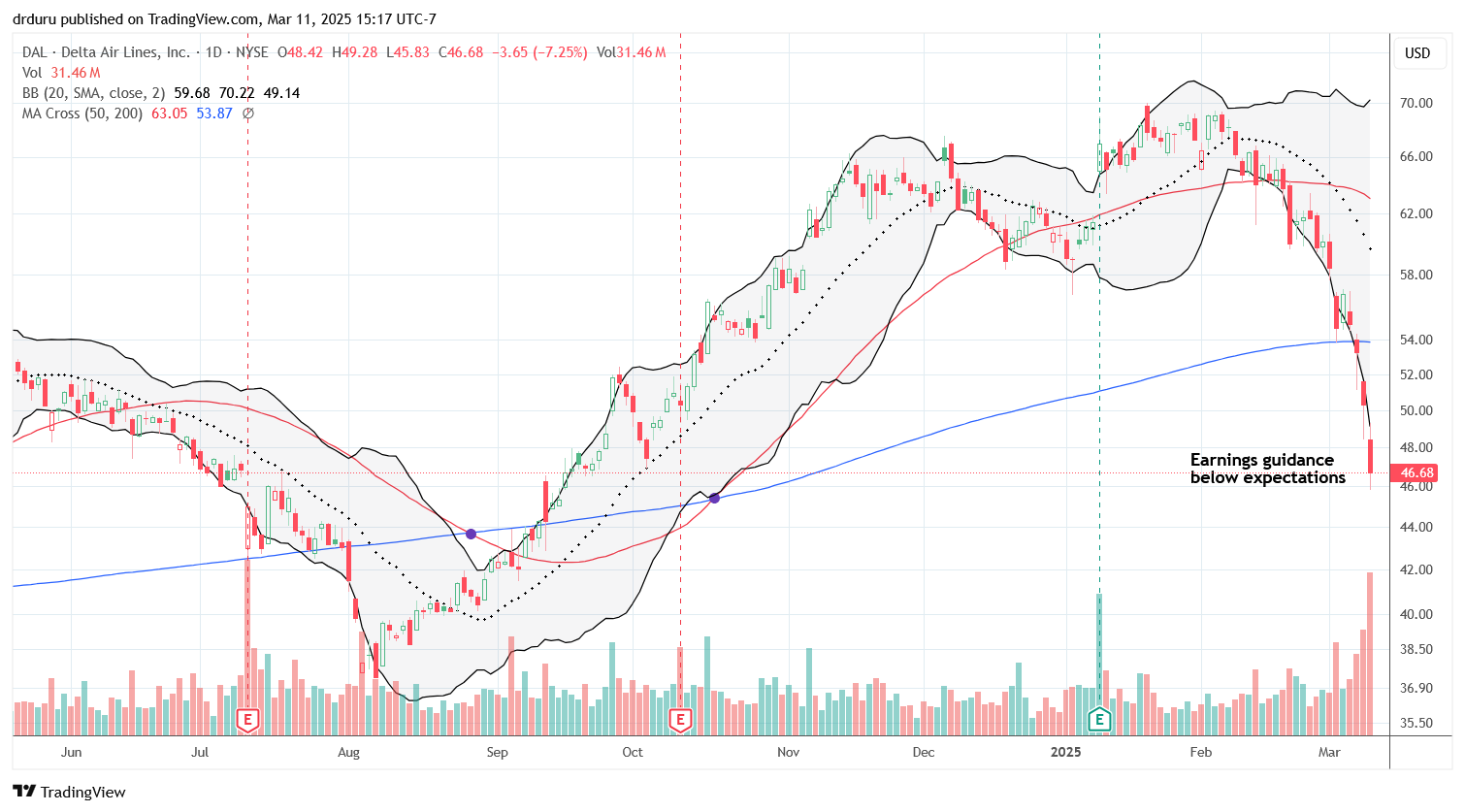

Delta Air Lines, Inc (DAL) gave the earnings warning no one wants to hear right now. DAL confirmed growing concerns about consumer and business confidence and spending. The bad news was soundly punished with a 7.3% loss on the day. In less than a month, sellers wiped out a lot of excitement from late last summer to January. Notice how the trading volume spiked on this warning. As a result, DAL has a high potential to print some kind of tradeable short-term bottom soon. At a minimum, DAL is over-stretched below its lower BB.

Oracle Corporation (ORCL) generated a lot of excitement with Stargate in January. The celebration and hype quickly dissipated. Sellers even successfully faded the subsequent rebound. After today’s 3.1% post-earnings loss, ORCL also reversed its gains from September earnings. Given the strong reversal from the lows of the day after reversing the September post-earnings gains, I put ORCL on the buy list for a trade at least back to overhead 200DMA resistance.

Asana, Inc (ASAN) delivered a crushing defeat. In December I described the stock as a buy on the dips, but I assumed momentum was so strong that good risk/reward dips would not be forthcoming. In January, the stock tested, held, and climbed 50DMA support. I thought the pullback was such a gift, I even continued to hold the stock as it sold off with the market into earnings. I also bought a pre-earnings call option at the $18 strike, eyeing a rebound to $20 and 50DMA resistance. Instead, ASAN collapsed 24% post-earnings and reminded of the risks of holding a stock with such poor trading action going into earnings.

With a lot of cash already spent on share repurchases, ASAN did not say a thing about repurchasing shares in the earnings conference call. Moreover, co-founder and CEO Dustin Moskovitz is retiring. The company’s stock will likely struggle for some time to recover from this major reversal of fortunes. An eventual buyout from an institutional investor (hello Thoma Bravo?) looks like the most attractive outcome from here.

I end this trail of fallen apples with a stock that is sitting in picture-perfect buying position: semicondutor company Broadcom (AVGO). AVGO finished reversing the monster gains from December earnings right before its latest earnings report. After jumping 8.6% post-earnings, sellers quickly reversed those gains the next day. With AVGO rebounding again, support at the pre-earnings low may be firming. I am looking to buy a post-earnings high….assuming support will hold long enough for a short-term swing trade.

Be careful out there!

Footnotes

Subscribe for free to get email notifications of future posts!

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #310 over 20% (overperiod), Day #2 under 30% (underperiod), Day #7 under 40%, Day #19 under 50%, Day #46 under 60%, Day #147 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long IWM calls, long TSLA put spread, long ASAN, long VXX puts, long SPY, long QQQ call calendar spread and call

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, BlueSky, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.