GDPR, the European Union’s General Data Protection Regulation, rolls into effect starting May 25th. Expectedly, there is a flurry of media attention on this topic. One meme spreading quickly compares Google Trend searches for GDPR to pop music icon and diva Beyoncé. It turns out that GDPR is now so popular that it surpassed Beyoncé in Google searches in the past week or so. The buzz around this event suggested to me that Beyoncé can serve as a baseline of mainstream popularity – what I will now call the “Beyoncé Baseline.”

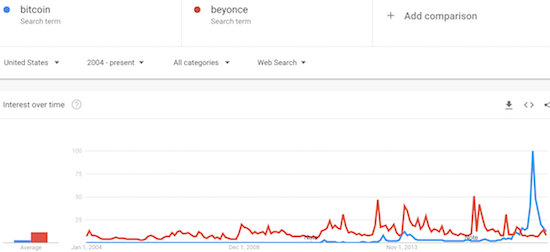

In previous posts on Bitcoin, I used Google Trends to put some context and perspective on extremes in Bitcoin price action. Google Trends helps define extreme tops and bottoms. The Beyoncé Baseline puts Bitcoin’s relative popularity into mainstream context. Last year was a pivotal year for Bitcoin. Starting a year ago, Bitcoin’s popularity in the U.S. surpassed the Beyoncé Baseline and then sustained higher levels. The only other prior time Bitcoin pulled off a similar feat was a very brief period in November, 2013. By the time of Bitcoin’s blow-off top in December, Bitcoin’s popularity reached heights Beyonce could never imagine in the Google Trends era!

Source: Google Trends

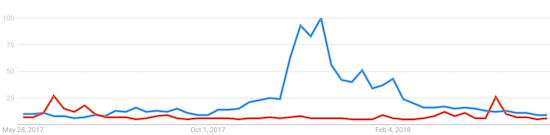

The excitement has clearly worn off. Zooming into the last 12 months puts the Bitcoin ennui into perspective. Now, Bitcoin is effectively just as “boring” as Beyonce.

Source: Google Trends

The worldwide popularity contest looks similar to the U.S. chart. The main difference is that worldwide Bitcoin currently holds a slightly larger popularity gap than in the U.S. alone.

I purposely describe Bitcoin as “boring” because the collapse in Google Trends matches the implosion in Bitcoin’s price and its inability to sustain a new rally. In previous posts I have claimed that new money, as implied by fresh Google Search interest, must flow to Bitcoin to sustain another rally. This resurgence has yet to arrive. I even find the on-going lack of relative interest a sufficient explanation for Bitcoin’s recent failure to break through the $10,000 mark – just not enough new interest to overcome the temptation of the sellers to take their profits and run.

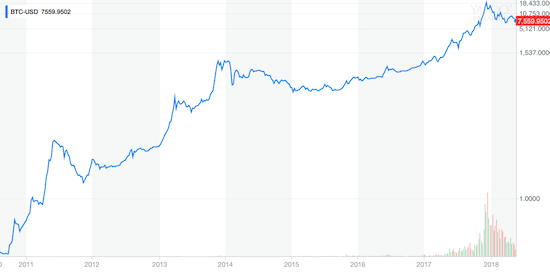

So just how bad is the current malaise compared to prior periods of malaise in Bitcoin’s price? Bitcoin has gone 6 months and counting without setting a new all-time high. This duration is nothing compared to the three years or so Bitcoin went without a new all-time high after a run-up in late 2013. During this time, Bitcoin took 12-18 months (depending on how you want to count) to establish a lasting bottom. Moreover, the current 60% collapse in price is still just a pinprick when compared to Bitcoin’s longer-term run-up. In other words, the current boredom and resulting malaise could continue for quite some time without looking abnormal relative to Bitcoin’s history.

Source: Yahoo Finance

Bottom-line: fresh (mainstream) excitement may still take quite a while to return to Bitcoin. Beyoncé can continue enjoying the company in popularity for now!

Be careful out there!

Full disclosure: no position

Your sense of humor in this article is so tongue-in-cheek that I think you might need some kind of surgery after writing it, to be able to eat again.

To be clear: I loved it.

Glad you appreciated the subtle humor! 😀