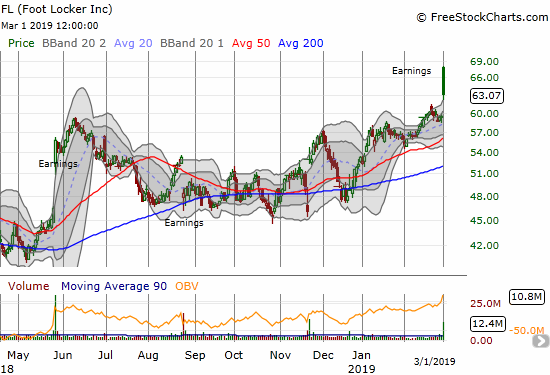

Foot Locker (FL) reported earnings before the market opened on March 1, 2019. The initial reaction to the news was extremely positive: FL gapped up 14.0%. Sellers took over from there and pushed the stock down to a close with a 6.0% gain. The stock still managed to close above its upper Bollinger Band (BB), so technically it remains extended.

This gap and crap (or trap) was dramatic. However, since the stock still closed the day with a substantial gain, this gap and crap is not a topping pattern in of itself. The stock still has a “decent” chance to recover its post-earnings strength after what is called a “calm after the storm” pattern. In the case of FL, the storm is the post-earnings gap up. The calm will be a relative deceleration in the trading action where volume and the daily price range contracts for a short time period. Sometimes this period looks like a brief consolidation where the stock drifts. Ideally, the stock will reverse the entire post-earnings gap to provide a definitive test for traders (buyers in the case of FL). Swingtradebot describes a calm this way:

In the days after a “storm”, the stock must make an NR7, a narrow range bar (NRB) (day’s range less than half the stock’s average true range) or have a real body (distance between the open and the close) less than half the stock’s average true range (which might catch reversal candlesticks like doji, hammers or shooting stars).

The buying opportunity occurs at any given point during the calm – a 1 to 3 day wait seems typical. For FL, the clear stop-loss would be at a new post-earnings low. At such a point, trading with the on-going downward momentum makes sense.

I will probably use options to trade FL in the immediate post-earnings period. On the long side, I might start with a calendar call spread at the $65 strike for a 2-week trade. For longer time periods, I would go for the $70 strike. I set the strike at a point where I think the stock can reach but not surpass before the short side of the calendar spread expires. This options configuration also assumes the upward momentum will continue apace after the short side expires. If I am buying options several days into the calm, I would go for straight call options under the assumption that the resumption of upward momentum is imminent and will be strong.

To the downside, I like a put spread with the bottom of the spread set around $54 where the 50 and 200-day moving averages (DMAs) are converging to provide support.

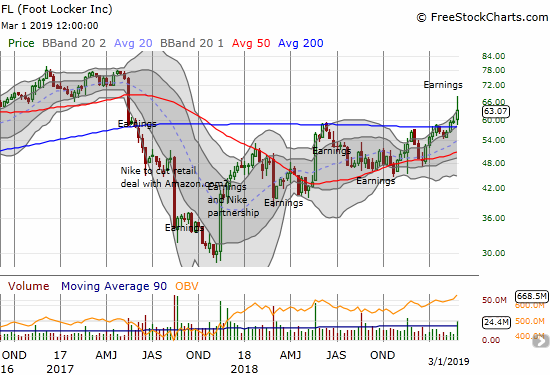

FL is a heavily shorted stock with 9.8% of its float sold short as of February 14th (per Yahoo Finance). I am guessing that short-covering helped to exaggerate the move higher after bears saw the good headlines on earnings like “Fourth Quarter Comparable Store Sales Increased 9.7%” and “A Record Total Annual Sales of $7.9 Billion.” Guidance was also strong: “…we can continue to elevate our financial performance by generating a mid-single digit comparable sales gain and another double-digit percentage increase in earnings per share.” Moreover, the company continues to express great confidence in its business by returning a lot of cash to shareholders. From the transcript (emphasis mine):

“During the quarter, we repurchased a total of 1.2 million shares for approximately $62 million, bringing our full year total to 7.8 million shares at a cost of $375 million. We also returned $158 million of cash to our shareholders through our quarterly dividend in 2018, which brought our total return to shareholders for the year to $533 million.

As we announced in February, our board increased our quarterly dividend payout rate to $0.38 per share and authorized a new 3-year $1.2 billion share repurchase program. “

If a calm unfolds after this storm, I am guessing it will come as a result of the end of profit-taking from the over-extended condition at least partly created by shorts scrambling to cover.

Full disclosure: no positions