Tears In May

Three weeks ago, I wrote about my skepticism about the strength of the British pound (FXB) in the wake of a resounding political defeat for the Conservatives. Brexit-related moves in the pound have proven fleeting and this time was no different. The pound peaked right after that post, but the persistent nature of the subsequent weakness surprised me. The pound sold off for three weeks going right into the dramatic resignation of United Kingdom (UK) Prime Minister Theresa May. The speech ended in tears as May struggled to establish her legacy beyond her Brexit failures.

The tears made complete sense. Theresa May took on the job of Prime Minister to face an impossible situation. Her time at the top was nearly three years of futility trying to get the UK and the European Union to an agreement over Brexit. The situation proved intractable as the politics of the UK were not up to the task. Even May’s resignation is hardly a solution. Yet, it may provide just enough hope to spur a relief rally in the British pound. To the extent the market believes May’s resignation is the beginning of an eventual solution, the British pound should regain a positive bias. Predictably, the British pound rallied after May’s resignation.

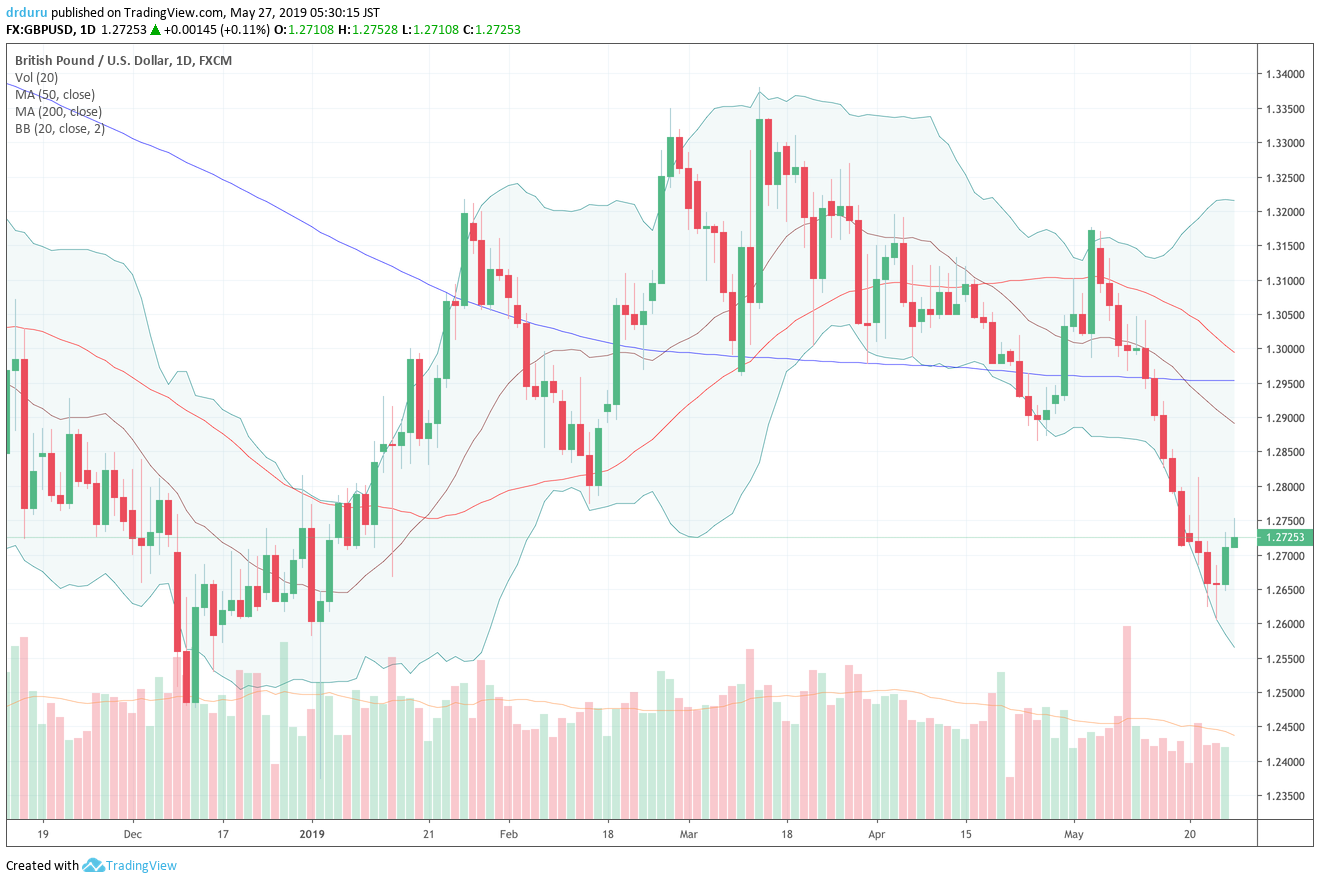

Source: TradingView

The technical picture above is a bit mixed. I can make the case for GBP/USD bouncing to its downtrending 20-day moving average (DMA) where double-resistance including last month’s low should stop the relief rally. A similar bounce could be in store for GBP/JPY. However, the runway for a pullback in EUR/GBP looks very short given the presumed support available from its nearby 200DMA. Note EUR/GBP already broke through and then bounced back from its 200DMA on Friday.

For now, I am sticking with a relief rally thesis; I am prepared to take further pain in my short EUR/GBP. I used May’s resignation as the opportunity take profits on my short GBP/JPY (a large position I accumulated for most of 2019 to-date as part of my overall bearishness on the currency pair) and re-established a very small short on Friday. I accumulated bullish positions on the pound during the slides in GBP/USD and the soaring EUR/GBP. Per the typical volatility, I expected to take profits on these positions much earlier, especially beforr closing out my GBP/JPY short.

Organized Chaos

The weekly charts show the enduring impact of the Brexit vote. In both weekly charts below I drew horizontal lines showing the pound’s approximate closing price the day the Brexit results were announced. GBP/USD bounced above this line for about 4 months before descending below the line for good. This move looks like a kind of double-top.

EUR/GBP, which is a clearer lens for assessing the pound, shows how the post-Brexit close has served as a firm floor on the currency pair for almost three years. That line creates organization out of the post-Brexit chaos. The line was last tested in early 2017. The 2019 breakdown from the higher trading range looked like it could lead to an overdue retest of the post-Brexit floor.

Brexit Wildcard

I am claiming that May’s resignation will usher in the typical relief rally as all the negatives associated with May’s Brexit failures are fully priced into the market. Yet, a wildcard exists in the selection of the next Prime Minister. If this person is someone like Boris Johnson who supposedly supports a hard Brexit with no deal with the EU, then the tables could quickly turn against the British pound. In this scenario, the market would have to price in a whole new set of negatives. Perhaps the Bank of England (BoE) even becomes compelled to take out another “insurance” rate cut. I will be watching the UK political winds a little more closely for signs that I need to become a full bear on the British pound.

Be careful out there!

Full disclosure: long GBP/USD, short EUR/GBP, short GBP/JPY