Last week, I made a bullish case for trading ahead of earnings for Apple (AAPL). My calendar call spread hit its initial profit target and left behind the put spread and a search for a new strategy. Last Friday, CNBC Options Action presented its own bullish case for Apple’s earnings, but I did not like the proposal to buy a call option outright.

My assessment of AAPL’s earnings trading history suggests options are well-priced to over-priced, so I am more inclined to make my bullish trade by selling some premium back to the market. I prefer an August $210/$215 call spread or a new calendar call spread at the $215 strike (August 2 / August 16).

Since 2007, AAPL has delivered 50 earnings reports and 22 since 2014. Since 2007, AAPL generated +/- 4.5% one-day post-earnings moves 25 times (50%) and 12 times (55%) since 2014. AAPL closed today at $209.80, and the options market has priced in a +/- 4.3% move at the end of this week. The frequency perspective makes the options look well-priced. The median or average perspective, where the median move is about +/- 2.7% and the average move is about +/-1.1%, makes the options look expensive using a balance of risk/reward.

The multi-day average price changes are on-track to support a bullish trade. The 6-day average price change for AAPL is 0.6%, and the 13-day average price change for AAPL is 0.3%. It will take a deeply negative day on Tuesday to reverse the direction of those averages: -3.4% sends the 7-day average to 0% and -3.2% sends the 14-day average to 0%. So, assuming AAPL is headed for a positive average for both the 7-day and 14-day price change averages, I will defer to the more consistent 14-day positive correlation and go long.

Tuesday’s performance is even more important for the 1-day correlation. Per the historical pattern, AAPL has an inverse correlation to the close just ahead of earnings. So if AAPL is headed for a gain, say at least 0.5% which should be above “noise” level, then I will likely avoid making an additional trade on earnings.

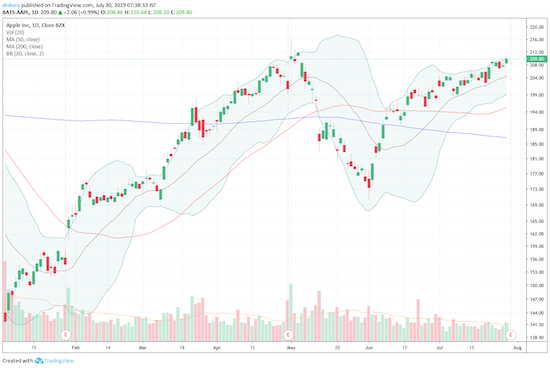

Source: TradingView.com

Be careful out there!

Full disclosure: long AAPL put spread

Addendum – if not for my AAPL put spread hedge, I would have been fine just selling a 195/190 or 200/195 put spread short as the complete play on earnings. At the time of the hedge, I was thinking through worst case scenarios. NOW, I am not so concerned about the worst case scenario. Let’s see what happens next…!

One more addendum: CNBC reported on a big bearish bet in the options market and suddenly they are quoting several pundits who are cautious to bearish on AAPL earnings! https://www.cnbc.com/2019/07/30/mystery-trader-bets-apple-could-fall-8percent-on-earnings.html