The National Association of Home Builders (NAHB) consistently complains about rising construction costs, so I have taken for granted that lumber prices remain an issue.

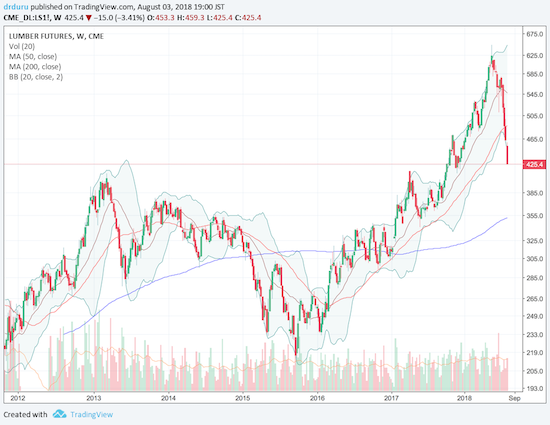

Lumber futures actually peaked in mid-May after a tremendous 2018 breakout and run-up. The return back down was a lot faster than the ride up. Earlier this week, lumber futures reversed all their 2018 gains.

Source: TradingView.com

The weekly view really paints a stark picture of the current sell-off.

Source: TradingView.com

The sell-off begs obvious questions. Are plunging lumber prices indicative of a housing/construction market coming to a screeching halt? The drop is certainly consistent with a two quarter contraction in private residential fixed investment. Can this drop in prices help boost profit margins for home builders? Assuming sales momentum continues, builders should directly benefit given adjustments they have made to the previous period of rising costs.

I will be watching lumber prices a lot more closely. A LOT hangs in the balance given the iShares US Home Construction ETF (ITB) is struggling at its own 2018 low. (Notice the lack of correlation between lumber and home builders given the peak in lumber came FOUR months after the stocks of most builders).

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long ITB call options

Couple thoughts:

– Lumber is a large fraction of residential construction cost, but under 30%; a useful, fairly recent breakdown is here:

https://www.nahbclassic.org/assets/images/11HEO/SS1115_Table1.jpg

– Tariffs on lumber have made headlines, but given market ability to inventory and likely skepticism about tariff persistence, I’d want to know what industry insiders were saying about their role

I haven’t read any builders talking about inventorying lumber ahead of it because of tariffs. In fact I have never heard of materials inventory. Suppliers might have inventory but amthat sure is a lot of risk in a cyclical industry. But an inventory build could help explain the price drop without implying economic alarm. Regardless, I for one am extremely wary.

Thanks for the link!