The Selling

It turns out investors and traders care a lot more about an analyst downgrade than insider selling right under the all-time high….at least when it comes to Roku (ROKU).

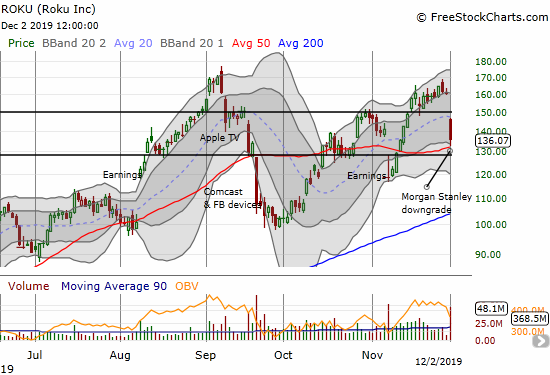

Source: FreeStockCharts

Morgan Stanley issued a downgrade of Roku from equal-weight to under-weight (aka SELL!) just as the stock market happened to be in one of those now rare selling moods – the NASDAQ lost 1.1% and the volatility index (VIX) soared 18.2%.

That selling mood likely helped grease the skids for the stampede out of ROKU. The stock lost 15.2% after the dust settled. Sellers only paused long enough to allow a bounce from the 50-day moving average (DMA).

The Downgrade

Sellers did NOT pause to consider the context of this downgrade. Firstly and ironically, Morgan Stanley increased its price target from $100 to $110 (according to Briefing.com). In other words, the buyers were perfectly happy accumulating stock while Morgan Stanley had a lower price target. Even if Morgan reduced a price target from $110 to $100, the move would not be material relative to the market’s willingness to ignore the bearishness of the analyst call. Secondly, Morgan Stanley did not appear to offer anything the market does not already know: ROKU has a high valuation along with slowing revenue and margin growth (aka competition). ROKU’s huge sell-off in September was mainly about competitive fears.

To me, today’s selling had more to do with technicals igniting with a poor sentiment day; the downgrade was a convenient excuse to push the process into high gear. ROKU returned to the presumed bear/bull band that I drew in early November and dampens my inclination to buy into the market’s angst over a downgrade with an improved price target and no new information. Moreover, today’s sharp sell-off likely confirms the top that I suspected insiders feared almost two weeks ago. As a result, I am very doubtful ROKU will break out above the band anytime soon.

The (New) Trade

The market’s mercurial interpretation of ROKU’s worth has generated large trading opportunities. This latest shift in sentiment would have created a fresh buying opportunity except for the points of caution I mentioned above. From here, I will strictly wait for a trade to play a breakout above (bullish) or below (bearish) the band.

My slow adjustment to a bullish trade during November’s run-up turned out beneficial in the wake of the Morgan Stanley downgrade. The experience also reminded me of the value of hedged positions in volatile, speculative stocks. Most of my call options converted to profits as ROKU continued to drift higher into the end of November’s trading. Last week left me with my short position and one last call spread (Dec $170/$180). After ROKU cracked the $140 level I earlier assumed was support, I took profits on the short position.

Be careful out there!

Full disclosure: long ROKU call spread