When a financial market gets expensive, traders and investors start broadening their search for low-price opportunities. As an overbought U.S. stock market hits the late stages of an impressive rebound from March’s crash, its stock market looks expensive. Meanwhile, “emerging market” currencies like the Turkish lira, South African rand, and the Mexican have barely started a recovery from the crash in global financial markets. These currencies are finally emerging from massive sell-offs that started in March and may have finally ended this month with nearly synchronized tests and breaks of key support levels.

Suddenly, these emerging currencies, and their constituent financial markets, look cheap relative to markets which are fully pricing in an imminent economic recovery. By comparison, investors and traders are still clinging to the idea that the economies in countries like Turkey, South Africa, and Mexico face very dire prospects. As sentiment turns around, a lot of room exists for recovery in currency values.

Global central banks have taken historic steps to underwrite the response to the coronavirus pandemic and are encouraging risk-taking on a grand scale. The Turkish lira, the South African rand, and the Mexican peso each look like prime candidates to sop up some central bank largesse.

Turkish Lira

A little over two weeks ago, the Turkish lira looked like it was about to suffer another hyperbolic price move similar to 2018.

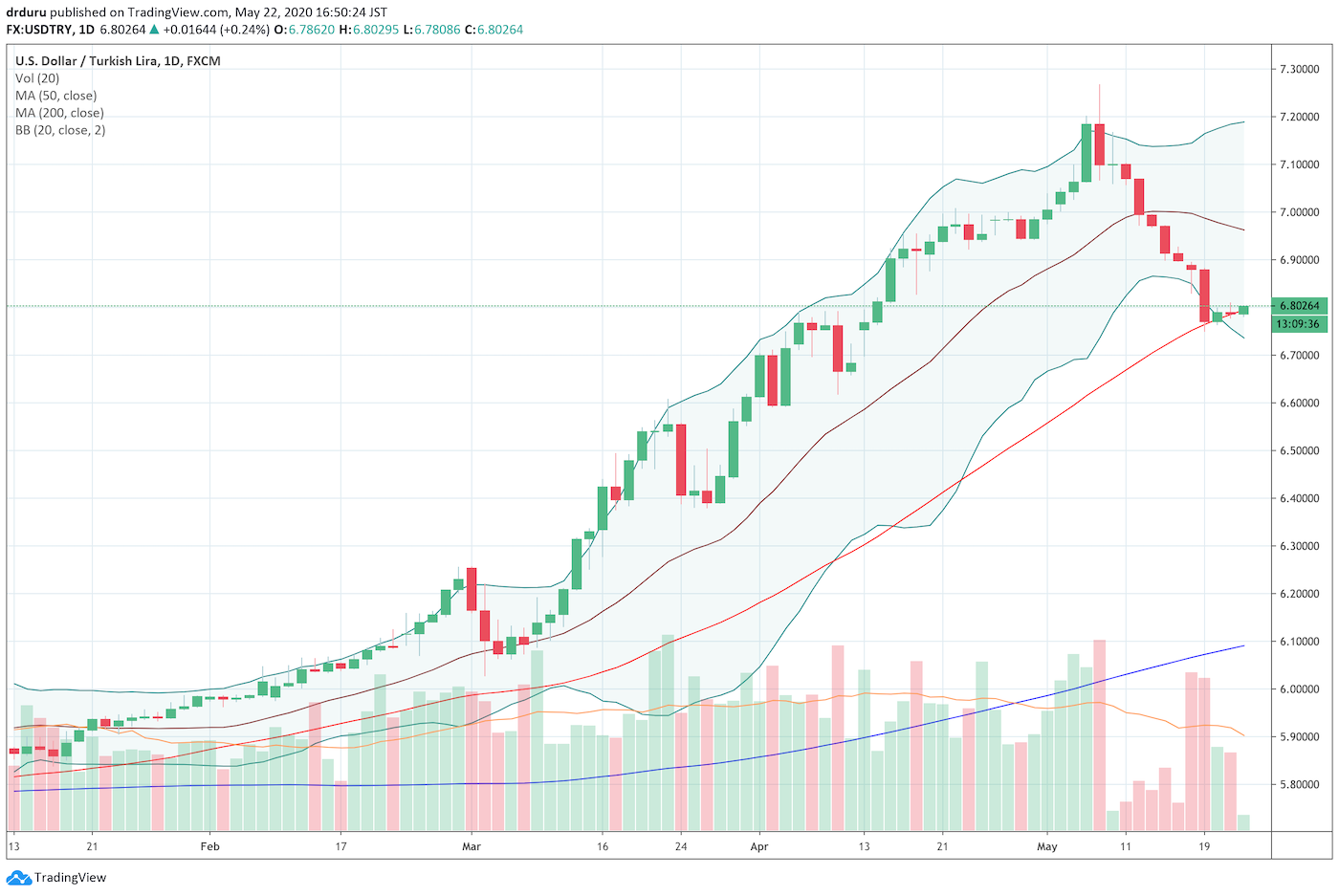

USD/TRY, the U.S. dollar versus the Turkish lira, hit a new all-time high on May 6/7th. On the daily chart, USD/TRY surged above its upper Bollinger Band (BB) before sellers stepped in and pressed the currency pair all the way back to its 50-day moving average (DMA). Central bank action was likely at work trying to support the Turkish lira. At the time of writing, USD/TRY is still resting on that key support line as if it is waiting for permission for its next move.

Source: TradingView.com

There is some good economic news to support the Turkish lira. Going into the coronavirus pandemic, inflation in Turkey was well off its painful highs from 2018. Inflation even looks like it stabilized through April of this year.

Indeed, this stabilized inflation allowed the CBRT to cut interest rates again. In its statement on monetary policy, the CBRT observed:

“Developments in inflation expectations and domestic demand conditions have contributed to a mild trend in core inflation indicators. Despite the recent depreciation in the Turkish lira due to global developments, international commodity prices, especially crude oil and metal prices, affect inflation outlook favorably. While the rise in unit costs resulting from declining production and sales is closely monitored, the disinflationary effects of aggregate demand conditions are estimated to have increased. Although consumer inflation might follow a slightly higher course in the short-term due to seasonal and pandemic-related effects on food prices, demand-driven disinflationary effects will be more prevalent in the second half of the year.”

Accordingly, the CBRT justified a cut to its policy rate. The Turkish lira has so far not responded to the move.

In the meantime, I am watching for the Turkish lira’s next move, and I plan to trade in that direction. I am currently short EUR/TRY with a small hedge long USD/TRY. The long USD/TRY seemed particularly opportune with the big test of 50DMA support. I want to keep holding EUR/TRY if possible to continue collecting the attractive carry.

South African Rand

I have written in the past about the South African rand in purely technical terms. Once again, the technicals loom large as the South African rand seems to be strengthening after churning against the U.S. dollar for almost two months. This week, USD/ZAR finally sliced through 50DMA support. As technicians like to say, USD/ZAR looks “heavy.” The developing topping pattern makes the chart look like it is tipping over.

USD/ZAR is also a good play for a rebound in commodities. Easy money policies around the globe should eventually support a new rally on commodities that will soak up some fresh liquidity sloshing around the globe.

Source: TradingView.com

Mexican Peso

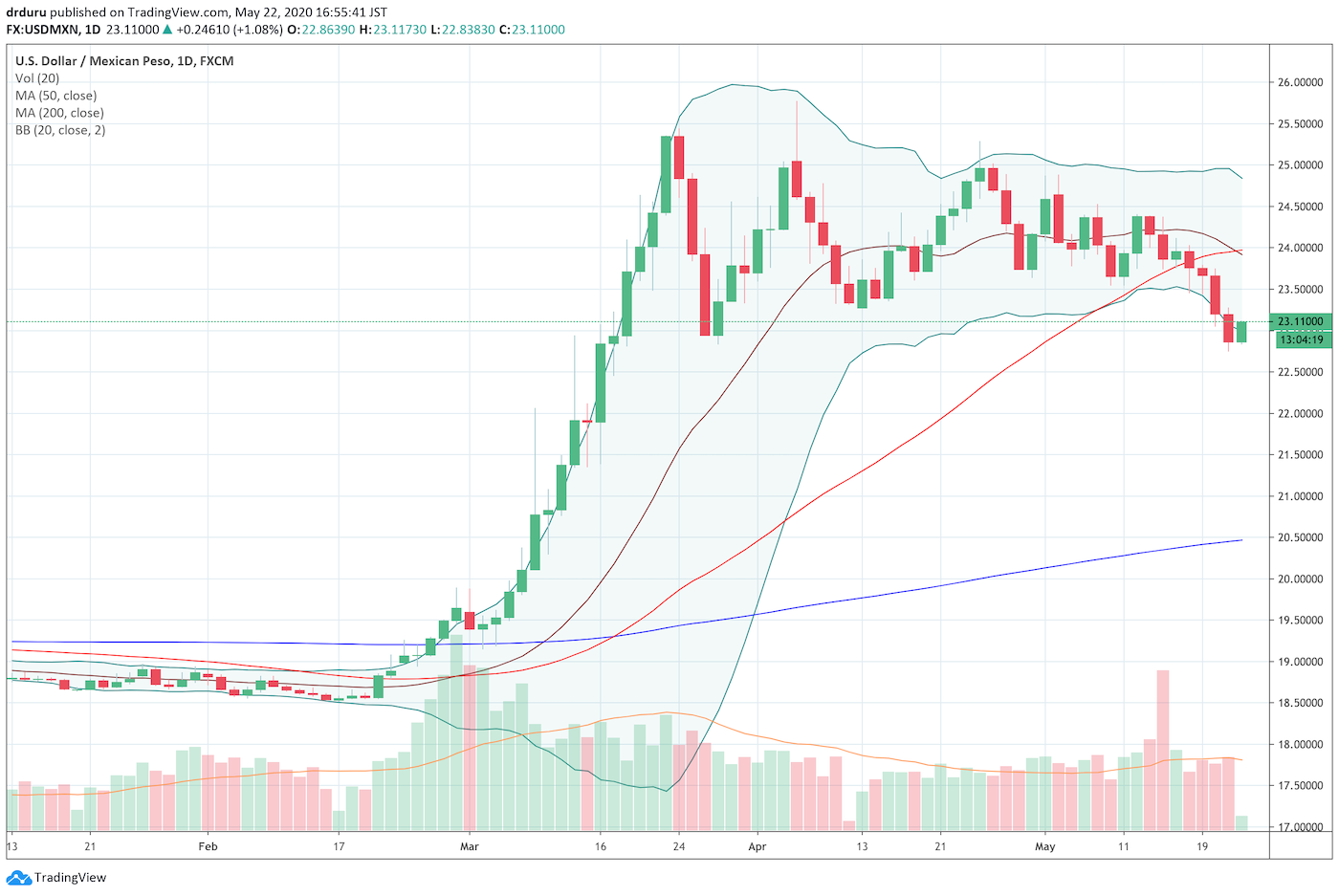

I have also written about the Mexican peso mostly from the technical side. Like USD/ZAR, USD/MXN looks heavy. Against the U.S. dollar, the Mexican peso sliced through 50DMA support. This milestone occurred last week. Now USD/MXN is challenging a key support level from March. After the crash in financial markets pushed USD/MXN to a fresh post-recession high, sellers stepped in for three days to usher in a two-month stabilization period.

Source: TradingView.com

The recent rebound in oil also supports the Mexican peso’s strengthening. I called one more bottom in oil prices earlier this week. I took profits early on my call options in the United States Oil Fund (USO) because it went nearly parabolic in today’s trading.

Summary

All three currency pairs have similar charts. Against the U.S. dollar, the Turkish lira, South African rand, and the Mexican peso experienced near relentless weakness in March. While the Turkish lira continued to weaken into May, the South African rand and the Mexican peso finally topped out in their U.S. currency pairs in April. Now, 50DMA support lines are critical thresholds for each of these currencies. My trades are focused on how these 50DMAs hold up as sources of support and resistance.

Be careful out there!

Full disclosure: short EUR/TRY, long USD/TRY, short USD/MXN, short USD/ZAR