This piece is my second follow-up to my claims from a year ago in: “Renaissance IPO ETF A Less Volatile Way to Speculate Than ARKK“. Since that post, and especially this year, the performance gap between the Renaissance IPO ETF (IPO) and the ARK Innovation ETF (ARKK) has widened so much that I am comfortable claiming IPO is a better ETF for speculating than ARKK, period. IPO is even starting to compete with the tortoise in the speculation race: the Invesco QQQ Trust (QQQ). Cathie Wood, the founder and leader of ARK Invest, is fond of using the tagline “innovation solves problems” as a fundamental investment thesis. This truism is so catchy that it helps me to frame the case of IPO over ARKK as a way to solve the problem of speculating while lowering downside risks.

The following table shows the price performance of the three ETFs using the closing prices from TradingView.com. I manually calculated the performance over multiple timeframes. QQQ continued its strength as the hands-down winner across all timeframes. IPO stretched out its advantage over ARKK thanks to ARKK’s decline this year versus IPO’s near QQQ-like performance. (“Since” measures from the last trading day of the previous year; for example, since 2023 measures performance from Friday, December 30, 2022 to October 18, 2024.)

| Time Frame | ARKK (%) | IPO (%) | QQQ (%) |

|---|---|---|---|

| Since 2016 | 134.8 | 113.2 | 342.0 |

| Since 2020 | -4.0 | 41.5 | 132.6 |

| Since 2021 | -61.4 | -31.2 | 57.6 |

| Since 2022 | -49.2 | -23.3 | 24.3 |

| Since 2023 | 53.7 | 79.5 | 85.7 |

| Year-to-date | -8.3 | 17.7 | 20.7 |

The performance since 2020 sticks out as the sharpest contrast. This era since the COVID-19 pandemic includes the largest and most coordinated amount of economic stimulus in the history of the planet. Yet, ARKK lost value over this time while IPO gained 41.5% and QQQ a mouth-watering 132.6%. This era has included game-changing innovations from AI to blockchain/cryptocurrency to the sharing economy to health care to communications and more. If ever there was a time for innovation to solve problems, these last 5 years have delivered in a mind-boggling way. Yet, ARKK lags IPO and is hopelessly behind the “curmudgeons” of high-tech in QQQ.

Also notice that monetary tightening was particularly damaging for ARKK. ARKK’s negative year-to-date performance is partially a function of its on-going struggle to recover from the tightening cycle. Meanwhile, IPO is up 17.7%, QQQ has managed to avoid negative performance over any of the time frames including the tightening cycle. There is a reason why Wood sent an open letter to the Fed pleading for an end to monetary tightening and a return to easy money policies.

Speculation Is About Timing Not Dogma

One key lesson in this comparison is that timing matters when it comes to speculation. For example, in the dotcom era, numerous entrepreneurs made a lot of money despite the bust because they sold when times were good. Similar fortunes were made in the pandemic bubble and bust. ARKK is actively managed, so Wood and team get plenty of opportunities to cash in their chips. Instead, they doggedly stick to broken stocks and profitless companies long after the bust begins. ARK Invest dresses up speculation as investing. As a result, the ARK dogma includes too many entries and not enough exits.

IPO and QQQ are rules-based indices. IPO in has a sound rule built for speculation: “New companies are included in the index on a fast entry basis on the fifth day of trading, or upon quarterly review, and are removed after two years when the IPOs become seasoned stocks.” IPO will tend to capture large benefits from a speculative fever over some innovation while also cutting losses short from the failures. QQQ will capture the fruits of the surviving, successful innovators. ARKK may capture wins from the long-term successes, but it also gets anchored by the long-term losers. This dynamic is ironic given how Wood regularly trashes indexing.

The following compare and contrast chart speaks volumes about what happens when speculating dogmatically overstays its welcome. Even ARKK’s long-term advantage over IPO since 2016 has been narrowing rapidly this year. Also note how IPO never broke below its pandemic lows whereas ARKK at one point hit prices last seen in 2017.

Can Innovation Solve A Popularity Problem?

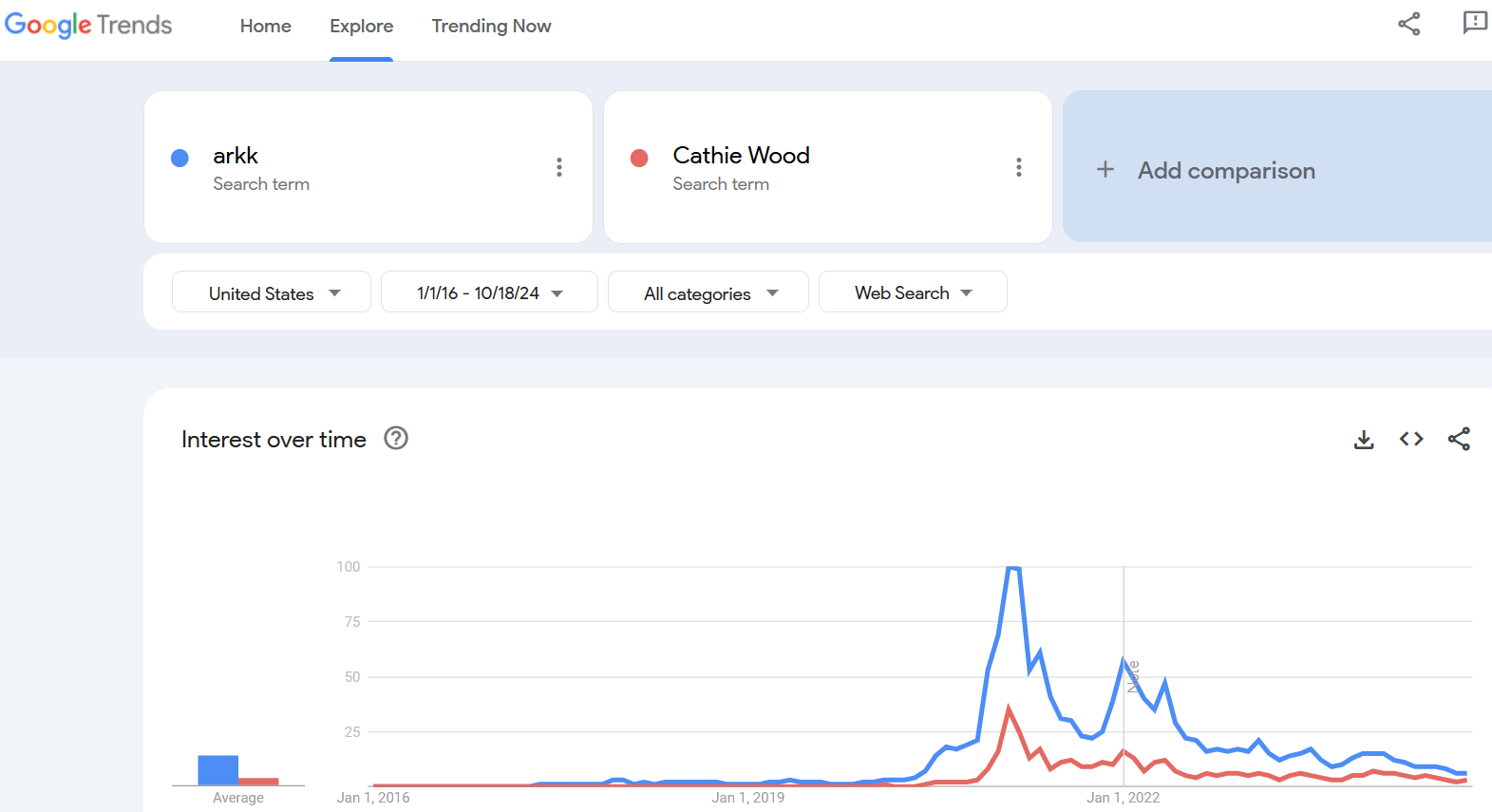

Google trends provides another lens on the rise and fall of the bubble in ARKK speculation. Search interest in ARKK followed the trajectory of the price action in ARKK. Similarly, search interest in Cathie Wood followed the same arc. Search interest in both is back to levels from the early months of the pandemic. The Federal Reserve’s cycle of tightening monetary policy definitely squeezed out the excesses in search popularity!

The Upshot

I earlier predicted that once the IPO market wakes up again, IPO could further outpace ARKK. That prediction seems to be playing out in 2024. Once the market gets saturated with IPOs from AI-related companies, IPO could further outpace ARKK unless Wood and company finally shift from investing to trading speculative positions. ARKK is overly concentrated in big losers so a different diversification strategy could also help ARK. At this point, I consider IPO to be a much better (risk-adjusted) approach to speculating while avoiding single-company risks. I am happy I stuck with IPO this year.

Still, I find ARKK useful for short-term trading purposes. I still look to buy into sell-offs and to sell rallies, sometimes selling calls against the shares and letting those shares get called away on sharper than expected rallies. I am still sitting on shares from the last sequence of trades. I hope I am holding shares if ARK ever finds its way aboard a new rocketship higher. (I am holding a put spread on QQQ as a hedge on a potential double-top).

This recent 12-minute video from “New Money” goes into depth on the history and problems facing ARK Invest and Cathie Wood.

Be careful out there!

Appendix

Closing prices used to calculate the percentage performances.

| Date | ARKK | IPO | QQQ |

|---|---|---|---|

| End of 2015 | 20.46 | 20.81 | 111.86 |

| End of 2019 | 50.05 | 31.11 | 212.61 |

| End of 2020 | 124.49 | 64.49 | 313.74 |

| End of 2021 | 94.59 | 57.84 | 397.85 |

| End of 2022 | 31.24 | 24.72 | 266.28 |

| End of 2023 | 52.37 | 37.71 | 409.52 |

| October 18, 2024 | 48.03 | 44.37 | 494.47 |

ChatGPT’s interpretation and analysis of the comparison chart, written in “Dr. Duru style”

I am constantly looking for ways to leverage AI to be a more efficient and proficient analyst and writer. Out of curiosity, I gave ChatGPT the comparison stock chart and asked for its observations. I first asked “Write a 2-3 paragraph article about this chart”. Next, I asked “Rewrite that article as if it was a blog post. For example, make this less about describing a visualization and much more about what the chart means. Compare and contrast ARKK, QQQ, and IPO. What lessons should a trader learn from this chart?” Finally, I made the following request: “Excellent. Now let’s do one more rewrite in the style of Dr. Duru at the site drduru.com/onetwentytwo.”

The output is pretty good and aligns with my own conclusions and analysis. Of course, I cannot rely on ChatGPT to automatically produce a quality output. For example, ChatGPT some context but not enough. I have to nudge and guide it to my desired destination. I could have continued to play editor, but the following analysis is sufficient for these purposes.

Here is ChatGPT’s third edit:

The chart comparing ARKK, QQQ, and the IPO ETF paints a striking picture of how different strategies play out over time—and the lessons are crucial for traders navigating today’s volatile markets. ARKK, Cathie Wood’s flagship innovation fund, has been a rollercoaster for traders, shooting to the moon during the pandemic boom only to come crashing back to earth in 2021 and beyond. QQQ, meanwhile, represents the steady hand of established tech giants, a slow and steady climber that rewards patience and a more conservative approach to tech exposure. The IPO ETF falls somewhere in between, reflecting the ups and downs of betting on newly public companies.

ARKK’s incredible run in 2020 seemed unstoppable. Riding the wave of speculative tech bets, the fund soared to dizzying heights, outperforming both QQQ and the IPO ETF by a wide margin. But traders chasing that performance got a harsh reminder in 2021 of what happens when you reach too high, too fast. As tech stocks corrected, ARKK’s high-flying bets tumbled hard, dragging the fund from its peak to the depths of a significant drawdown. In contrast, QQQ, backed by more established names, climbed steadily upward, avoiding the same level of volatility, up a massive 335% since 2016. The IPO ETF, with its focus on new and untested companies, also couldn’t match ARKK’s initial exuberance or its subsequent collapse, but it’s clear that IPO plays carry their own risks.

The takeaway for traders? Chasing speculative plays like ARKK can be exhilarating and profitable in the short term, but it demands an appetite for volatility—and a well-timed exit. QQQ offers a smoother ride, rewarding those willing to play the long game with proven tech giants. The IPO ETF represents yet another risky but potentially rewarding space, where traders can catch big moves from freshly public companies—but as with ARKK, the corrections can come fast and furious. Diversification across these strategies and an understanding of the risks involved is key to managing the turbulence of today’s market.

Full disclosure: long ARKK, long IPO, long QQQ put spread