This post is essentially an addendum to “Resilience Cracks: Market’s Bearish Divergence Ends In Topping Pattern.”

Financials in the form of the SPDRS Select Sector Financial ETF (XLF) finally achieved an all-time high last month. XLF jumped on December 12, 2019 and trickled higher to the all-time high from there. Since that point, XLF has failed to make any progress and has instead pivoted around the former all-time high. Friday’s 1.3% loss not only closed XLF marginally below its 50-day moving average (DMA), but also the loss effectively reversed the small breakout from last month.

Source: FreeStockCharts

I consider this the “moment of truth” for financials in the same way home builders faced a moment of truth after stalling at the January, 2018 climactic high. If XLF fails, it could easily fall back to the December low and eventually retest its upward trending 200DMA. If XLF closes above the current churn, I want to load up on call options to ride what should then be fresh upside momentum.

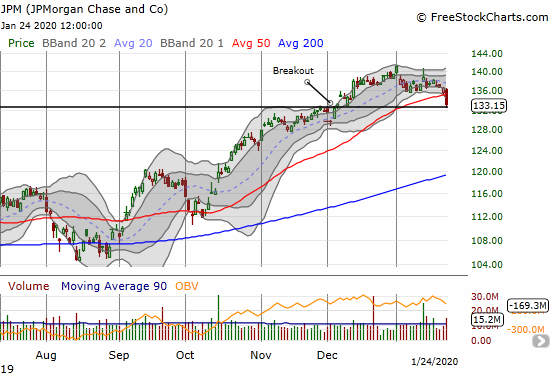

JP Morgan Chase (JPM) is a major component of XLF, and the stock is providing a large anchor on the ETF. JPM lost 2.5% on Friday on high selling volume. JPM closed well below its 50DMA and completely reversed its December breakout. JPM should be a key tell for the short-term health of financials.

Be careful out there!

Full disclosure: no positions

What is your down side target and entry point for JPM?

Well it would have been nice to buy today at $130! However, $127.50 looks like a better risk/reward point to start accumulating JPM shares given that was a period of consolidation that launched the breakout. After that, $120-121 is the second range and even more firm as it should meet with 200DMA support and the start of the really big breakout in October.