At the time of writing, Bitcoin (BTC) just experienced another large one-day loss…currently around 10%.

Source: Yahoo Finance

A week ago, sellers panicked and sent Bitcoin careening toward $10,000 as an orderly pullback from all-time highs suddenly became chaotic. Buyers quickly moved in and the cryptocurrency stabilized. Until last week’s low gets violated, I am assuming the most motivated sellers have flushed themselves from the system.

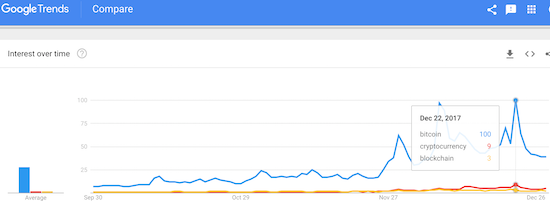

Google Trends is assisting me in this interpretation. In early December, I noted how Google Trends confirmed the run-up in Bitcoin. This time around, Google Trends may have flagged a bottom in Bitcoin. In the immediate aftermath of Bitcoin’s latest massive sell-off, search interest in “Bitcoin” surged to a new all-time high. As a reminder, when I use Google Trends for assessing extremes in gold prices, a surge of search interest at a price extreme signals the imminent reversal of the price extreme. So far, so good for Bitcoin’s extremes.

Source: Google Trends

Note that the last all-time high for Google Bitcoin searches occurred on December 7th. Bitcoin on that day made a brief all-time high around 17,300. Bitcoin managed to make one more brief surge to a new all-time high before a sell-off began in earnest. So, in this case, there was a lag between Bitcoin and search extremes by several days.

I still consider my associations between Bitcoin and Google Search Trends to be “experimental.” The history is relatively short compared to the number of extremes and search data available for gold trading. If Bitcoin holds last week low on the way to a fresh rally, I will get a key confirmation of this approach. Even more importantly, such a development would provide a small step toward a more general model of using Google Search trends for trading extremes in financial markets. If the Bitcoin sell-off continues, I will obviously revisit and likely revise the developing theories.

As a reminder, I posted live/real-time Google Search Trend charts in “Google Search Trends Confirm the Bitcoin Run-Up.”

Be very, very careful out there!

Full disclosure: long GLD

DD, I thought you said you were not going to trade Bitcoin. Have you perchance changed you mind ?

Nope! I am watching and learning though.

A crypto crazed friend of mine ALMOST got me in. But the recent volatility finally shook him out, and his nerves couldn’t handle it anymore. He locked in his profits from Bitcoin and Ripple and called it quits.