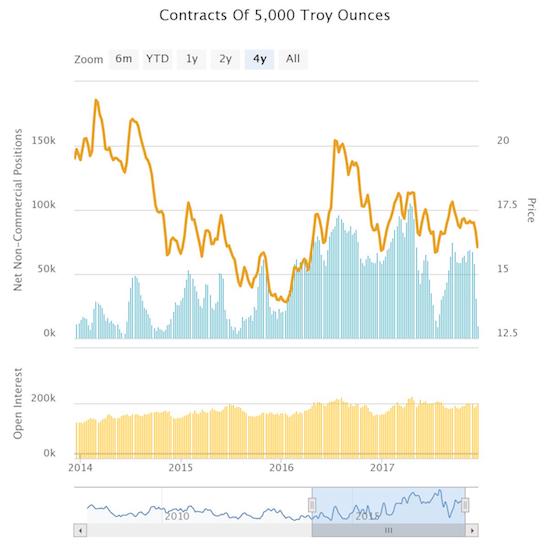

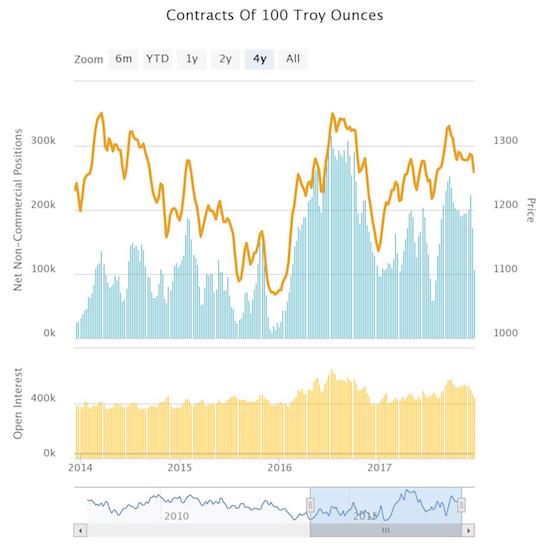

Maybe it is fear of the Fed, maybe it is the distraction of cryptocurrencies reaching for infinity. Whatever the issue, speculators in precious metals are in rapid retreat as net long contracts dropped to levels not seen in 4 to 5 months.

Source: Oanda’s CFTC’s Commitments of Traders

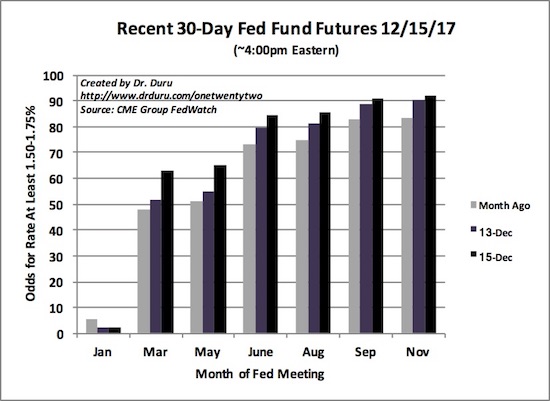

This decline represents the climax of October’s abrupt end of a seasonal pattern of accumulation of net long silver and gold contracts. In an earlier post, I discussed the implications of the U.S. Federal Reserve’s latest decision and discussion on monetary policy. The market seemed disappointed that the Fed was not more hawkish, but the week ended with sentiment for rate hikes picking up more steam. Perhaps the firming prospects of a very stimulative U.S. tax reform bill also firmed up expectations for a bevy of rate hikes. If 2018 does indeed become a year of rate hikes, especially among other global central banks, the year could become a “lost year” for precious metals…at least until the rate hikes start to make market participants think about recession risks…and future rate cuts.

Source: CME FedWatch Tool

Note that the futures have priced in a second rate hike for September.

Unlike the June rate hike, the precious metals sold off going into the December rate hike. SPDR Gold Shares (GLD) and iShares Silver Trust (SLV) have now rallied like the sellers exhausted themselves in anticipation of the Fed’s rate hike.

Source: FreeStockCharts.com

Normally, I would rush into a new set of long trades with an assumption that a sustainable bottom just happened. However, given the strong global growth story building for 2018, I am going to pass on this round. If GLD and/or SLV manage to break out above resistance, I might reconsider my positioning especially if speculators are getting back on the wagon. In the meantime, I will continue holding my core positions as usual.

Be careful out there!

Full disclosure: long GLD and SLV