Last November, the South African rand (USD/ZAR) finished reversing its pandemic related losses against the U.S. dollar. Along the way I pointed out the benefits of getting long the South African rand. This week, USD/ZAR dropped to levels last seen in January, 2020. The rand looks to strengthen further based on the confidence expressed by South Africa’s Reserve Bank Governor Lesetja Kganyago in a recent Reuters interview.

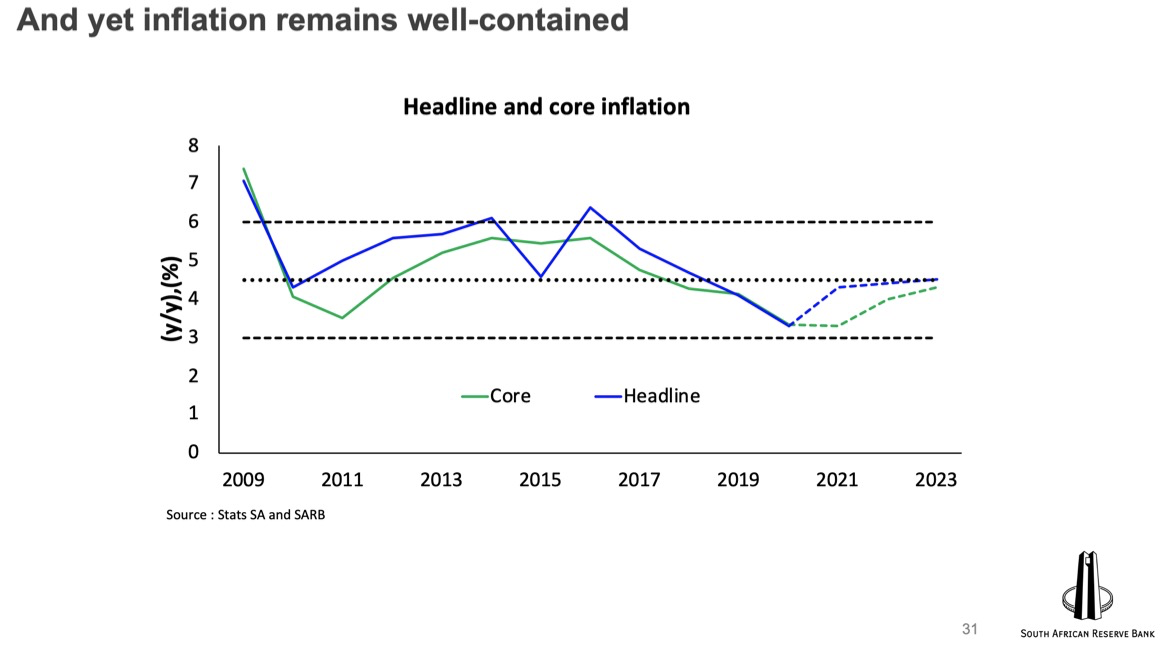

In the interview, Kganyago expressed confidence that investors will remain interested in buying high-yielding South African bonds even as monetary policies start to normalize (higher rates) around the globe. Moreover, South Africa enjoys a real rate advantage over other emerging market countries given South Africa’s success in containing inflation. Higher bond yields attract capital inflows and boost the domestic currency.

The following quote convinced me of Kganyago’s determination to contain inflation:

“High inflation perpetuates inequality..Those who are rich can buy assets to protect themselves from inflation, they can buy shares and bonds and property. But those who are earning fixed incomes, whether a salary or a government social grant … if inflation erodes it you have to wait for the next increase.”

The South African Monetary Policy Forum

The Reuters interview likely came after the Reserve Bank released its April report monetary policy (the “Monetary Policy Forum”): the commentary in the interview supported themes from the report. The report reflected Kyganyago’s confidence. For example, here are some of the Reserve Bank’s main points:

- Global recovery stronger on vaccination & stimulus

- Domestic recovery on track, some sectors constrained

- SA inflation well-contained… balanced risks

- Gradual normalization with low inflation

I was most impressed with the strength in South Africa’s terms of trade. The country’s terms of trade broke out in late 2019 and has trended sharply higher since then. The trend managed to to stay strong through the pandemic with a slowing in Q4 of 2020. This overall strength bodes well for the post-pandemic recovery in South Africa.

The Trade in the South African rand

The strong terms of trade particularly support a strong currency with surging commodity prices leading the way. Combining with a high yield, the South African rand is an attractive currency trade. I missed the last round of downward pressure on USD/ZAR, but I am on alert to fade the next bounce. Ideally, I can start a new position short USD/ZAR on another test of declining resistance at the 20-day moving average (DMA) and/or the 50DMA (the dotted and solid red lines respectively in the currency chart above).

Be careful out there!

Full disclosure: no positions