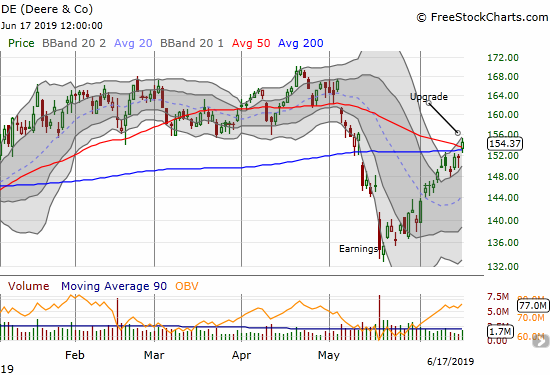

Analyst action can quickly flip a stock and change its prospects. Such a move happened to Deere & Company (DE) as Baird moved from neutral to outperform and upped its price target from $129/share to $175/share on the stock. I previously flagged DE as a bearish stock given its week-long inability to break through overhead resistance. Baird’s big upgrade flipped DE from bearish to bullish as the stock responded to the upgrade with a breakout above converged resistance.

Source: FreeStockCharts

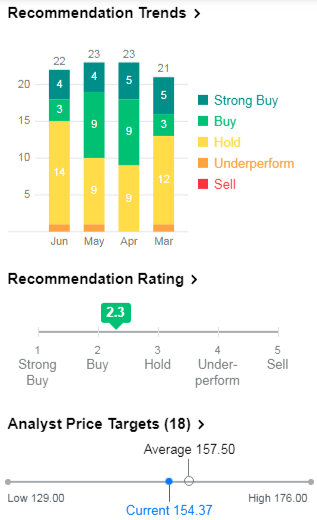

Baird reignited a rally that has been underway since the stock broke down post-earnings. Baird’s move puts the pressure on other analysts to catch up. DE avoided Baird’s original $129 target at the post-earnings low, so other bearish analysts are likely feeling left behind as well.

Source: Yahoo Finance

Even with so many bearish analysts, the price target average is still above the current price. Two main things can happen as a stock rallies to a price target: 1) bullish analysts downgrade as they find the stock fully valued, 2) and/or bearish analysts rush to catch up with market sentiment. Assuming the latter given Baird’s move, I moved quickly on the upgrade by buying a July $160 call option with plans to accumulate at lower prices if they happen over the next week or so. The call options gets me a stake in the game with low risk versus a lot of potential upside if momentum continues in Baird’s favor.

Be careful out there!

Full disclosure: long DE call option