In a blunt and direct discussion, Bank of Canada (BoC) Governor Tiff Macklem made a compelling case for fighting inflation by declaring that “the economy has entered this period of excess demand with considerable momentum and high inflation, and we are committed to getting inflation back to target.” To do so, the BoC hiked its rate by 50 basis points to 1.0% (as expected). Macklem explained during the conference call that the BoC needs to normalize policy relatively quickly. The opening statement anchored the monetary policy narrative on three key points: 1) the economy is strong and is experiencing excess demand, 2) “inflation is too high…higher than we expected, and it’s going to be elevated for longer than we previously thought”, 3) “we need higher interest rates”. Senior Deputy Governor Carolyn Rogers reminded the audience that current rates are exceptionally low and stimulating the economy. This is the wrong policy for an inflationary economy experiencing excess demand.

The Bank of Canada opened Inflation University during its press conference.

The Case for Fighting Inflation

The Bank of Canada’s confidence in its policy direction comes from a position of economic strength:

“Job growth has been strong, the unemployment rate is at a record low, job vacancies are elevated, and wage growth has reached pre-pandemic levels. Businesses are also telling us they expect they’ll need to increase wages further to keep and attract workers.”

The BoC is using higher rates to moderate growth and realign demand with constrained supply. Moreover, The Bank of Canada is leaning into the psychological component of inflation. During the press conference, Macklem pointed out that the longer inflation remains above target (2%), the greater the risk Canadians will think higher inflation levels will persist. Specifically, “with inflation broadening and remaining higher for longer, the risk is that Canadians start to think that high inflation will become entrenched.” In other words, inflation is too high.

Just as the U.S. Federal Reserve noted, Macklem pointed out that inflation was already too high before Russia’s invasion of Ukraine. The war has worsened an already poor inflation outlook. Thus, the claim “we need higher interest rates.” By hiking rates, the BoC expects CPI inflation to hit the 2% target in 2024.

The Canadian Dollar

Interestingly, the Canadian dollar (USD/CAD) weakened going into this monetary policy announcement. The Loonie only “reluctantly” reversed following the announcement. A reporter in the conference call asked about the surprisingly low level of the Canadian dollar. Macklem acknowledged that the Canadian dollar is not as strong as expected given soaring commodity prices. However, he pointed out that oil producers expect lower prices in the future. These expectations could be constraining the Canadian dollar. Also, the yield curve in the U.S. has increased sharply in recent weeks. The yield differential supports the U.S. dollar over the Canadian dollar.

Housing Market

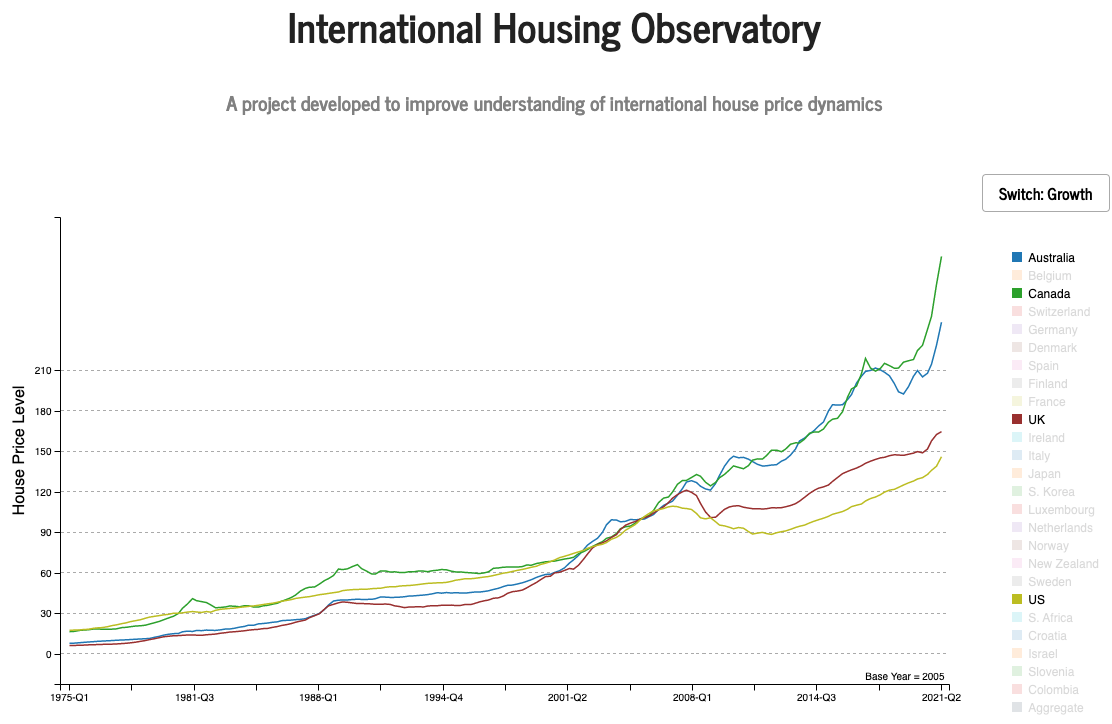

The Canadian housing market is in focus because prices have recently accelerated upward thanks largely to pandemic-era easy money.

The Bank of Canada sees the so-called soft landing ahead for housing. The Bank expects housing activity to moderate but remain at a high level. Rogers reassured the audience that moderating housing will not create a drag on the economy. Despite extremely high levels of indebtedness among Canadian households, she expects otherwise strong balance sheets and savings levels to provide a sufficient buffer against a rising rate environment. Still, the BoC is “monitoring” the situation. For many years now, the Bank of Canada has warned Canadians that low rates cannot persist. The test of preparation and resilience has arrived.

The Trade When Inflation Is Too High

I am currently short USD/CAD. The Canadian dollar has been in a tug-of-war with the U.S. dollar since late 2020. USD/CAD experienced a brief period of weakness from April to June, 2021. Outside of that dip, USD/CAD has been a range-bound trade. I do not expect much to change with both North American central banks racing against inflation. Inflation is too high in both countries, and both central banks are are activated now. The baton next goes to the U.S. Federal Reserve when it meets in May.

Be careful out there!

Full disclosure: short USD/CAD