Taylor Morrison Home Corporation (TMHC)

Taylor Morrison Home Corporation (TMHC) is once again doing its best to prove wrong my skepticism over its acquisition of William Lyons Homes.

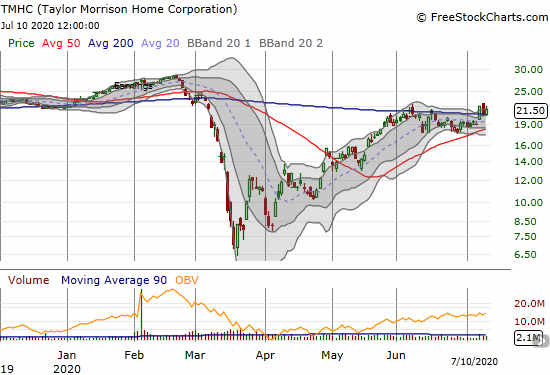

On July 8th, the company recorded strong sales performance as the housing market continues its swift recovery from the temporary economic shutdown forced by the COVID-19 (coronavirus) pandemic. TMHC soared 16.9% on the day and broke out above its 200-day moving average (DMA) for the second time in a month.

TMHC has yet to confirm the breakout as the stock pulled back the next day by 7.5% and closed right on top of its 200DMA. On Friday, TMHC gained 5.1%. A confirmation of the breakout comes with a close above Thursday’s intraday high of $22.61.

A confirmation is important because TMHC’s results were strong BUT the company did not specify how much of the gain was from the sizeable William Lyons acquisition. This acquisition had to make a notable impact on the overall numbers. Here are the performance highlights from the press release:

- June net sales orders: +94% year-over-year (the 1,715 homes were a monthly record for the company)

- Q2 net sales orders: +23% year-over-year

- June sales pace: 4.3, a monthly all-time high

- Q2 sales pace: 2.8

- Q2 closings: +24% year-over-year

- Q2 sales order backlog of homes under contract: +35% year-over-year

- Q2 value of backlog: +28% year-over-year

Taylor Morrison described the strength as broad-based: “The strength in performance was found across the company’s portfolio—which includes a broad geographic footprint within 22 top U.S. housing markets across eleven states—as well as across its varying price points and consumer groups.”

Since these results most likely incorporate the newly added business from William Lyons, then the sales pace numbers are the best way to normalize TMHC’s sales performance. Taylor Morrison reported impressive numbers, but an earnings per share number and growth rate will be more indicative of underlying performance – even better if Taylor Morrison breaks out the numbers in its next earnings report (I will look to analysts to force the issue if the company does not provide the splits in its earnings report).

The iShares U.S. Home Construction ETF (ITB)

As the U.S.’s 5th largest builder, Taylor Morrison strength translates into more optimism for the entire home builder sector. The iShares U.S. Home Construction ETF (ITB) gained 3.6% in sympathy with TMHC’s breakout. However, ITB gave up nearly the entire gain the next day. Overall, ITB continues to struggle against the resistance formed by the 2020 breakout. Not even last month’s continued rebound in the Housing Market Index (HMI) pushed ITB through this barrier.

All this hesitation makes me wary when combined with the current bearish divergence in the stock market. Is the housing recovery reaching its plateau? Has the market absorbed all the pent-up demand from the economic shutdown? Will new buyers continue to arrive with high unemployment rates in the economy? Stay tuned…!

Be careful out there!

Full disclosure: long ITB