Housing Market Intro and Summary

An aggressively hawkish Federal Reserve has changed the game for the housing market. After falling behind the curve and failing to start the rate hike cycle last year, America’s central bank is now desperately scrambling to catch up without causing a recession. The housing market is ground zero for the challenge. A historic injection of liquidity facilitated a startlingly fast recovery for the housing market even while pandemic lockdowns remained in effect. Prolonged accommodation helped set off a frenzy in the housing market. Even with prices soaring month after month, the Fed kept its foot on the pedal. The Fed only got inflation-fighting religion after severe supply constraints, labor shortages, and soaring materials costs became well-entrenched in the housing market and throughout the American economy. Going forward, the Fed will warily march forward under the shadow of recession fears.

Fortunately, an extremely strong labor market gives the Fed a chance to avoid a recession. Accordingly, there is also a chance the housing market will avoid a hard downturn. Sales should hit lower levels. Yet, the new price equilibrium with higher rates may be higher than might otherwise be expected. Higher price levels are here to stay absent an outright recession. The Fed does not even expect the inflation rate to come back down to its 2% target for another 3 years. In that time, all the supply and price issues besetting the housing market will persist. The demographic forces supporting demand should also persist even if some of it returns to pent-up demand. In other words, in many regions of the country, a high floor still exists on the housing market.

In my last Housing Market Review, I officially ended the seasonal trade on home builders. The Fed’s fight against inflation serves to confirm and validate that decision. The next question is whether the next seasonal trade will even present an attractive trade. The natural skepticism investors reserve for the cyclical housing industry should rise with rates. This dynamic will create a significant overhang on the prices of housing-related stocks. The Fed’s ability to march out of the shadow of recession will be a key for these trades. Regardless, as always, significant sell-offs in these stocks will deliver buying opportunities.

Housing Stocks

The prospects for higher rates weighs on housing-related stocks. While the S&P 500 (SPY) enjoys a healthy rebound from recent lows, the iShares Dow Jones US Home Construction Index Fund (ITB) struggles at 52-week lows.

Lennar Corporation (LEN) provided a brief spark of hope. After reporting earnings with a positive message on the housing market, investors rushed in to buy the stock. The “relief” rally lasted all of three days. The renewed buying power fell short of breaking through the downtrend represented by the 50-day moving average (DMA) (the red line below). LEN closed last week right at its closing low for the year.

With the lesson from LEN weighing freshly on memories, investors wasted no time in selling KB Home (KBH) post-earnings. KBH dropped to prices last seen at the beginning of 2021. Normally, I would look to start accumulating shares here. However, per my discussion in the intro, I see no rush to make moves.

Housing Data

New Residential Construction (Single-Family Housing Starts) – February, 2021

Builders managed to push single-family home starts higher than the previous month. However, starts are not likely to go higher for a while given supply constraints and the prospects for lower sales in the future (see the HMI below).

Starts increased 5.7% for a second month to 1,215,000. January’s starts were revised upward from 1,116,000 to 1,150,000. Starts were 13.7% above last year’s February starts and are still running at a healthy pace. For example, compare to the 1,200,000 level that preceded the 2001 recession. With builders looking ahead to the lower demand that will come from higher rates, I do not expect starts to increase materially from current levels. For now, normalization still looks like starts at the 1,000,000+ pace.

![Housing starts Source: US. Bureau of the Census, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], first retrieved from FRED, Federal Reserve Bank of St. Louis, January 29, 2022.](https://fred.stlouisfed.org/graph/fredgraph.png?g=Nsc4)

The West was the only region to increase year-over-year in January but the only region to decrease in February. Housing starts in the Northeast, Midwest, South, and West each changed +17.4%, +39.8%, +18.4%, and -5.1% respectively year-over-year.

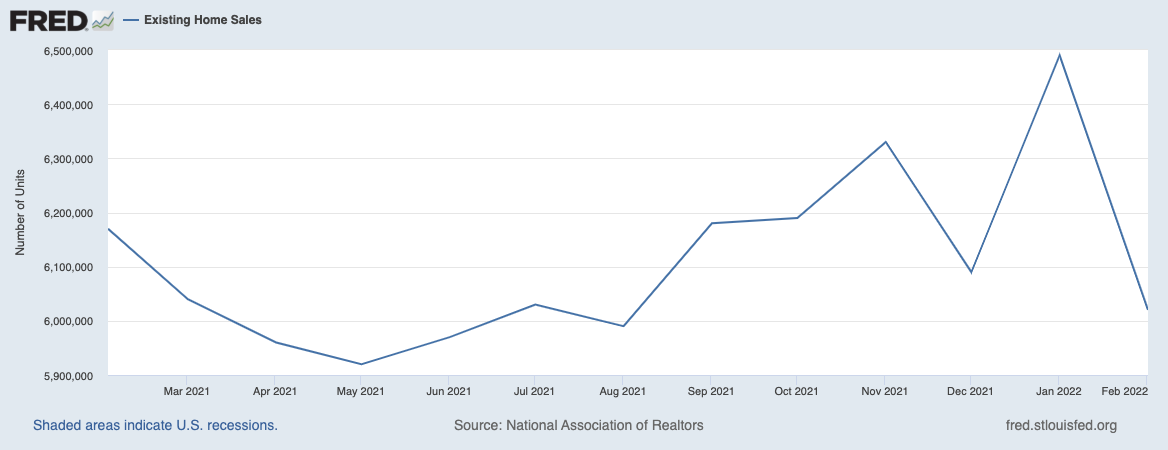

Existing Home Sales – February, 2021

Existing home sales surged in January only to plunge in February. As a result, the seasonally adjusted annualized sales in February of 6.02M decreased 7.2% month-over-month from the slightly downward revised 6.49M in existing sales for January. Year-over-year sales decreased 2.4%. From the year-over-year perspective, the jump in sales in November and January look like outliers in the middle of the normalization process.

For January, the National Association of Realtors (NAR) pointed to the prospects of higher mortgage rates as a driver of demand. Those buyers are surely breathing a sigh of relief given the subsequent sharp jump in mortgage rates. For February, higher rates dampened demand: “…rising rates and escalating prices have prevented many consumers from making a purchase. ‘The sharp jump in mortgage rates and increasing inflation is taking a heavy toll on consumers’ savings’.” I also suspect January’s surge pulled forward as much demand as limited inventory allowed.

(For historical data from 1999 to 2014, click here. For historical data from 2014 to 2018, click here) Source for chart: National Association of Realtors, Existing Home Sales© [EXHOSLUSM495S], retrieved from FRED, Federal Reserve Bank of St. Louis, March 27, 2022.

January’s absolute inventory level of 870K homes increased 2.4% from January, ending six consecutive month-over-month declines to all-time lows. Still, inventory dropped 15.5% year-over-year (compare to January’s 16.5%, December’s 14.2%, November’s 13.3%, October’s 12.0%, September’s 13.0%, August’s 13.4%, July’s 12.0%, June’s 18.8%, May’s 20.6%, and April’s 20.5% year-over-year declines, unrevised). “Unsold inventory sits at a 1.7-month supply at the current sales pace, up from the record-low supply in January of 1.6 months and down from 2.0 months in February 2021.” The on-going year-over-year decline in inventory is on a 33-month streak. Recall in January that the NAR noted inventory scarcity was worst below the $500K price level. Decreasing affordability will surely push more buyers toward the lower price ranges. Per the NAR, “monthly payments have risen by 28% from one year ago.”

The average 18 days it took to sell a home in February dropped by a day from the previous two months. In other words, market demand among those who can still afford a home is as strong as ever.

The median price of an existing home increased 2.1% from January at $357,300. Prices have increased year-over-year for 120 straight months, which is a fresh all-time record streak. Suddenly, the downtrend from June’s $362,900 all-time high looks like it could actually end soon. February’s price hike was a 15.0% year-over-year gain.

While affordability issues should hit first-time home buyers hardest, they actually increased their share from January. First-time home buyers increased to a 29% share of sales in February, up from 27% in January but down from 31% in February, 2021. The NAR’s 2017 Profile of Home Buyers and Sellers reported an average of 34% for 2017, 33% for 2018, 33% for 2019, 31% for 2020, and 34% for 2021. The gap between the current share and the prevailing annual average remains significant. Investors retreated with their share of sales dropping from 22% to 19%. Their share was 17% a year ago.

The South was the only region to gain in sales year-over-year. The regional year-over-year changes were: Northeast -12.7%, Midwest -1.5%, South +3.0%, West -8.3%.

For the fifth month in a row, the South’s median price soared year-over-year. In January, the NAR reflected on this strength in general terms. For February, the NAR specifically pointed to the employment picture: “Employment is vital for housing demand…The Southern states are seeing faster job growth, and consequently, it’s the only region to experience a sales gain from a year ago.” The combination of on-going price gains and sales gains speaks volumes for the relative popularity of the South. Inflation could even accelerate the divergence of the South from other regions. The regional year-over-year price gains were as follows: Northeast +7.1%, Midwest +7.5%, South +18.1%, West +7.1%.

Single-family home sales decreased 7.0% from January and declined on a yearly basis by 2.2%. The median price of $363,800 was up 15.5% year-over-year.

California Existing Home Sales – February, 2022

While overall sales of existing Californian homes continued to decline, the California Association of Realtors (C.A.R.) put an informative spin on the numbers: “While home sales declined from both the previous month and year, February’s sales pace was still the second highest sales level for a February in the last 10 years and strong relative to pre-pandemic levels of 2018 and 2019.” The positive interpretation makes sense given other indicators of relative strength. For example, it took 9 days at the median to sell an existing single-family home versus the 10 days a year ago. Moreover, the sales-price-to-list-price ratio increased year-over-year from 101.0% to 102.6%. California’s Unsold Inventory Index (UII) dropped slightly year-over-year from 2.1 to 2.0. Relative inventory is at its highest level in 3 months.

California’s existing homes sales decreased 4.5% month-over-month. For February, the C.A.R. reported 424,640 in existing single-family home sales. Sales decreased 8.2% year-over-year. C.A.R. noted that February, 2021 was abnormally strong. Seventy percent of California’s counties experienced year-over-year sales declines. The Central Valley was the only region that increased in sales year-over-year as lower-priced areas are regaining favor over the more expensive ones receiving favor at the depths of the pandemic.

At $771,270 the median price increased 0.7% from January. The median was up 10.3% year-over-year. The average $392 price per square foot surged from January’s $372 and is up 16.0% year-over-year. Home prices increased year-over-year in all 5 of California’s regions. Twenty-four counties set new price records.

New Residential Sales (Single-Family) – February, 2022

New home sales of 772,000 were down 2.0% from January’s 788,000 (significantly revised downward from 801,000 – making three of four months of large downward revisions). Sales were down 6.2% year-over-year. Note that February, 2021 came off a major peak in sales in January that marked the end of the pandemic-era buying frenzy. That January peak was a 14-year high and created at least two additional months of tough comparables.

![new home sales Source: US. Bureau of the Census, New One Family Houses Sold: United States [HSN1F], first retrieved from FRED, Federal Reserve Bank of St. Louis, February 3, 2022.](https://fred.stlouisfed.org/graph/fredgraph.png?g=Nt4Y)

At $400,600 the median home price fell sharply from January which in turn was a sharp rebound from from December’s mix-driven plunge. Indeed, a fresh shift in mix helped to drive prices down. The $200-$299K range soared from 10% to 18% of sales. No other price range gained in share. The all-time price high was set in October, 2021 at $427,300. I do not know what is causing the sharp shifts back and forth, but I have to assume that affordability issues will tend to favor the lower price ranges on an on-going basis. The chart below supports the view that median prices have topped out for now.

![new home median sales price Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development, Median Sales Price for New Houses Sold in the United States [MSPNHSUS], retrieved from FRED, Federal Reserve Bank of St. Louis; February 3, 2022.](https://fred.stlouisfed.org/graph/fredgraph.png?g=Nt6U)

The monthly inventory of new homes for sale increased from 6.1 to 6.3, a second straight increase that may still go higher given the relatively high level of housing starts ahead of the Spring selling season. The absolute inventory level of 407,000 delivered a seventh month of gains. The marketplace for new homes remains balanced.

The large mix of year-over-year swings in regional sales finally came to an end with February’s numbers. The Northeast was the only region to gain with a lift of 7.5%. The Midwest plunged 19.2%, a fifth straight month with a significant decline. The South ended three straight months of double digit declines with a drop of 3.0%. The West ended two straight months of gains with a 9.3% loss.

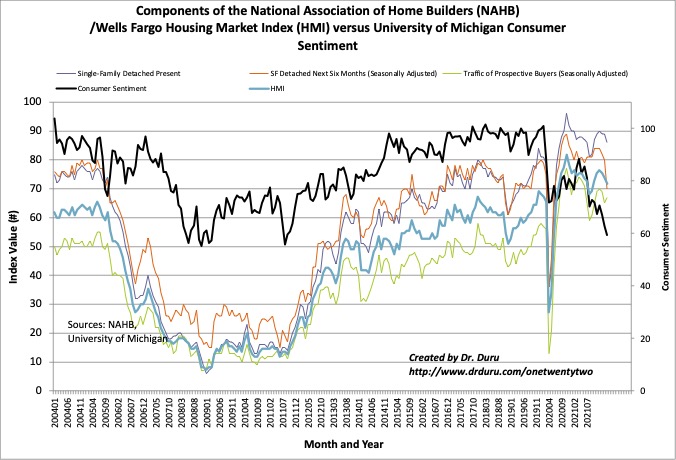

Home Builder Confidence: The Housing Market Index – March, 2022

The NAHB/Wells Fargo Housing Market Index (HMI) dropped two points to 79 from a downwardly revised February. Under the covers, the components once again tell a more interesting story. The Traffic of Prospective Buyers increased by 2 points which demonstrates the on-going strength in current demand. However, builders soured significantly on the future. The SF Detached Next Months plunged from 80 to 70 – its lowest level in almost two years. Even if buyers show up for the Spring selling season to get ahead of whatever additional rate increases are to come, it looks likely that a slowdown for new homes is on the horizon. The National Association of Home Builders (NAHB) duly noted:

“Builders are reporting growing concerns that increasing construction costs (up 20% over the last 12 months) and expected higher interest rates connected to tightening monetary policy will price prospective home buyers out of the market. While low existing inventory and favorable demographics are supporting demand, the impact of elevated inflation and expected higher interest rates suggests caution for the second half of 2022.”

For the first time, I am including the overall HMI in the HMI chart (see the thick blue/turquoise line).

Source for data: NAHB

Home builder sentiment has otherwise been incredibly resilient despite all sorts of pressures in the housing market. However, the on-going drag in consumer sentiment has to bleed into the housing market at some point. That point has finally arrived.

The regions were very divergent for a third straight month. Based on the changes, I suspect the builders are most pessimistic about future sales in the Northeast. The Northeast HMI plunged from 76 to 60. The Midwest managed to increase by 2 points. The South declined a second month, this time from 84 to 80. The West held steady at 91 after two straight months of gains, an extremely high reading persists. The Northeast was the main driver of the drop in the HMI.

Home closing thoughts

Soaring Mortgage Rates

Just last week, the 30-year fixed mortgage rate stunned observers by soaring from 4.0% to 4.95%. The chart below says it all. The 30-year mortgage is the top line. It accelerated to the upside and followed the trend of shorter-dated yields.

Mortgage rates were last this high in early 2019. While that time started a firm run in the housing market, this time housing prices are significantly higher. Affordability is worse than ever.

Unaffordable, Unattainable

The news show 60 Minutes got on the case of housing affordability with a look at the impact of corporate landlords. A couple in Jacksonville provided the central human side of the story. The couple lamented their fading dreams of someday buying a house. Soaring rental costs will impede their ability to save. They are marching forward in the shadow of a recession.

The corporate landlord interviewed in the story was clearly quite willing to talk about the industry. He confidently defended his company’s role in the economy as enabling households to rent homes (also refer to Upward America Venture: Lennar Tackles Housing Affordability Challenge). He showed the dramatic make-overs his company does.

Be careful out there!

Full disclosure: long ITB shares

1 thought on “Marching Under the Shadow of Recession Fears – Housing Market Review”