Stock Market Commentary:

The Federal Reserve released the minutes from its May policy meeting. While reporting on the minutes suggest the content contained nothing new, the stock market found rally material anyway. Perhaps it was a relief rally from the fallout in social media stocks. The broad-based buying pushed the stock market out of a one day long oversold period. Blink and you missed the latest oversold period. However, given the gyrations that typically follow Fed news, yet another oversold period is likely right around the corner.

The Stock Market Indices

The S&P 500 (SPY) followed the previous day’s buying off the intraday lows to notch a 1.0% gain. The index even closed at a new (marginal) high for the week. The band between the May, 2021 low and the bear market line is looking more and more like the latest churn zone for the S&P 500.

The NASDAQ (COMPQX) fell far short of its high for the week despite a 1.5% gain. The September, 2020 high is looking more and more like solid resistance.

The iShares Russell 2000 ETF (IWM) was stymied yet again by its downtrending 20-day moving average (DMA) (the dotted line below). The ETF of small caps gained 1.8%.

Stock Market Volatility

The volatility index (VIX) has traded with a downward bias this week with faders jumping in at the highs each day. While the VIX remains “elevated” above 20, this chart hardly has fear written all over it.

The Short-Term Trading Call After A Blink of An Oversold Period

- AT50 (MMFI) = 23.7% of stocks are trading above their respective 50-day moving averages (ending 1 day oversold)

- AT200 (MMTH) = 22.8% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: cautiously bullish

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, dropped into a marginal and 1-day oversold period. The previous day my favorite technical indicator closed at 19.7%. Today, AT50 jumped to 23.7% and brought a quick end to oversold conditions. It was a blink driven by strong buying off the lows (I found the buying a bit eerie given it occurred in the wake of news of the slaughter of children and teachers in Texas in yet another mass shooting in America). The noncommittal trading in and out of oversold conditions looks like a key characteristic of this phase of bear market trading.

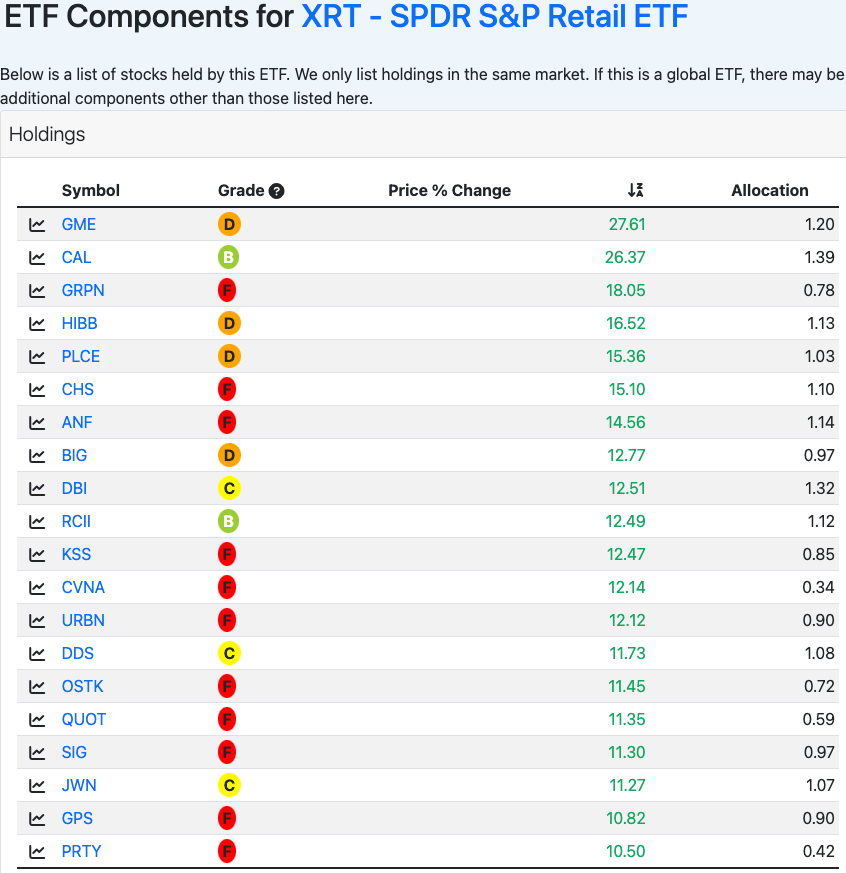

The indices hid the true excitement of the day: retail stocks. Retailers dragged the market down last week, but they were stars today. The SPDR S&P Retail ETF (XRT) rallied 6.9% on what looked like machines going wild. The best description is a snapshot of the double digit gains from the top 20 stocks in XRT. I used this opportunity to try a short as a small hedge on my bullish bias in short-term trading positions. Table from SwingTradeBot…

Be careful out there!

Footnotes

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #1 over 20% (first day over 20% ending 1 day oversold), Day #15 under 30%, Day #24 under 40%, Day #35 under 50%, Day #40 under 60%, Day #311 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long SPY call calendar spread, long QQQ calls

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, Twitter, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.