Stock Market Commentary:

“The U.S. economy remains fundamentally strong, despite recent mixed data. Recent developments have increased the risk of a future adverse outcome. Our fortress principles are designed to withstand

JP Morgan Chase & Co (JPM), Investor Day 2022, Firm Overview, page 12

any operating environment.”

Starting from oversold conditions, the market was looking for an excuse to rally. Jamie Dimon, CEO of JP Morgan Chase & Co, delivered with Investor Day 2022 commentary. The market was all ears for the soundness of the economy and ignored the prospects for heightened risks. JPM responded with an impressive 6.2% rally. I call this the “Jamie Dimon push” that drove a lot of gains in the stock market. The rally was broad enough to lift the stock market out of oversold trading conditions.

“Well, the macroeconomic environment has definitely deteriorated further and faster than we expected when we issued our guidance for the second quarter. So even though our revenue continues to grow year-over-year in the second quarter, it’s likely that revenue and EBITDA will come in below the low end of our guidance range.”

Evan Spiegel, Co-Founder and Chief Executive Officer, Snap Inc (SNAP) at the J.P. Morgan Global Technology, Media and Communications Conference (Seeking Alpha transcript)

Spiegel pulled attention right back to risks with the above commentary at the very beginning of his discussion at the J.P. Morgan Global Technology, Media and Communications Conference. The heavy dose of economic reality overshadowed the rest of the review about the company’s business and product progress. SNAP lost a whopping 28.4% in after hours trading. The stock looks set to give up the rest of its pandemic era gains. This collapse is a devastating setback for a stock that hit the public market at $17 over 5 years ago.

SNAP’s warning was bad enough to knock down a swath of related stocks in the after market. Last week’s spotlight on troubled retailers now turns to the health of the advertising market. Even Facebook lost 7%. Thus, the stock market looks set to sink right back into oversold trading conditions as economic concerns mount all over again.

The Stock Market Indices

The S&P 500 (SPY) jumped 1.8% as financials led the way higher. The automatic buying at and around the bear market line worked out one more time. Per plan, I promptly took profits on my SPY shares. I strongly suspect the S&P 500 will not hold on a third test of this obvious and clear line of support. The index now needs buyers to step into whatever SNAP-related weakness greets the stock market at tomorrow’s open. Overhead resistance awaits with a convergence from the downtrending 20-day moving average (DMA) (the dotted line below) and the May, 2021 low.

The NASDAQ (COMPQX) gained 1.6% yet failed to clear Friday’s intraday high. Still, the tech-laden index could have a date with overhead resistance before weakness returns. If Carter Braxton Worth’s technical observations hold, the NASDAQ (100) will lead a continuation of the bounce out of oversold conditions… or the S&P 500 will lead the way right back down.

The iShares Russell 2000 ETF (IWM) was relatively unexciting. The ETF of small caps gained 1.2% as it continues to churn under its downtrending 20DMA.

Stock Market Volatility

The volatility index (VIX) surprised last week with an inability to push to greater heights. The VIX surprised today with resilience in the face of a broad market rally. The VIX faded from earlier gains to close with a modest 3.2% loss.

The Short-Term Trading Call With A Dimon Push and A Snap Pull

- AT50 (MMFI) = 20.9% of stocks are trading above their respective 50-day moving averages (ending 3 days oversold)

- AT200 (MMTH) = 23.1% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: cautiously bullish

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, pushed out of oversold conditions with a close at 20.9%. I was expecting a stronger push, especially with Apple Inc (AAPL) playing catch-up. A 4.0% surge saved AAPL from a more convincing breakdown below its October, 2021 close. If AAPL manages to hold the momentum, it can join forces with the Jamie Dimon push to buttress the stock market.

Even with the prospects of oversold conditions starting up all over again, I am good leaving the short-term trading conditions at cautiously bullish. I remain much more interested in looking for excuses to buy for short-term trades than braving bear rallies to stick by a commitment to bet against a stock. This attitude will change on a rally into overhead resistance.

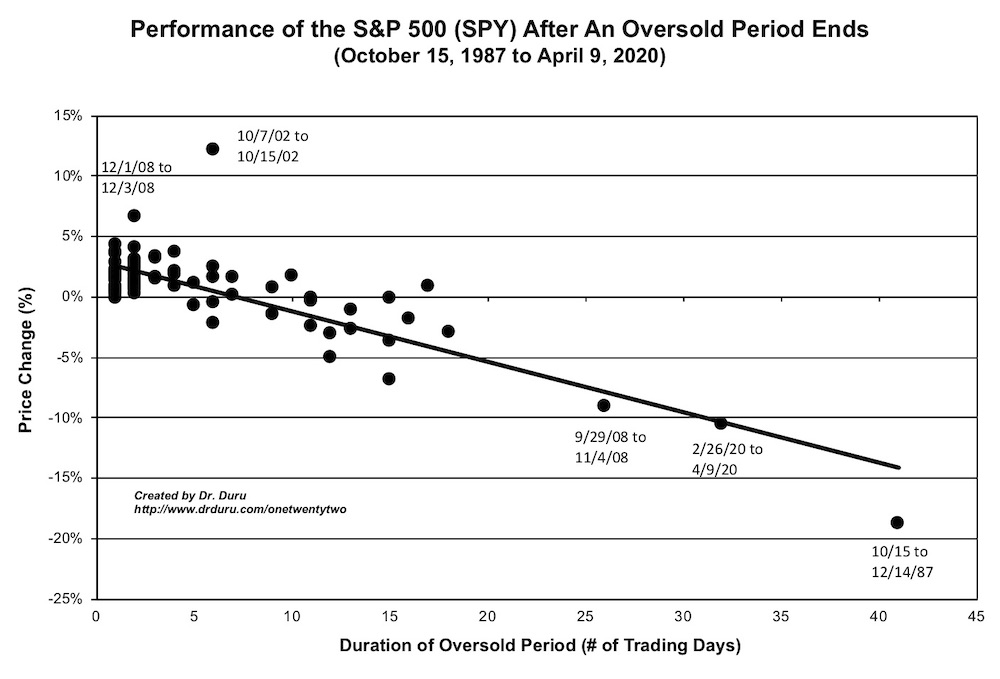

The S&P 500 gained 1.3% over the course of the 3-day oversold period. This performance is right below expectations per the chart below (note this chart was made with the former market breadth indicator AT40 (T2108)).

Be careful out there!

Footnotes

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #1 over 20% (first day over 20% ending 3 days oversold), Day #13 under 30%, Day #22 under 40%, Day #33 under 50%, Day #38 under 60%, Day #309 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long SPY call calendar spread, long QQQ calls

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, Twitter, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.