“Despite the challenging environment we encountered at the end of the first quarter, our business was stronger in April than we had originally expected and we are seeing positive momentum in recent sales trends that leads us to believe the impact from the COVID-19 pandemic may be less severe than we had originally expected. We are building, selling and closing homes across the nation every day and our customers are telling us that they are more ready than ever to move out of densely populated living situations and into homes that offer more space and privacy. As a result, our outlook for the coming months is tempered, but positive.”

LGI Homes Q1 2020 Earnings Report, May 5, 2020

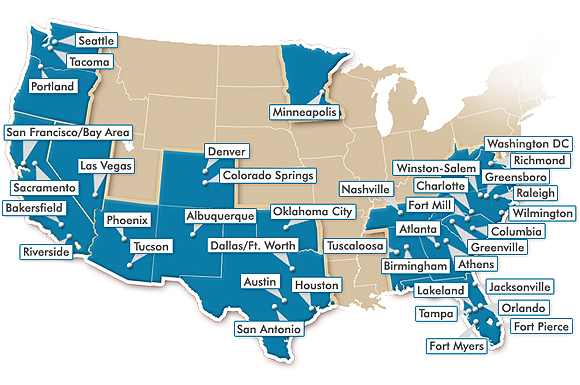

The above quote from the first quarter earnings report for LGI Homes (LGIH) sums up well a bundle of surprisingly good news. Not only is housing market activity showing more resilience than expected, but also consumer behaviors may be shifting in favor of suburban builders like LGI Homes. The news from builders has trended upward over the last several weeks, and the news from LGI Homes is the best yet. The news is quite a turn-around from just over a month ago when LGI appeared to confirm a significant housing downturn by closing at a 3-year low.

Strong guidance

LGIH had another strong first quarter summarized by year-over-year gains of 133.7% for net income, a 58.1% in home sales revenue, and a jump of 49.4% in home closings. Given most of this performance occurred before the coronavirus pandemic exacted its toll, they are not so useful in understanding performance in the coming months. While, LGI Homes pulled guidance for the full year, the company still provided guidance for the current second quarter. All things considered, the short-term expectations are very impressive and very encouraging. During the earnings call, LGIH provided the following key points of guidance (reference the Seeking Alpha transcript):

- Close 500 to 600 homes in May (compare to 681 home closings in May, 2019).

- Q2 Average sales price (ASP) from $230,000 to $240,000 (compare to $237,567 ASP in Q2 2019 and $240,815 in Q4 2019). The company explained that guidance is lower than the $247,808 ASP from the first quarter because of changes in sales mix.

- Gross margins and adjusted gross margins “similar” to the 23.4% and 25.5% respectively from the first quarter. Q1 margins were up 30 and 40 basis points year-over-year.

- Increased employee count (no furloughs or layoffs)

In other words, the Q2 guidance suggests the company has a good chance of moving forward with a healthy business. The guidance is so different from much of the news from other companies across industries, especially given the plans to grow the company. These results make LGIH a stand-out builder and a coveted stock to buy on the dips.

Strong demand

I was astonished to read that LGIH is sticking to its 100% spec business model. Specs are homes built ahead of orders. The willingness to create housing inventory ahead of demand is a sign of bullish expectations. I assumed this recession would force builders to quickly retreat from what had been increasing spec building to keep up with strong market demand. Granted, LGIH will build fewer specs than originally planned, but sticking by the 100% spec model means LGIH is also standing by the health of its markets and its business. LGI Homes is not even offering greater incentives to its buyers because demand is relatively strong. Supply remains tight.

LGI Homes reported a 35% year-over-year drop in sales in April but this aggregate number hides strong undercurrents. The company broke down activity within the past 5 6 weeks and painted a very encouraging picture:

The first two weeks of April were softer than the last two weeks of April. And then the first week of May was the best week this past weekend, the best week since we’ve had — since the beginning of March. So like other builders have said, we are seeing positive trends and seeing more people come out to our offices as the stay-at-home orders have been limited [lifted?].

LGIH also released its monthly sales report for April. Closings were roughly comparable to April, 2019 with the company closing 605 homes this April versus last year’s April with 612 homes. This number is down from the 795 homes closed in March, 2020.

Source: LGI Homes

Balance Sheet Strength

LGI Homes took rapid action in the face of the coronavirus pandemic. For example, the company cut advertising by 30% year-over-year in Q1. The company cited “optimized performance in advertising campaigns, increased demand and our ability to respond to a rapidly changing environment” as enablers for cutting advertising.

Other actions to strengthen the balance sheet included:

- Closing out existing order flow and constraining new housing starts (remember that these starts are 100% spec)

- Cuts in marketing

- Suspension of new land acquisitions and postponing almost all existing land acquisitions into the future

All these actions mean that future revenues and earnings will necessarily be lower year-over-year for at least the next 2 to 3 quarters no matter what happens with housing demand.

LGIH actually paid down $50M on its credit facility in April. Cash on hand sits at $120M and existing borrowing capacity is about $137M. This combined liquidity is 34% of outstanding debt of $753M. The company extended the maturity for an existing $520M from 2022 to 2023. LGIH has a lot of balance sheet runway to meet the challenges of the current economic environment.

Buyback

LGI Homes’ execution of its buyback program is the icing on top of its stellar management through the downturn in housing. In Q1, the company spent $31.3M on 567,000 shares for an average price of $55/share. LGI Homes started buying at the end of February and got the real bargains buying in late March when other companies were too scared or otherwise unable to load up on the firesales in their shares.

The Trade

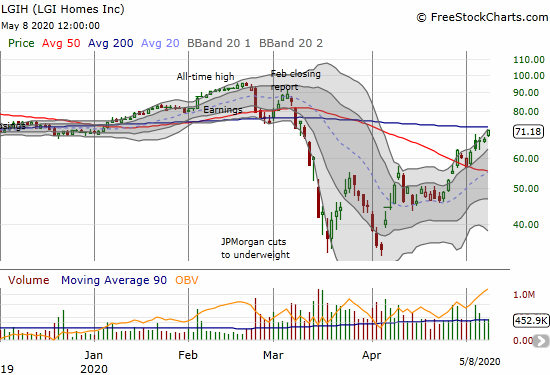

Like LGIH, I was in the market buying shares during the market crash. However, I took profits last month. The stock bullishly confirmed a breakout above its 50-day moving average (DMA) last week and is now challenging resistance overhead from its 200DMA (blue line in the chart below). The stock has now reversed all its losses from March’s confirmation of the 50/200DMA breakdown. Given LGIH will not likely return to February performance levels for many more months, I cannot chase the stock higher on a 200DMA breakout. However. I do want to buy the stock on a dip back to 50DMA support and/or April’s consolidation period right above the 20DMA (dashed line in the chart below).

Source: FreeStockCharts

Be careful out there!

Full disclosure: no positions