On June 25th, call options in sportings goods retailer Hibbett Sports (HIBB) sprang to life. At the time, around 1500 October $22.50 calls traded versus 0 open interest. On June 29th, open interest climbed above 2500. For context, HIBB options are sparsely traded. The second highest open interest sits with the Jan 15 ’21 calls at 2000 calls. The third highest count is 843 with the July 20 calls. The open interest in August call AND put options totals 19.

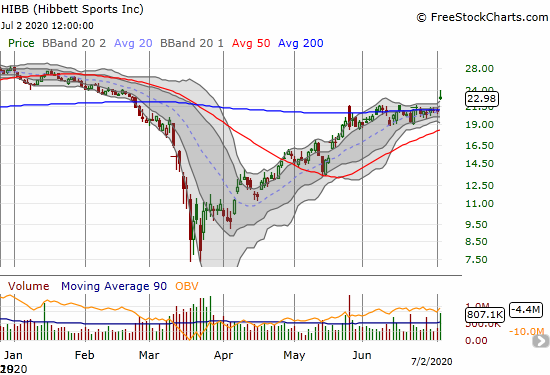

During the time of accumulation in the October $22.50 calls, HIBB was stuck in a 1-month trading range that started with its earnings report on May 26th. The closing price on that day carved out the bottom of the trading range. For a month afterward, HIBB pivoted around its 200-day moving average (DMA).

On July 2nd, an analyst upgrade provided HIBB a breakthrough. The stock surged 10.6% and delivered a clean breakout above and away from its 200DMA pivot.

Source: FreeStockCharts

The anatomy of this breakout consists of call option accumulation supporting a bullish thesis combined with a high-volume bout of buying that sent price well above a solid consolidation phase. The stock looks like it is well-supported by investors.

The fresh momentum is also supported by the bullish note from a Bank of America analyst. The analyst delivered a decisive upgrade from underperform and a $10 price target to buy and a $30 price target. According to Benzinga, the analyst cited strength in Hibbett Sports’ omnichannel sales as a catalyst fr the upgrade. Digital sales are of course extremely important in this period of a coronavirus pandemic and associated changes in consumer behavior and access to stores.

The Trade

I see at least two potential trades here.

- The simplest trade is just to buy the stock and ride it toward or to the $30 price target. The stop loss point is below the 50DMA which is currently at $18.28. A move this low could even be bearish given it would break below the recent price consolidation and confirm a repudiation of the bullish analyst call.

- A more conservative, yet bullish, trade is a covered call position: sell short a call for each 100 shares purchased. The October $22.50 calls look like a perfect target given they seem to have the most liquidity. The $4.19 closing price locks in 56% of the presumed upside from the analyst call and delivers significant price protection all the way to the 50DMA. A stop loss can be executed at a lower price. This position is profitable even if the stock goes nowhere for the next three and a half months to the October expiration.

I personally prefer the covered call option. While breakouts are bullish buying opportunities, I think the go-forward price action is subject to a lot of churn with the stock market and individual stocks like HIBB already so far above the March lows.

Be careful out there!

Full disclosure: no positions