In mid-July, the Australian dollar (FXA) surged higher after a hawkish interpretation of the RBA minutes. Guy Debelle, Deputy Governor of the Reserve Bank of Australia (RBA), tried to walk the market off its enthusiasm. The pause was temporary. By the early September RBA meeting, AUD/USD hit a 2+ year high, albeit partially because of weakness in the U.S. dollar.

Since then, the RBA produced two nearly identical statements on Monetary Policy which helped to cool off interest in the currency. In October, the RBA suggested it had no intention of hiking rates anytime soon by pointing to the undesirable strength in the Australian dollar:

“The Australian dollar has appreciated since mid year, partly reflecting a lower US dollar. The higher exchange rate is expected to contribute to continued subdued price pressures in the economy. It is also weighing on the outlook for output and employment. An appreciating exchange rate would be expected to result in a slower pick-up in economic activity and inflation than currently forecast.”

The RBA also described inflation as “low.” In November (Tuesday the 7th), the RBA reiterated the same observations on the Australian dollar and then confirmed definitively that rates are not going up anytime soon by providing the following observations on inflation:

“Inflation remains low, with both CPI and underlying inflation running a little below 2 per cent. In underlying terms, inflation is likely to remain low for some time, reflecting the slow growth in labour costs and increased competitive pressures, especially in retailing. CPI inflation is being boosted by higher prices for tobacco and electricity. The Bank’s central forecast remains for inflation to pick up gradually as the economy strengthens.”

The rhetoric has helped to push AUD/USD below its flattening 200-day moving average (DMA).

Source: FreeStockCharts.com

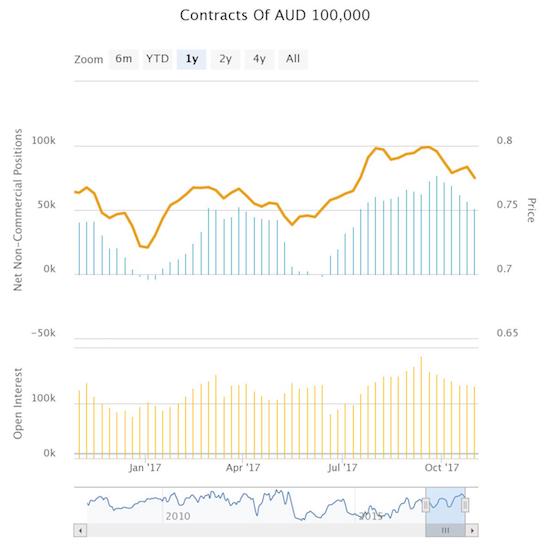

I am inclined to short the Australian dollar here against the U.S. dollar, but I am waiting for more clarity like trading below the low of the current consolidation range. Speculators have followed the Australian dollar downward by reducing net long positions ever so slowly. This trend seems to confirm a bias of weakness. If net positioning is trending down to zero as in June, then there should be substantially more weakness ahead for AUD/USD and perhaps other Aussie pairs…just waiting for some technical confirmation…

Source: Oanda’s CFTC’s Commitments of Traders

Be careful out there!

Full disclosure: short EUR/AUD

Hard to have any conviction with AUD currently.

Had a look at the long term Sterling chart today and it hit me like a hammer DD. I have to get long sterling somewhere before Brexit/March 2018. The whole brexit fear is probably overblown or if it isn’t, is pretty well priced in. Over a 5 year time horizon GBP is a buy for me. Also, UK inflation has been above 2% recently so when the Brexit thing is over, they will need to hike further.

Anyway, I suppose how to size any GBP long. Must be able to withstand a move to 1.1. Maybe a 1/3 here, 1/3 at 1.2 and 1/3 at 1.1 with a long time horizon.

Hard for me to think of currencies in such long-term ways. So much can happen in between to set the plan off course. And GBP does not pay a real yield while you wait. I say a very small position to start and then don’t buy anymore until some amount of time just ahead of your March deadline….unless the pound breaks out above some key technical level.

Yes, quite true DD, much can happen in between. I wonder though whether most of the negatives have been priced into sterling. Much like most of the negatives had been priced into the euro around 1.05 before the Macri election. Most players expect a tough negotiation with Europe. I think what is partially priced in is a nuclear option of no trade deal which is way too pessimistic to be realistic. I read a good comment recently that there is no nation in the developed world that has been locked out of trade with Europe so it would’ve amazing if the UK was.

From a historical range perspective sterling is good value here and exceptional value near 1.1. Also from a sentiment and positioning perspective pound is still good value. The carry is negative but over a 2 year time horizon it is tolerable.

Can’t see much else that is good value out there in FX.

Value that is in terms being potentially mispriced significantly.

Another thing I am looking at is a potential double top in dollar index. With US data where it has been, I wouldn’t be surprised if there were some negative surprises. Still mulling over the best vehicles for expressions of dollar short. I still like JPY and NZD. But NZD might still have a soft patch with fallout from Venezuela default.

Interesting move in lumbar- at a 20 year high. I don’t trade it and am not familiar with the drivers though.

Darn, didn’t have the balls to hold onto the bitcoin short @ 7300. Topped out 7800. Now 6500. The problem is risk management in shorting bubbles. Probability is very high terminal value is low/zero but it is all a mind game.

So I was short 2 bitcoins at 7300. But I was getting phased by the upside risk, which is basically unlimited and bailed. The main reason for shorting was because the short term parabolic trend had become overdone- so it was a mean reversion trade but just back to the uptrend, not assuming the bubble was over. Short 2 bitcoins is tiny but the risk I was extrapolating was 100k per bitcoin. Who knows it might go completely nuts and go to 500k.

The way to have made money out of the Internet bubble would have been to buy OTM put options on Nasdaq or pets.com and keep buying a fixef percentage of your portfolio value every 6 months. Even if you were a year or 2 early that would have done well. Not sure if bitcoin will get to the level of euphoria that OTM puts will be cheap.

I am enjoying reading about your bitcoin adventures. You will be able to write a small book after you’re done!

I am not sure all the negativity is priced into the pound just yet. Speculators were net long just a few weeks ago and now neutral. I was listening to a podcast where a UK commentator was speculating about the small chance that Brexit will just get reversed. So, there must still be some fleeting hope out there that this whole Brexit thing has been a terrible mistake! 🙂

I am neutral on the USD now. I am not seeing the double-top you are seeing, but I am seeing a likely bottom. Churn from here until who knows how long…